Fs Form 1048

What is the FS Form 1048

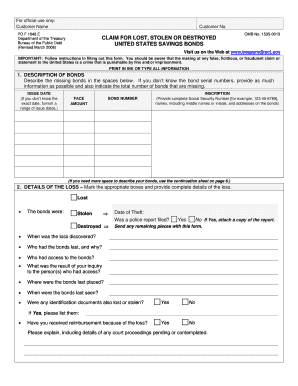

The FS Form 1048, also known as the Treasury Form 1048, is a document used by individuals to request the replacement of lost or stolen savings bonds. This form is essential for those who wish to reclaim their financial assets that may have been misplaced or damaged. The FS Form 1048 is specifically designed for U.S. savings bonds and must be filled out accurately to ensure proper processing by the U.S. Department of the Treasury.

How to Use the FS Form 1048

Using the FS Form 1048 involves a straightforward process. First, gather all necessary information regarding the lost or stolen savings bonds, including the bond serial numbers and issue dates. Next, complete the form with accurate details, ensuring that all required fields are filled. Once the form is completed, it can be submitted either online or via mail to the appropriate Treasury office. It is important to follow any specific instructions provided on the form to avoid delays in processing.

Steps to Complete the FS Form 1048

Completing the FS Form 1048 requires careful attention to detail. Here are the steps to follow:

- Obtain the FS Form 1048 from the U.S. Department of the Treasury website or other official sources.

- Provide your personal information, including your name, address, and Social Security number.

- List the details of the lost or stolen savings bonds, including their serial numbers and issue dates.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form as instructed, either electronically or by mailing it to the designated address.

Legal Use of the FS Form 1048

The FS Form 1048 is legally binding when completed and submitted correctly. It serves as a formal request for the replacement of savings bonds, and the information provided must be truthful and accurate. Misrepresentation or fraudulent claims can lead to legal consequences. It is crucial to ensure compliance with all relevant laws and regulations when using this form.

Key Elements of the FS Form 1048

Several key elements must be included in the FS Form 1048 to ensure its validity:

- Personal Information: Your full name, address, and Social Security number.

- Bond Information: Serial numbers and issue dates of the lost or stolen bonds.

- Signature: A signature certifying the accuracy of the information provided.

- Date: The date on which the form is completed and submitted.

Form Submission Methods

The FS Form 1048 can be submitted through various methods, providing flexibility for users. The available options include:

- Online Submission: The form can be filled out and submitted electronically through the U.S. Department of the Treasury's website.

- Mail Submission: A printed version of the form can be mailed to the designated Treasury office.

- In-Person Submission: Individuals may also visit a local Treasury office to submit the form in person.

Quick guide on how to complete fs form 1048

Effortlessly Prepare Fs Form 1048 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Fs Form 1048 on any platform with the airSlate SignNow apps for Android or iOS, and simplify any document-based workflow today.

How to Edit and Electronically Sign Fs Form 1048 with Ease

- Locate Fs Form 1048 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, cumbersome form navigation, or mistakes requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fs Form 1048 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fs form 1048

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FS Form 1048 and how is it used?

The FS Form 1048 is a crucial document used for requesting payment for certain U.S. Department of Treasury services. By utilizing airSlate SignNow, you can easily fill out and eSign the FS Form 1048, streamlining your payment request process and ensuring compliance.

-

How can airSlate SignNow help me with the FS Form 1048?

airSlate SignNow provides an intuitive platform to electronically sign and send the FS Form 1048, simplifying your documentation workflow. Our solution ensures that your form is completed accurately and securely, allowing you to focus on your core business activities.

-

Is there a cost associated with using airSlate SignNow for the FS Form 1048?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Accessing features specifically for the FS Form 1048 will be included in these plans, providing a cost-effective solution for managing your document signing processes.

-

Can I integrate airSlate SignNow with other software I use for the FS Form 1048?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your FS Form 1048 alongside other tools you may already be using. This integration enhances efficiency and data accuracy across your document management system.

-

What are the benefits of eSigning the FS Form 1048 with airSlate SignNow?

eSigning the FS Form 1048 with airSlate SignNow offers several benefits, including faster turnaround times, enhanced security, and reduced paper waste. Our platform ensures that you can electronically manage your documents while maintaining compliance with legal standards.

-

How do I get started with airSlate SignNow for the FS Form 1048?

Getting started with airSlate SignNow for the FS Form 1048 is simple. Just sign up for an account, and you can begin uploading your forms, filling them out, and sending them for eSignature in no time. Our user-friendly interface guides you through each step.

-

Is airSlate SignNow secure for handling the FS Form 1048?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your FS Form 1048 and other sensitive documents are protected. We use advanced encryption technology and secure data storage practices to keep your information safe from unauthorized access.

Get more for Fs Form 1048

- Degree seeking hawaii pacific university form

- Aamu deposit form

- King driveadm 203 form

- Dcccd transcript request form

- Verification of living with parent form fall spring

- Faculty appraisal and planning form louisiana lctcs

- How to make and print business cards at home form

- Support letter for graduate school application fee waiver form

Find out other Fs Form 1048

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online