California Form 100 Instructions

What is the California Form 100 Instructions

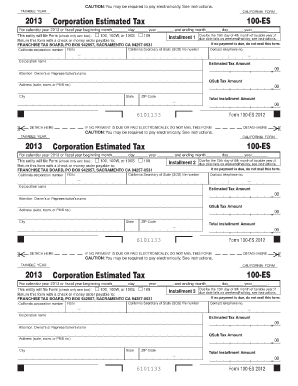

The California Form 100 Instructions provide detailed guidance for corporations filing their California corporate income tax return. This form is essential for corporations operating in California, as it outlines the necessary steps and information required to comply with state tax laws. The instructions cover various aspects, including eligibility criteria, required documentation, and specific rules applicable to different business entity types.

Steps to complete the California Form 100 Instructions

Completing the California Form 100 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and balance sheets. Next, carefully read through the instructions to understand the specific requirements for your corporation. Fill out the form with accurate information, ensuring that all figures are correctly calculated. After completing the form, review it thoroughly for any errors or omissions before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the California Form 100. Typically, the due date for filing is the 15th day of the fourth month after the close of the corporation's fiscal year. For most corporations operating on a calendar year, this means the form is due by April 15. It's crucial to be aware of these deadlines to avoid penalties and ensure timely compliance with state tax regulations.

Required Documents

When completing the California Form 100, several documents are required to support your filing. These include financial statements, prior year tax returns, and any relevant schedules that detail income, deductions, and credits. Having these documents ready will facilitate a smoother completion process and help ensure that your submission is accurate and complete.

Legal use of the California Form 100 Instructions

The California Form 100 Instructions are legally binding and must be followed to ensure compliance with state tax laws. Corporations are expected to adhere to the guidelines outlined in the instructions, as failure to do so may result in penalties or audits. Understanding the legal implications of the instructions is essential for maintaining good standing with the California Franchise Tax Board.

Who Issues the Form

The California Form 100 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring compliance among corporations operating within the state. The FTB provides the necessary forms, instructions, and resources to assist corporations in fulfilling their tax obligations.

Penalties for Non-Compliance

Failure to comply with the California Form 100 filing requirements can result in significant penalties. Corporations may face late filing fees, interest on unpaid taxes, and potential legal action from the state. Understanding these penalties emphasizes the importance of timely and accurate submission of the form to avoid unnecessary financial burdens.

Quick guide on how to complete california form 100 instructions

Complete California Form 100 Instructions effortlessly on any device

Digital document management has become popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and smoothly. Handle California Form 100 Instructions on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign California Form 100 Instructions with ease

- Locate California Form 100 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign California Form 100 Instructions and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 100 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the California Form 100 instructions for 2020?

The California Form 100 instructions for 2020 provide detailed guidelines on how to complete and submit your corporate tax returns. It covers necessary information regarding taxable income, deductions, and credits specific to California. For a downloadable version, you can find the california form 100 instructions 2020 pdf available on the official Franchise Tax Board website.

-

How can airSlate SignNow help with submitting the California Form 100?

airSlate SignNow streamlines the submission process for the California Form 100 by allowing you to easily sign and send documents electronically. This service ensures that your forms are securely processed, reducing the risk of errors in submission. Use our easy-to-navigate platform to manage and track your submissions, all while accessing california form 100 instructions 2020 pdf directly.

-

Is there a cost associated with using airSlate SignNow for California Form 100 submissions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure you gain access to essential features, including document eSigning and storage. With all features included, you can confidently complete and send your california form 100 instructions 2020 pdf documents without worrying about hidden costs.

-

What features does airSlate SignNow offer for managing California Form 100 documents?

airSlate SignNow offers features like customizable templates, document tracking, and secure cloud storage that enhance your management of California Form 100 documents. You can create templates based on the california form 100 instructions 2020 pdf to streamline your filing process. Our platform also enables real-time collaboration for team members working on submissions.

-

Are there any integrations available with airSlate SignNow for filing tax documents?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easier to file tax documents like the California Form 100. These integrations facilitate data transfer between platforms, saving you time and ensuring accuracy. Utilize our tools alongside your existing software to handle your california form 100 instructions 2020 pdf submissions efficiently.

-

How secure is the transmission of California Form 100 documents using airSlate SignNow?

Security is a top priority for airSlate SignNow. We use advanced encryption to protect your documents during transmission and storage, ensuring that your California Form 100 documents remain confidential. Our compliance with industry standards further guarantees the safety of your california form 100 instructions 2020 pdf files.

-

Can I access the California Form 100 instructions 2020 pdf on mobile devices?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access the California Form 100 instructions 2020 pdf from your smartphone or tablet. This flexibility enables you to manage and sign documents on the go, providing convenience for your busy schedule. Simply download our app to get started.

Get more for California Form 100 Instructions

- 201 x 2017 2019 form

- Jv 595 info s how to ask the court to seal your california courts form

- Liability is due at the due date of the original return form

- Motor carrier services manual alabama department of revenue form

- Wardship petition 2017 2019 form

- Jv 600 s juvenile wardship petition spanish judicial council forms

- Jv 625s notice of hearing juvenile delinquency proceeding spanish judicial council forms courts ca

- Jv 680 findings and orders for child california courts form

Find out other California Form 100 Instructions

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple