CT 1040X, Amended Connecticut Income Tax Return and Instructions CT 1040X 2019

What is the CT 1040X, Amended Connecticut Income Tax Return

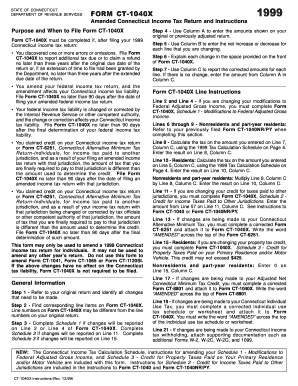

The CT 1040X is the Amended Connecticut Income Tax Return form used by taxpayers to correct errors on their previously filed CT 1040 forms. This form allows individuals to amend their income, deductions, or credits, ensuring that their tax filings are accurate and compliant with state regulations. It is essential for taxpayers who discover discrepancies after submitting their original returns, as it provides a legal avenue to rectify such issues.

Steps to Complete the CT 1040X

Completing the CT 1040X involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your original CT 1040 form and any relevant financial records. Next, clearly indicate the changes being made on the form, providing detailed explanations for each amendment. Be sure to calculate the new tax liability accurately, as this will affect any refunds or additional payments owed. Finally, review the completed form for any errors before submitting it to the Connecticut Department of Revenue Services.

Legal Use of the CT 1040X

The CT 1040X is legally recognized as a valid method for amending tax returns in Connecticut. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame. Compliance with state tax laws is crucial, as failure to do so can result in penalties or legal repercussions. Utilizing a reliable eSignature solution can further enhance the legal validity of the document by ensuring secure and compliant electronic submissions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the CT 1040X. Generally, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines helps avoid penalties and ensures that any refunds due are received in a timely manner.

Required Documents

To complete the CT 1040X, certain documents are required. These typically include your original CT 1040 form, any supporting documentation for the changes being made, and any additional forms that may be relevant to the amendments. Having these documents ready will streamline the process and help ensure that all necessary information is included in your amended return.

Form Submission Methods

The CT 1040X can be submitted through various methods, including online, by mail, or in person. For electronic submissions, using a secure eSignature platform simplifies the process, providing a digital trail and ensuring compliance with state regulations. If submitting by mail, ensure that the form is sent to the correct address as specified by the Connecticut Department of Revenue Services.

Examples of Using the CT 1040X

There are several scenarios where taxpayers might need to use the CT 1040X. For instance, if an individual discovers that they omitted a significant income source after filing their original return, they would need to amend their return using this form. Another example could be correcting a miscalculation in tax credits that resulted in an incorrect refund amount. In both cases, the CT 1040X provides a structured way to make necessary corrections and maintain compliance.

Quick guide on how to complete ct 1040x 1999 amended connecticut income tax return and instructions 1999 ct 1040x

Effortlessly Prepare CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed materials, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Simple Steps to Edit and Electronically Sign CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X with Ease

- Locate CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040x 1999 amended connecticut income tax return and instructions 1999 ct 1040x

Create this form in 5 minutes!

How to create an eSignature for the ct 1040x 1999 amended connecticut income tax return and instructions 1999 ct 1040x

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is CT 1999 in the context of airSlate SignNow?

CT 1999 refers to a specific version or feature set within airSlate SignNow that enhances the electronic signature process. This version includes improved functionalities that facilitate document management and secure eSignatures, ensuring compliance with legal standards.

-

How does airSlate SignNow streamline document signing with CT 1999?

With CT 1999, airSlate SignNow offers a streamlined approach to document signing. This allows users to send, sign, and manage documents seamlessly, reducing the time it takes to finalize agreements while maintaining high levels of security.

-

What are the pricing options for airSlate SignNow's CT 1999 features?

airSlate SignNow provides flexible pricing plans that include access to CT 1999 features. Whether you are a startup or a larger enterprise, you'll find a plan that fits your budget while still offering robust eSigning capabilities.

-

Can I integrate CT 1999 with other software tools?

Yes, airSlate SignNow's CT 1999 is designed to integrate smoothly with various software applications. This includes CRM systems, cloud storage solutions, and productivity tools to enhance your workflow and efficiency.

-

What are the key benefits of using airSlate SignNow with CT 1999?

Using CT 1999 with airSlate SignNow provides numerous benefits, including time savings, enhanced security, and improved document accuracy. Businesses can rely on this solution to expedite their signing processes while ensuring compliance with industry standards.

-

Is CT 1999 suitable for small businesses?

Absolutely! CT 1999 is particularly beneficial for small businesses seeking cost-effective and user-friendly eSigning solutions. It allows them to manage documentation efficiently without the need for extensive resources.

-

What types of documents can be signed using CT 1999?

CT 1999 supports a wide range of document types, including contracts, agreements, and forms. This versatility makes it ideal for various organizations that need to streamline their signing processes across different types of documentation.

Get more for CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X

- State form 44606

- Indiana report vehicle form

- Affidavit for certificate of title correction form

- Affidavit for certificate of title correction 474769661 form

- Indiana form vehicle motor

- Limited power of attorney vehicle and watercraft transactions indiana form

- Fmcsa drug and alcohol background check form

- Log of supervised driving form

Find out other CT 1040X, Amended Connecticut Income Tax Return And Instructions CT 1040X

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document