Rule 11 Dd Form

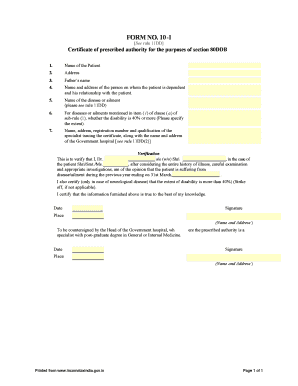

What is the Rule 11dd?

The Rule 11dd refers to a specific legal framework that governs the execution and submission of certain forms, particularly in the context of electronic signatures and digital documentation. This rule ensures that documents, such as the 11dd form, are executed in a manner that is legally binding and compliant with relevant laws. The rule emphasizes the importance of using secure methods for signing and submitting documents, ensuring that the identity of the signer is verified and that the integrity of the document is maintained throughout the process.

How to use the Rule 11dd

Using the Rule 11dd involves understanding the requirements for completing the associated form correctly. This includes ensuring that the form is filled out accurately and that all necessary signatures are obtained. When utilizing electronic tools, it is crucial to select a platform that complies with eSignature regulations, such as the ESIGN Act and UETA. By following these guidelines, users can ensure that their submissions are valid and accepted by institutions or courts.

Steps to complete the Rule 11dd

Completing the Rule 11dd form involves several key steps:

- Gather all necessary information and documentation required for the form.

- Access the form through a reliable electronic platform that supports eSignature.

- Fill out the form carefully, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Sign the form electronically using a secure method that verifies your identity.

- Submit the completed form as directed, either electronically or by mail.

Legal use of the Rule 11dd

The legal use of the Rule 11dd is contingent upon adherence to specific regulations governing electronic signatures. To ensure that the 11dd form is legally binding, it must be executed in compliance with the ESIGN Act, UETA, and other applicable laws. This includes using a certified electronic signature platform that provides an audit trail and ensures the security of the document. By following these legal standards, users can protect themselves and their submissions.

Key elements of the Rule 11dd

Several key elements define the Rule 11dd and its application:

- Identity verification: Ensuring the signer's identity is confirmed through secure methods.

- Document integrity: Maintaining the original content of the document throughout the signing process.

- Compliance with laws: Adhering to federal and state regulations concerning electronic signatures.

- Audit trails: Keeping records of the signing process, including timestamps and IP addresses.

Form Submission Methods

The Rule 11dd form can be submitted through various methods, depending on the requirements of the requesting institution. Common submission methods include:

- Online submission: Using a secure electronic platform to submit the form digitally.

- Mail: Printing the completed form and sending it via postal service.

- In-person: Delivering the form directly to the relevant office or agency.

Quick guide on how to complete rule 11 dd

Effortlessly prepare Rule 11 Dd on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without hold-ups. Handle Rule 11 Dd on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Rule 11 Dd without hassle

- Obtain Rule 11 Dd and then click Get Form to initiate.

- Employ the resources we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select your preferred method for sending your form via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Rule 11 Dd and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rule 11 dd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rule 11dd in pdf format?

Rule 11dd in pdf format refers to specific guidelines and regulations that govern electronic signing processes. Understanding these rules helps businesses ensure compliance when sending eSign documents, making airSlate SignNow an ideal solution.

-

How does airSlate SignNow support rule 11dd in pdf compliance?

airSlate SignNow is designed to meet various legal standards, including rule 11dd in pdf requirements. Our platform provides built-in compliance features that ensure your electronic signatures are valid and legally binding.

-

What are the pricing options for airSlate SignNow?

We offer flexible pricing plans for airSlate SignNow that cater to different business needs. From individual to enterprise plans, each package includes features that support workflows, including the management of rule 11dd in pdf documents.

-

Does airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications such as CRM systems and cloud storage solutions. These integrations enhance document management, including those related to rule 11dd in pdf, making it easier to streamline your processes.

-

Can I customize templates to include rule 11dd in pdf references?

Absolutely! airSlate SignNow allows you to create and customize templates to include references to rule 11dd in pdf. This feature ensures that your documents align with specific compliance needs while providing a professional appearance.

-

What are the benefits of using airSlate SignNow for rule 11dd in pdf documents?

Using airSlate SignNow for rule 11dd in pdf documents offers numerous benefits, including improved efficiency and secure storage. Our solution not only helps you comply with regulations but also enhances document tracking and user accessibility.

-

Is support available for users navigating rule 11dd in pdf document requirements?

Yes, airSlate SignNow provides comprehensive support to assist users with all aspects of rule 11dd in pdf document requirements. Our expert team is ready to answer queries and offer guidance to ensure you fully understand the compliance expectations.

Get more for Rule 11 Dd

- Scat plus form

- Civics task cards lake county schools lake k12 fl form

- Parking permit form the school district of palm beach county palmbeachschools

- Broward county public schools leave of absence form

- Dc4 711b florida revised 10 25 18 form

- Certification of no records form

- Attached are forms for a change of name duration jurisdiction or purpose for a foreign profit or not for profit corporation

- How to change a name on sunbiz form

Find out other Rule 11 Dd

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free