it 201 X Form 2019

What is the It 201 X Form

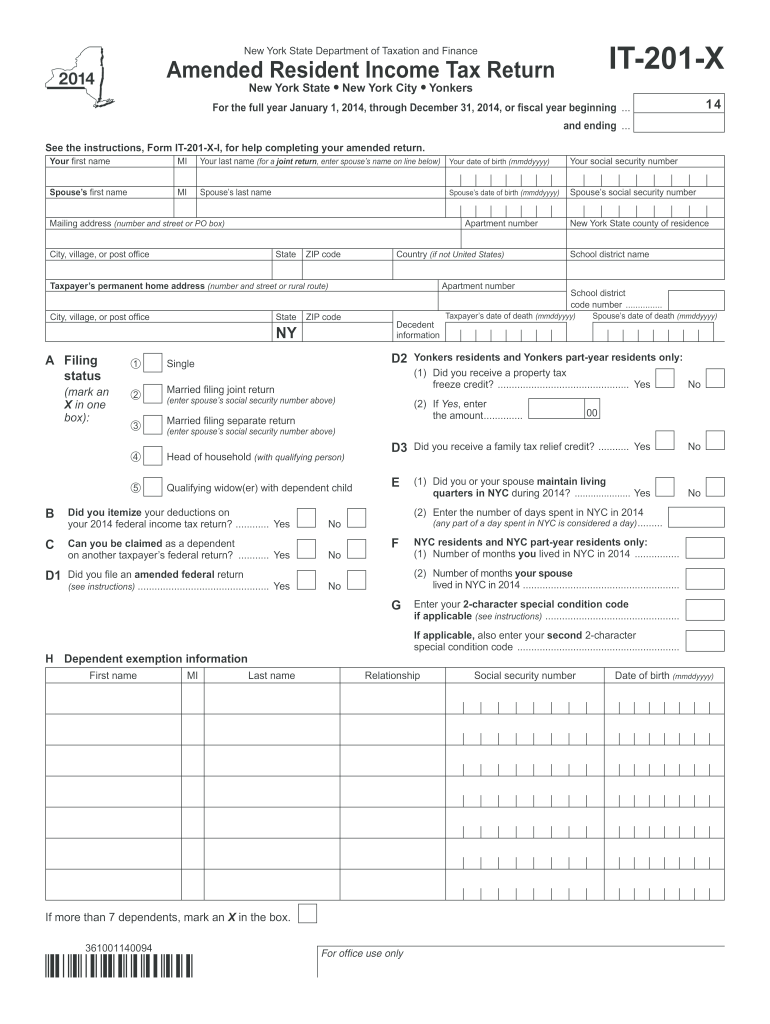

The It 201 X Form is a tax form used by individuals in the United States to amend their New York State personal income tax returns. This form allows taxpayers to make corrections to their previously filed It 201 forms, ensuring accurate reporting of income, deductions, and credits. It is essential for those who need to address errors or changes in their financial situation after filing their original return.

How to use the It 201 X Form

To use the It 201 X Form effectively, taxpayers should first gather all relevant documents related to their original tax return. This includes W-2s, 1099s, and any other income or deduction records. After completing the form, individuals must ensure that they clearly indicate the changes being made. It is important to provide a detailed explanation of the reasons for the amendments, as this can facilitate the review process by the tax authorities.

Steps to complete the It 201 X Form

Completing the It 201 X Form involves several key steps:

- Obtain the latest version of the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- List the original amounts reported on your It 201 form alongside the corrected amounts.

- Provide a detailed explanation for each change made.

- Sign and date the form before submission.

Legal use of the It 201 X Form

The It 201 X Form is legally recognized as a valid method for amending tax returns in New York State. To ensure compliance with state tax laws, it is crucial that all information provided is accurate and truthful. Filing this form correctly can help avoid potential penalties and interest charges related to underreported income or incorrect deductions.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when submitting the It 201 X Form. Generally, the form should be filed within three years from the original due date of the return being amended. For example, if the original return was due on April 15, the amended form should be submitted by April 15 of the third year following that date. Staying informed about these deadlines is essential to ensure that amendments are accepted and processed in a timely manner.

Required Documents

When filing the It 201 X Form, individuals should prepare several documents to support their amendments. These may include:

- Copies of the original It 201 form.

- Any relevant W-2s, 1099s, or other income statements.

- Documentation for any deductions or credits being claimed.

- A detailed explanation of the changes being made.

Quick guide on how to complete 2014 it 201 x form

Prepare It 201 X Form seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and eSign your documents swiftly without interruptions. Manage It 201 X Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign It 201 X Form effortlessly

- Obtain It 201 X Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your preference. Modify and eSign It 201 X Form and ensure exceptional communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 it 201 x form

Create this form in 5 minutes!

How to create an eSignature for the 2014 it 201 x form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the IT 201 X Form and how can airSlate SignNow help with it?

The IT 201 X Form is an essential document for reporting changes in your New York income tax filings. airSlate SignNow simplifies the process by allowing users to complete, eSign, and send the IT 201 X Form digitally, making it convenient and efficient.

-

Is airSlate SignNow affordable for handling the IT 201 X Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage the IT 201 X Form without breaking the bank, providing excellent value for your document management needs.

-

What key features does airSlate SignNow provide for the IT 201 X Form?

airSlate SignNow includes features such as electronic signatures, templates, document storage, and tracking capabilities. These features streamline the completion of the IT 201 X Form, ensuring accuracy and saving you time in the filing process.

-

Can I integrate airSlate SignNow with other applications for the IT 201 X Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This means you can easily manage the IT 201 X Form alongside your existing tools, enhancing productivity.

-

How does airSlate SignNow ensure the security of the IT 201 X Form?

Our platform prioritizes security with top-notch encryption protocols to protect your data while handling the IT 201 X Form. You can trust that your sensitive information is safe and secure during the eSigning process.

-

What benefits can I expect from using airSlate SignNow for the IT 201 X Form?

Using airSlate SignNow for the IT 201 X Form offers numerous benefits, including enhanced efficiency, reduced paperwork, and expedited processing. With our solution, you can quickly gather necessary signatures and ensure timely submissions.

-

Does airSlate SignNow provide customer support for issues related to the IT 201 X Form?

Yes, airSlate SignNow offers dedicated customer support to assist users with any issues related to the IT 201 X Form. Our knowledgeable team is available to help you navigate the platform and resolve any concerns.

Get more for It 201 X Form

Find out other It 201 X Form

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free