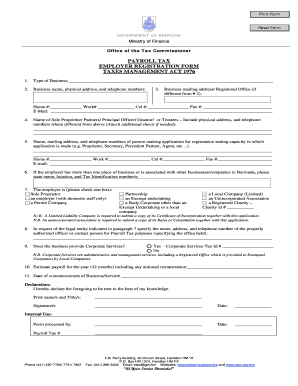

Etax Bermuda Form

What is the Etax Bermuda

The Etax Bermuda is a digital platform designed for individuals and businesses to manage their payroll tax obligations in Bermuda efficiently. It simplifies the process of filing payroll taxes by allowing users to complete and submit necessary forms electronically. This system is particularly beneficial for those who prefer a streamlined approach to tax compliance, reducing the need for paper forms and in-person visits to government offices.

Steps to complete the Etax Bermuda

Completing the Etax Bermuda involves several straightforward steps:

- Access the Platform: Begin by visiting the official Etax Bermuda website or portal.

- Create an Account: If you are a new user, you will need to register by providing your personal information and creating a secure password.

- Gather Required Documents: Collect all necessary documents, such as your payroll records and identification information, to ensure a smooth filing process.

- Fill Out the Form: Navigate to the payroll tax form section and input the required information accurately.

- Review and Submit: Double-check all entries for accuracy before submitting the form electronically.

Legal use of the Etax Bermuda

The Etax Bermuda is legally recognized for filing payroll taxes, provided that users adhere to the guidelines set forth by the Bermuda government. Electronic submissions through this platform are considered valid as long as they meet the necessary legal requirements, including proper signatures and documentation. It is essential to ensure compliance with local tax laws to avoid any potential legal issues.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with payroll tax regulations. Typically, the deadlines for submitting payroll tax forms through the Etax Bermuda align with the Bermuda government's tax calendar. Users should regularly check for updates on specific dates to avoid penalties. Common deadlines include:

- Quarterly payroll tax submissions

- Annual tax reconciliation deadlines

Required Documents

To successfully complete the Etax Bermuda, users must prepare several key documents. These typically include:

- Payroll records for the reporting period

- Employee identification information

- Previous tax filings, if applicable

- Any supporting documentation required for deductions or credits

Who Issues the Form

The payroll tax forms associated with the Etax Bermuda are issued by the Bermuda government’s tax authority. This agency is responsible for overseeing tax compliance and ensuring that all submissions meet the necessary legal standards. Users can find specific forms and guidance directly on the official government website dedicated to tax matters.

Quick guide on how to complete etax bermuda

Effortlessly prepare Etax Bermuda on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without holdups. Manage Etax Bermuda on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Etax Bermuda with ease

- Find Etax Bermuda and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, and errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Etax Bermuda to maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etax bermuda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is eTax Bermuda and how does it work?

eTax Bermuda is an online platform that simplifies tax filing for residents and businesses in Bermuda. It allows users to submit their tax returns electronically, ensuring quicker and more efficient processing. By using eTax Bermuda, you can manage your tax obligations easily and securely.

-

What are the features of airSlate SignNow that support eTax Bermuda?

airSlate SignNow offers a range of features designed to enhance your eTax Bermuda experience, including eSigning, document sharing, and advanced security options. These features ensure that your tax documents are securely signed and delivered without the hassle of paper forms. With airSlate SignNow, managing your eTax Bermuda submissions is more efficient than ever.

-

How much does airSlate SignNow cost for eTax Bermuda users?

airSlate SignNow provides flexible pricing plans that cater to various needs, including those focused on eTax Bermuda submissions. Plans are designed to be cost-effective, ensuring you can manage your tax documentation without breaking the bank. You can access detailed pricing information on our website or contact our support team for tailored assistance.

-

What are the benefits of using airSlate SignNow for eTax Bermuda tasks?

Using airSlate SignNow for eTax Bermuda tasks offers numerous benefits, including increased efficiency, secure document management, and easy collaboration. You can streamline your tax submission process, reduce paperwork, and ensure compliance with Bermuda's tax regulations. This ultimately saves time and increases productivity for businesses of all sizes.

-

Does airSlate SignNow integrate with other platforms for eTax Bermuda?

Yes, airSlate SignNow seamlessly integrates with various platforms that may complement your eTax Bermuda experience. Whether it's document management systems or accounting software, our integrations help streamline your workflow and enhance data accuracy. This connectivity ensures your tax processes are as smooth and efficient as possible.

-

Is airSlate SignNow suitable for both personal and business use regarding eTax Bermuda?

Absolutely! airSlate SignNow is designed to cater to both personal and business needs when it comes to eTax Bermuda. Individual users can manage their personal tax filings, while businesses can take advantage of bulk document handling and advanced security features. This flexibility makes it an ideal solution for anyone needing to navigate Bermuda's tax system.

-

How secure is my information when using airSlate SignNow for eTax Bermuda?

Security is a top priority at airSlate SignNow, especially for sensitive information like eTax Bermuda submissions. Our platform employs industry-leading encryption and security protocols to protect your data at all times. You can rest assured that your documents and personal information are safe and secure while using our services.

Get more for Etax Bermuda

- Special consideration shortfall in coursework teacher assessment form 2 marchdoc

- Diary of dog walking information

- Domestic visual condition report form

- Tsb dispute transaction form

- Nsfas apepeal 2020 online fillable form unisa

- Raad op verpleging pretoria form

- Unisa form

- Midlands college application forms 2020

Find out other Etax Bermuda

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will