Tan Correction Form

What is the Tan Correction Form

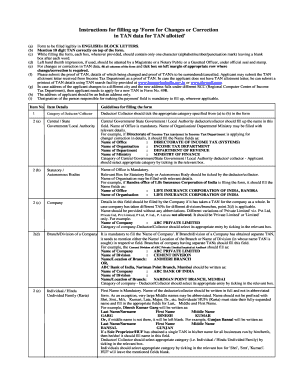

The Tan Correction Form is a crucial document used to correct errors related to the Tax Deduction and Collection Account Number (TAN) in TDS challans. This form is essential for ensuring that tax payments are accurately reflected in the records of the Income Tax Department. When a taxpayer mistakenly deposits TDS against the wrong TAN or makes an error in the TAN number, this form serves as a formal request for correction. It helps maintain compliance with tax regulations and ensures that taxpayers do not face penalties for incorrect filings.

How to Use the Tan Correction Form

Using the Tan Correction Form involves several straightforward steps. First, ensure you have the correct form, which can typically be downloaded from the official tax authority's website. Fill in the required details, including the incorrect TAN, the correct TAN, and any relevant transaction details. It is vital to provide accurate information to avoid further complications. Once completed, submit the form as directed, either online or via mail, depending on the guidelines provided by the tax authority.

Steps to Complete the Tan Correction Form

Completing the Tan Correction Form requires careful attention to detail. Follow these steps for a successful submission:

- Download the Tan Correction Form from the official website.

- Enter your personal details, including your name, address, and contact information.

- Provide the incorrect TAN and the correct TAN that needs to be updated.

- Include details of the TDS challan, such as the payment date and amount.

- Review all entries for accuracy before submission.

- Submit the form online or send it to the designated address as instructed.

Legal Use of the Tan Correction Form

The Tan Correction Form is legally binding when filled out correctly and submitted according to the guidelines set by the tax authorities. It is important to understand that submitting this form does not guarantee immediate correction; the tax department will review the request and make the necessary updates in their records. Compliance with tax regulations is essential to avoid penalties, and using this form properly helps ensure that all tax-related documentation is accurate and up to date.

Required Documents

When submitting the Tan Correction Form, certain documents may be required to support your request. These typically include:

- A copy of the original TDS challan.

- Proof of payment, such as bank statements or receipts.

- Any correspondence related to the error, if applicable.

Having these documents ready can facilitate a smoother correction process and help verify the information provided in the form.

Form Submission Methods

The Tan Correction Form can be submitted through various methods, depending on the guidelines provided by the tax authority. Common submission methods include:

- Online submission through the official tax portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

It is advisable to check the specific requirements for submission to ensure compliance and timely processing of your correction request.

Quick guide on how to complete tan correction form

Complete Tan Correction Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Tan Correction Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Tan Correction Form with ease

- Obtain Tan Correction Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Tan Correction Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tan correction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the noc format for tan correction in TDS challan?

The noc format for tan correction in TDS challan is a specific template used to amend inaccuracies in the Tax Deduction and Collection Account Number (TAN) reported in challans. It is crucial for ensuring compliance with tax regulations and preventing penalties. Using this format can streamline the correction process for businesses.

-

How do I use airSlate SignNow for submitting the noc format for tan correction in TDS challan?

To use airSlate SignNow for submitting the noc format for tan correction in TDS challan, simply upload your completed document to the platform. You can then eSign and share it with the relevant authorities, ensuring a secure and efficient submission process that adheres to legal standards.

-

Is there any cost associated with using airSlate SignNow for the noc format for tan correction in TDS challan?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. While there are costs associated with premium features, the platform provides a cost-effective solution for handling the noc format for tan correction in TDS challan, making it accessible for businesses of all sizes.

-

Can I track the status of my submission for the noc format for tan correction in TDS challan?

Yes, airSlate SignNow allows you to track the status of your documents, including the noc format for tan correction in TDS challan. You will receive notifications and updates, providing peace of mind and ensuring you are informed every step of the way.

-

What benefits does airSlate SignNow offer for handling the noc format for tan correction in TDS challan?

airSlate SignNow simplifies the document management process by offering features like eSigning, secure storage, and easy sharing. These benefits enhance efficiency, reduce errors, and help ensure that the noc format for tan correction in TDS challan is completed correctly and submitted on time.

-

Does airSlate SignNow integrate with other software for managing the noc format for tan correction in TDS challan?

Yes, airSlate SignNow provides integrations with various productivity and financial software. This allows users to seamlessly manage the noc format for tan correction in TDS challan alongside other business processes, enhancing overall efficiency and accuracy.

-

What support options are available for users handling the noc format for tan correction in TDS challan?

airSlate SignNow offers comprehensive support options, including tutorials, FAQs, and customer service representatives ready to assist. Whether you have questions about the noc format for tan correction in TDS challan or any other features, support is available to help you navigate the process.

Get more for Tan Correction Form

Find out other Tan Correction Form

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now