Brevard County Dr 501t Form

What is the Brevard County Dr 501t Form

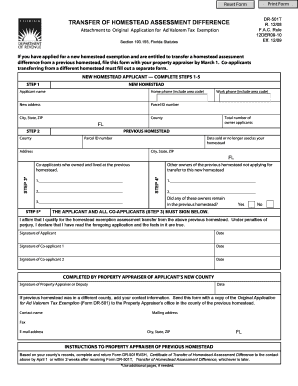

The Brevard County Dr 501t Form is a specific document used for property tax purposes in Brevard County, Florida. This form typically serves as a declaration of the assessed value of property and is essential for homeowners and property owners to ensure accurate taxation. Understanding the purpose and implications of this form is crucial for compliance with local tax regulations.

How to obtain the Brevard County Dr 501t Form

The Brevard County Dr 501t Form can be obtained through the official Brevard County Property Appraiser's website or by visiting their office in person. Additionally, the form may be available at local government offices or through authorized online platforms that facilitate access to county forms. Ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the Brevard County Dr 501t Form

Completing the Brevard County Dr 501t Form involves several key steps:

- Gather necessary documentation, including property details and previous tax assessments.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county office, either online or in person.

Following these steps carefully will help ensure that your form is processed without delays.

Legal use of the Brevard County Dr 501t Form

The Brevard County Dr 501t Form is legally binding when completed and submitted according to local regulations. It is important to ensure that all information provided is truthful and accurate, as misrepresentation can lead to penalties or legal repercussions. The form must be submitted within the designated time frame to maintain compliance with Brevard County tax laws.

Key elements of the Brevard County Dr 501t Form

Key elements of the Brevard County Dr 501t Form include:

- Property identification number

- Owner's name and contact information

- Description of the property

- Assessment value of the property

- Signature of the property owner

Each of these components is essential for the accurate processing of the form and the determination of property taxes.

Form Submission Methods (Online / Mail / In-Person)

The Brevard County Dr 501t Form can be submitted through various methods:

- Online submission via the Brevard County Property Appraiser's official website.

- Mailing the completed form to the designated county office.

- Submitting the form in person at the local property appraiser's office.

Choosing the right submission method can depend on personal preference and the urgency of processing.

Quick guide on how to complete brevard county dr 501t form

Effortlessly prepare Brevard County Dr 501t Form on any device

Online document management has surged in popularity among businesses and individuals. It offers a superior eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Brevard County Dr 501t Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Brevard County Dr 501t Form effortlessly

- Find Brevard County Dr 501t Form and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Brevard County Dr 501t Form to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brevard county dr 501t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brevard County Dr 501t Form and why do I need it?

The Brevard County Dr 501t Form is a crucial document for various legal and administrative purposes within Brevard County. It is essential for businesses and individuals who need to submit official requests or applications related to property or local regulations. Understanding its importance can help ensure compliance with local laws and streamline your processes.

-

How can airSlate SignNow help me with the Brevard County Dr 501t Form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Brevard County Dr 501t Form. With our specialized templates, you can fill out the form quickly and send it to recipients for their signatures without the hassle of printing or scanning. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for the Brevard County Dr 501t Form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs. You can choose a plan that best suits your requirements for managing the Brevard County Dr 501t Form and other documents. By investing in our service, you gain access to a robust tool that simplifies your document management tasks.

-

What features does airSlate SignNow provide for managing the Brevard County Dr 501t Form?

With airSlate SignNow, you can benefit from features such as customizable templates, secure eSignature capabilities, and document tracking. These tools make it easier to manage the Brevard County Dr 501t Form efficiently. You'll also have access to cloud storage for your documents, ensuring they're secure and easily retrievable.

-

Can I integrate airSlate SignNow with other tools for the Brevard County Dr 501t Form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and CRM systems. This means you can seamlessly manage the Brevard County Dr 501t Form alongside your other business tools, enhancing productivity and collaboration between teams.

-

What are the benefits of using airSlate SignNow for eSigning the Brevard County Dr 501t Form?

Using airSlate SignNow for eSigning the Brevard County Dr 501t Form streamlines the signing process, reducing the time spent on manual tasks. The digital signature is legally binding and secures your document transactions. Additionally, it provides an audit trail for compliance, ensuring every action taken is recorded.

-

Is airSlate SignNow user-friendly for someone unfamiliar with the Brevard County Dr 501t Form?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for individuals unfamiliar with the Brevard County Dr 501t Form. Our platform guides users through the process of completing and submitting forms, ensuring that even those with minimal technical skills can navigate it with ease.

Get more for Brevard County Dr 501t Form

- Document 00 6536 contractor warranty form project zenith

- Bwarranty formb kbd group inc

- Partial unconditional waiver form

- Construction pay application form

- Contractors questionnaire form

- 104th security forces squadron contractor entry authority list form

- Contract form impressive pups

- Template bid form 2242010xlsm pogue construction

Find out other Brevard County Dr 501t Form

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document