Challan Form 32a

What is the Challan Form 32a

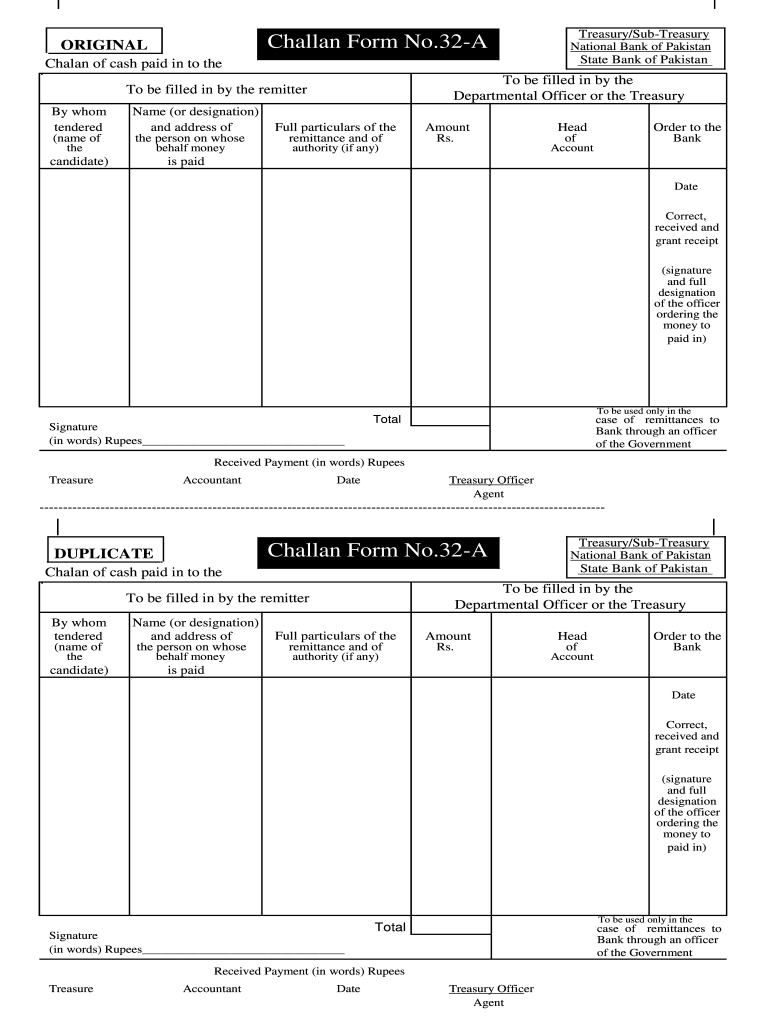

The Challan Form 32a is a crucial document used for various financial transactions, particularly in tax-related processes. It serves as a payment receipt for tax dues to the government, ensuring that payments are recorded accurately. This form is commonly utilized by individuals and businesses to fulfill their tax obligations, providing a clear record of payment. Understanding its purpose is essential for compliance with tax regulations.

How to use the Challan Form 32a

Using the Challan Form 32a involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from authorized sources. Next, fill in the required details, including the taxpayer's information and the amount being paid. Once completed, the form can be submitted online or in person at designated payment centers. Retaining a copy of the submitted form is important for your records and future reference.

Steps to complete the Challan Form 32a

Completing the Challan Form 32a requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, such as taxpayer identification and payment details.

- Enter the relevant financial year and the type of tax being paid.

- Fill in the amount due, ensuring it matches your calculations.

- Review all entries for accuracy before submission.

- Submit the form through the appropriate channels, either online or in person.

Legal use of the Challan Form 32a

The legal use of the Challan Form 32a is governed by various tax regulations. When filled out correctly and submitted, it acts as a binding document that confirms payment of taxes. It is essential to comply with all legal requirements to avoid penalties or disputes with tax authorities. The form must be retained as proof of payment, which can be requested during audits or reviews.

Key elements of the Challan Form 32a

Several key elements define the Challan Form 32a. These include:

- Taxpayer Information: Details about the individual or entity making the payment.

- Payment Amount: The total amount being paid for tax obligations.

- Financial Year: The year for which the payment is being made.

- Tax Type: The specific tax category applicable to the payment.

Form Submission Methods (Online / Mail / In-Person)

The Challan Form 32a can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many tax authorities offer online platforms for submitting the form, which is often the quickest method.

- Mail: You can send the completed form via postal service to the designated tax office.

- In-Person: Submitting the form directly at a local tax office or payment center is also an option for those who prefer face-to-face interactions.

Quick guide on how to complete challan form 32a

Complete Challan Form 32a effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the appropriate forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Challan Form 32a on any system with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Challan Form 32a with ease

- Find Challan Form 32a and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Challan Form 32a and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the challan form 32a

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is a চালান ফরম?

A চালান ফরম is a document used to request payment or show proof of transaction in various business processes. It is essential for ensuring both parties have a clear understanding of the details related to the transaction. airSlate SignNow allows users to create, send, and eSign this important document seamlessly.

-

How can I create a চালান ফরম using airSlate SignNow?

Creating a চালান ফরম with airSlate SignNow is straightforward. As a user, you can utilize our customizable templates to draft a form that meets your specific needs. Once created, you can easily send it to your recipients for eSigning.

-

What are the benefits of using airSlate SignNow for চালান ফরম?

Using airSlate SignNow for your চালান ফরম enhances efficiency and streamlines the signing process. It allows for quick digital signatures that save time compared to traditional methods. Furthermore, you can track the status of your documents in real-time.

-

Is airSlate SignNow cost-effective for managing চালান ফরম?

Yes, airSlate SignNow offers a cost-effective solution for managing your চালান ফরম and other documents. With various pricing plans, businesses can choose an option that fits their budget while still enjoying robust features. This makes it an ideal choice for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for my চালান ফরম?

Absolutely! airSlate SignNow supports integrations with numerous applications, which makes managing your চালান ফরম even more convenient. By connecting it with your existing tools, you can automate workflows and enhance productivity.

-

How secure is the information on my চালান ফরম when using airSlate SignNow?

airSlate SignNow takes security very seriously. All data, including your চালান ফরম, is encrypted and stored securely to protect sensitive information. Our compliance with industry standards ensures that your documents remain confidential throughout the signing process.

-

Can I track the status of my চালান ফরম sent for eSignatures?

Yes, with airSlate SignNow, you can easily track the status of your sent চালান ফরম. You'll receive notifications when the document is viewed and signed, so you are always updated on its progress. This feature enhances visibility and accountability in business transactions.

Get more for Challan Form 32a

Find out other Challan Form 32a

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form