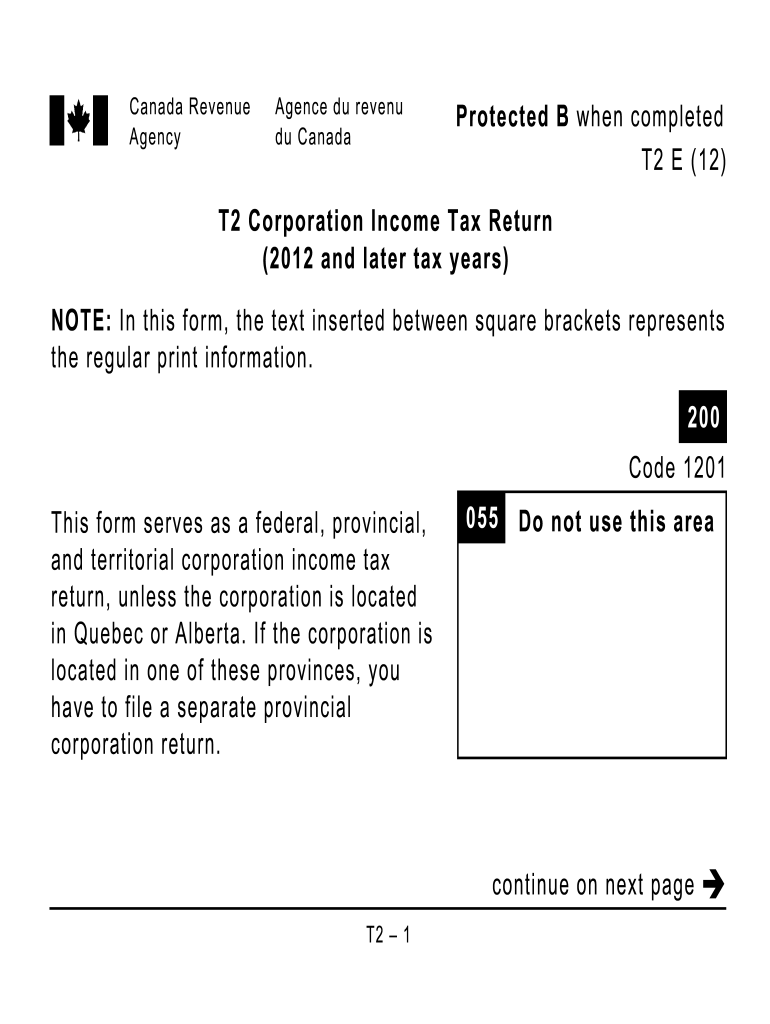

From T2 for and Later Form

What is the T 2 Form?

The T 2 form is a tax document used primarily by corporations in the United States. It is essential for reporting income, deductions, and credits to the Internal Revenue Service (IRS). This form provides a comprehensive overview of a corporation's financial activities during the tax year, ensuring compliance with federal tax laws. Understanding the T 2 form is crucial for business owners to accurately report their earnings and fulfill their tax obligations.

How to Use the T 2 Form

Using the T 2 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form with accurate figures, ensuring that all income, deductions, and credits are correctly reported. It is advisable to consult with a tax professional if there are any uncertainties. Once completed, the form can be submitted electronically or via mail to the IRS, depending on the chosen filing method.

Steps to Complete the T 2 Form

Completing the T 2 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all financial records, including revenue reports and expense receipts.

- Fill in the corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other revenue streams.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income by subtracting deductions from total income.

- Include any applicable tax credits to reduce the overall tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the T 2 Form

The T 2 form is legally binding and must be completed accurately to avoid penalties. Filing this form is a requirement for corporations to comply with federal tax laws. Failure to file or inaccuracies in reporting can lead to fines, audits, or other legal repercussions. It is essential for corporations to maintain accurate records and ensure that the information provided on the T 2 form is truthful and complete.

Filing Deadlines / Important Dates

Corporations must be aware of key deadlines associated with the T 2 form to avoid late filing penalties. Typically, the T 2 form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. Extensions may be available, but it is crucial to file any requests for extensions in a timely manner to ensure compliance.

Form Submission Methods

The T 2 form can be submitted in several ways, providing flexibility for corporations. Options include:

- Online Submission: Corporations can file electronically through the IRS e-file system, which is often faster and more secure.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, ensuring that it is sent well before the deadline.

- In-Person: Some corporations may choose to submit their forms in person at designated IRS offices, though this option may require an appointment.

Quick guide on how to complete from t2 for and later form

Complete From T2 For And Later Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage From T2 For And Later Form on any device with the airSlate SignNow apps for Android or iOS, and enhance your document-centered processes today.

How to edit and eSign From T2 For And Later Form with ease

- Obtain From T2 For And Later Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign From T2 For And Later Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from t2 for and later form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a T2 form and why is it important for businesses?

A T2 form, also known as the corporate income tax return, is essential for businesses operating in Canada. It reports the income and expenses of a corporation for a given tax year. Understanding the T2 form helps ensure compliance with the Canada Revenue Agency, allowing businesses to avoid penalties.

-

How does airSlate SignNow streamline the T2 form signing process?

airSlate SignNow simplifies the T2 form signing process by enabling electronic signatures, reducing the time spent on paperwork. Users can easily send the T2 form for signatures, track its status, and store it securely online. This efficiency minimizes delays in the filing process.

-

Is it cost-effective to use airSlate SignNow for T2 form processing?

Yes, airSlate SignNow offers a cost-effective solution for processing the T2 form compared to traditional methods. With subscription plans tailored for various business sizes, it minimizes costs associated with printing, mailing, and physical storage. This affordability makes it a smart choice for managing T2 forms.

-

What features does airSlate SignNow offer for handling the T2 form?

airSlate SignNow provides features like document templates, automatic reminders, and secure cloud storage specifically designed for forms like the T2. These tools enhance organizational efficiency and ensure that the T2 form is completed accurately and on time. Additionally, intuitive interfaces make it easy for users to navigate.

-

Can airSlate SignNow integrate with other software for T2 form preparation?

Absolutely, airSlate SignNow integrates seamlessly with popular accounting and tax software to facilitate T2 form preparation. This integration allows users to import necessary data directly, reducing manual entry errors. It enhances the overall workflow and saves valuable time during tax season.

-

What security measures does airSlate SignNow implement for T2 forms?

AirSlate SignNow prioritizes security with multiple layers of protection for your T2 forms. This includes data encryption, secure cloud storage, and user authentication protocols. These measures give businesses peace of mind that their sensitive information is safe and compliant with Canadian regulations.

-

How does airSlate SignNow enhance collaboration on T2 forms?

airSlate SignNow enhances collaboration on the T2 form through features that allow multiple users to access and edit documents simultaneously. Users can leave comments, assign tasks, and manage the workflow in real-time. This collaborative environment ensures that all team members contribute effectively before finalizing the T2 form.

Get more for From T2 For And Later Form

Find out other From T2 For And Later Form

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement