Colorado Exemption Form

What is the Colorado Exemption

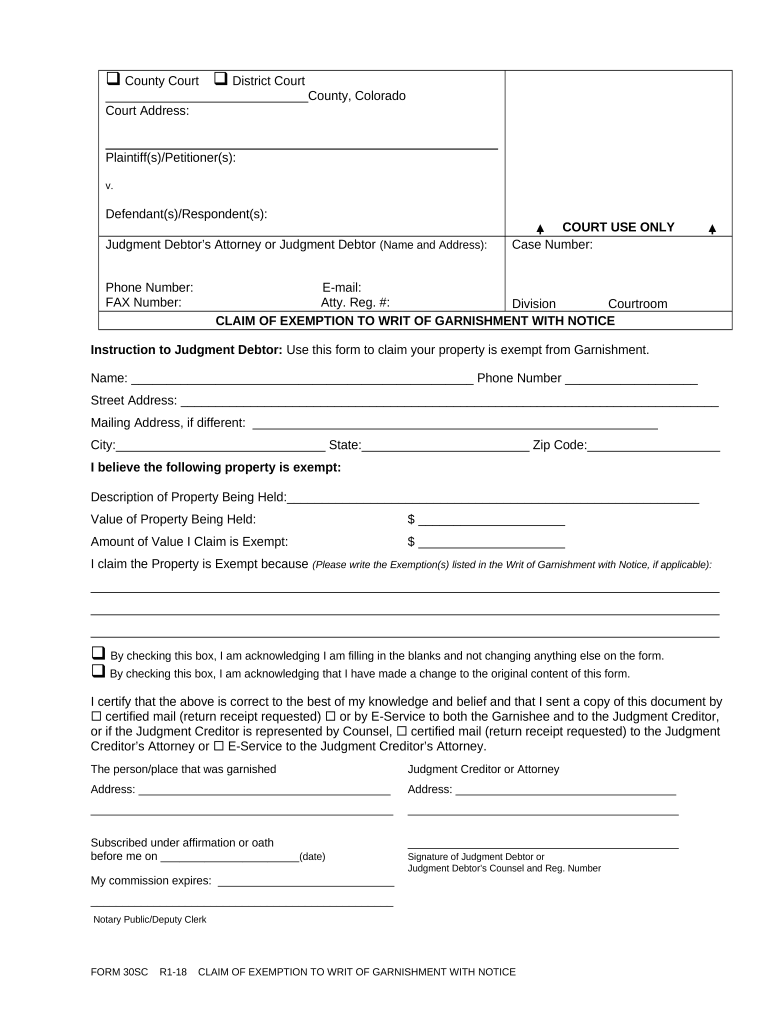

The Colorado Exemption is a legal provision that allows individuals to protect certain assets from garnishment in the state of Colorado. This exemption is particularly relevant for those facing financial difficulties, as it helps safeguard essential resources such as wages, bank accounts, and property from creditors. Understanding the Colorado Exemption is crucial for anyone dealing with debt collection, as it provides a legal framework to maintain a basic standard of living while addressing outstanding financial obligations.

How to use the Colorado Exemption

To effectively use the Colorado Exemption, individuals must first determine their eligibility based on income and asset criteria established by state law. Once eligibility is confirmed, the next step involves filing the appropriate forms, such as the claim exemption garnishment form, with the court. This process typically requires providing documentation that supports the claim, including proof of income and details about the assets in question. It is essential to follow the specific procedures outlined by the court to ensure that the exemption is recognized and upheld.

Steps to complete the Colorado Exemption

Completing the Colorado Exemption involves several key steps:

- Gather necessary documentation, including income statements and asset details.

- Fill out the claim exemption garnishment form accurately, ensuring all required information is included.

- File the completed form with the appropriate court, adhering to any submission guidelines.

- Attend any scheduled hearings if required, presenting your case to the judge if necessary.

- Receive confirmation from the court regarding the approval or denial of your exemption claim.

Legal use of the Colorado Exemption

The legal use of the Colorado Exemption requires compliance with state laws governing garnishment and debt collection. Individuals must ensure that they are using the exemption in accordance with the guidelines established by the Colorado Revised Statutes. This includes understanding which assets are exempt and the limits on the amount that can be protected. Proper legal use not only helps in preserving essential resources but also protects individuals from potential legal repercussions associated with improper claims.

Eligibility Criteria

Eligibility for the Colorado Exemption is determined by specific criteria set forth by state law. Generally, individuals must demonstrate that their income falls below a certain threshold and that the assets they wish to protect are necessary for their basic living needs. Factors such as family size, total household income, and the nature of the assets can all influence eligibility. It is advisable to consult legal resources or professionals to fully understand the criteria applicable to individual circumstances.

Required Documents

When filing for the Colorado Exemption, several documents are typically required to substantiate the claim. These may include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements showing account balances.

- Documentation of any other assets that are being claimed as exempt.

- Completed claim exemption garnishment form.

Having these documents prepared in advance can streamline the filing process and enhance the likelihood of a successful claim.

Quick guide on how to complete colorado exemption

Effortlessly Prepare Colorado Exemption on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without any delays. Manage Colorado Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to Edit and eSign Colorado Exemption with Ease

- Find Colorado Exemption and click on Get Form to initiate.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Exemption and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado exemption editable document?

A Colorado exemption editable document is a customizable form that allows users to specify exemptions applicable to their business or personal needs in Colorado. This document can be easily modified to suit individual requirements while ensuring compliance with state regulations. Using airSlate SignNow, you can create and manage your Colorado exemption editable documents efficiently.

-

How does airSlate SignNow help with Colorado exemption editable forms?

airSlate SignNow simplifies the process of creating, editing, and signing Colorado exemption editable forms. Our platform offers user-friendly tools that let you easily modify these documents as needed. With built-in compliance features, you can be confident that your Colorado exemption editable documents meet legal requirements.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes looking for Colorado exemption editable capabilities. Our plans are designed to provide cost-effective solutions while ensuring access to essential features. You can choose from monthly or annual subscriptions based on what best meets your needs.

-

Is it possible to integrate airSlate SignNow with other software?

Yes, airSlate SignNow provides seamless integrations with a variety of software solutions to enhance the management of Colorado exemption editable documents. This includes popular applications like CRM systems and cloud storage services, allowing for efficient workflow management. These integrations streamline your document processes and save time.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers multiple benefits, particularly for managing Colorado exemption editable documents. You gain access to a secure, cloud-based platform that supports electronic signatures, ensuring a faster, more efficient signing process. Plus, your documents remain legally binding and easily accessible.

-

Can I collaborate with others on Colorado exemption editable documents?

Absolutely! airSlate SignNow allows you to collaborate with team members on Colorado exemption editable documents in real time. You can invite others to review, edit, or sign the documents, which enhances teamwork and accelerates the completion process. This feature is essential for businesses looking to expedite their workflows.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security, ensuring that all your Colorado exemption editable documents are protected. We implement top-notch encryption and compliance with industry standards, safeguarding your sensitive information. You can trust that your documents are secure during storage and transmission.

Get more for Colorado Exemption

Find out other Colorado Exemption

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement