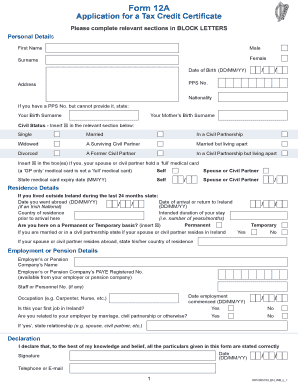

12a Form

What is the 12a Form

The 12a form, also known as the revenue form 12a, is a document used primarily for tax purposes in the United States. It is essential for individuals and businesses to report specific financial information to the relevant tax authorities. This form helps ensure compliance with federal and state tax regulations, allowing for accurate assessment and collection of taxes owed. Understanding the purpose and requirements of the 12a form is crucial for effective tax management.

How to use the 12a Form

Using the 12a form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, ensuring all entries are accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the 12a form according to the guidelines provided by the issuing authority, which may include online submission, mailing, or in-person delivery.

Steps to complete the 12a Form

Completing the 12a form requires careful attention to detail. Follow these steps for a smooth process:

- Gather Information: Collect all relevant financial documents, including previous tax returns, income records, and any supporting documentation.

- Fill Out the Form: Enter your information accurately in the designated fields. Ensure that all figures are correct and reflect your financial situation.

- Review: Double-check your entries for accuracy. Look for any missing information or mistakes that could affect your submission.

- Submit: Follow the submission guidelines provided by the relevant tax authority. This may involve online submission, mailing the form, or delivering it in person.

Legal use of the 12a Form

The legal use of the 12a form is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be filled out completely and accurately. Additionally, it should be submitted within the designated time frames set by tax authorities. Electronic submissions of the 12a form are recognized as valid under the ESIGN Act, provided that the necessary security measures are in place to protect the integrity of the document.

Who Issues the Form

The 12a form is typically issued by state tax authorities or the Internal Revenue Service (IRS), depending on its specific purpose. It is important to ensure that you are using the correct version of the form for your jurisdiction and that it complies with the latest regulations. Always check the official website of the issuing authority for the most current version and any updates regarding its use.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 12a form can be done through various methods, each with its own advantages. The most common submission methods include:

- Online Submission: Many tax authorities allow for electronic filing of the 12a form, which can expedite processing times and reduce paperwork.

- Mail: You can print the completed form and send it via postal service. Ensure that you use the correct address provided by the issuing authority.

- In-Person: Some individuals may prefer to deliver the form in person at their local tax office. This method allows for immediate confirmation of receipt.

Quick guide on how to complete 12a form

Effortlessly Prepare 12a Form on Any Device

The digital management of documents has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage 12a Form from any device with the airSlate SignNow applications available for Android or iOS, and enhance any document-related process today.

The easiest method to edit and eSign 12a Form effortlessly

- Locate 12a Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 12a Form and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 12a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form be 12a and how can airSlate SignNow help with it?

The form be 12a is an essential document used for various business purposes, including tax filings. airSlate SignNow simplifies the process of sending and eSigning this form, ensuring compliance and efficiency. With our platform, users can easily fill out, send for signatures, and manage their form be 12a in a secure environment.

-

What are the pricing options for using airSlate SignNow for form be 12a?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling documents like form be 12a. Our pricing is competitive, providing high value for features such as eSigning and document management. Users can choose from various subscription tiers based on their usage requirements.

-

What key features does airSlate SignNow offer for form be 12a management?

With airSlate SignNow, users can take advantage of features like templates, customizable workflows, and real-time tracking for form be 12a. These features streamline the signing process, making it easier to manage multiple documents simultaneously. Additionally, our platform ensures that all documents are legally binding and secure.

-

How can I integrate airSlate SignNow with other software for handling form be 12a?

airSlate SignNow provides integration capabilities with various software tools, enhancing the management of form be 12a. You can seamlessly connect with CRM systems, payroll software, and other applications to streamline your workflow. This ensures that your business processes remain efficient while dealing with crucial documents.

-

Is airSlate SignNow secure for sending sensitive documents like form be 12a?

Yes, airSlate SignNow prioritizes security, making it safe for sending sensitive documents, including form be 12a. We utilize advanced encryption methods and comply with industry standards to protect your information. Rest assured that your documents are secure at all stages of the signing process.

-

Can I track the status of my form be 12a once sent for signatures?

Absolutely! airSlate SignNow allows users to track the status of their form be 12a after sending it for signatures. You will receive notifications on the progress, including when it has been viewed and signed. This feature adds transparency and helps you manage document workflows effectively.

-

What benefits does using airSlate SignNow provide for managing form be 12a?

Using airSlate SignNow for your form be 12a offers numerous benefits, including time savings and increased efficiency in document management. The platform automates repetitive tasks, allowing you more time to focus on your core business. Additionally, our user-friendly interface makes it easy for teams to adopt and utilize.

Get more for 12a Form

- Do not mail to department of revenue services drs form

- Form ct 706709 ext instructions section 1 gift tax

- Fillable online strawberry marin rental agreement waiver form

- 2019 california form 3523 research credit 2019 california form 3523 research credit

- 2019 form 541 california fiduciary income tax return 2019 form 541 california fiduciary income tax return

- 2019 3885 corporation depreciation and amortization 2019 3885 corporation depreciation and amortization form

- 2019 california form 3885 l depreciation and amortization 2019 california form 3885 l depreciation and amortization

- 2019 instructions for schedule k 1 form 1041 for a

Find out other 12a Form

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself