it 370 Form 2019

What is the It 370 Form

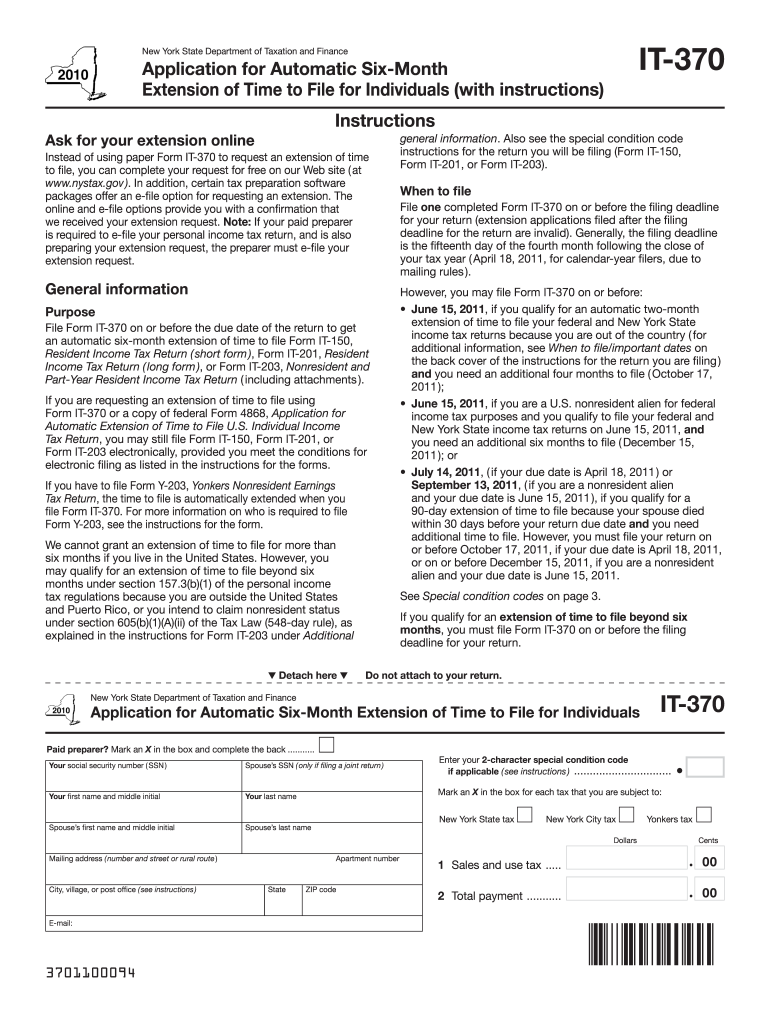

The It 370 Form is a tax document used in the United States, specifically for state income tax purposes. It is typically utilized by individuals to report their income, deductions, and credits to the state tax authority. This form plays a crucial role in determining the amount of tax owed or the refund due to the taxpayer. Understanding its purpose is essential for accurate tax filing and compliance with state regulations.

How to use the It 370 Form

Using the It 370 Form involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, carefully fill out the form, providing all required personal information and financial details. It is important to follow the instructions provided with the form to avoid errors. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the It 370 Form

Completing the It 370 Form can be broken down into several straightforward steps:

- Gather all necessary documents, including income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any deductions and credits for which you qualify.

- Calculate your total tax liability or refund.

- Sign and date the form to certify its accuracy.

Legal use of the It 370 Form

The legal use of the It 370 Form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Additionally, it must be signed by the taxpayer or an authorized representative. Failure to comply with these legal requirements can result in penalties or delays in processing. It is essential to ensure that the form is used in accordance with state regulations to avoid complications.

Filing Deadlines / Important Dates

Filing deadlines for the It 370 Form vary by state, but typically coincide with the federal tax filing deadline. Generally, taxpayers should aim to submit their forms by April 15 each year. However, extensions may be available under certain circumstances. It is important to check with the state tax authority for specific deadlines and any changes that may occur, especially during tax season.

Required Documents

When completing the It 370 Form, several documents are typically required to ensure accurate reporting. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical or educational costs.

- Previous year’s tax return for reference.

Having these documents ready can streamline the filing process and help avoid mistakes.

Quick guide on how to complete it 370 2010 form

Effortlessly Prepare It 370 Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It represents an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without complications. Manage It 370 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and Electronically Sign It 370 Form with Ease

- Download It 370 Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent portions of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign It 370 Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 370 2010 form

Create this form in 5 minutes!

How to create an eSignature for the it 370 2010 form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the It 370 Form, and who needs it?

The It 370 Form is a tax form used for certain tax-related activities. Individuals and businesses that need to report income or claim deductions relevant to their tax situation may need to fill out this form. Understanding how to properly fill out the It 370 Form can help ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the It 370 Form?

AirSlate SignNow streamlines the process of sending, signing, and managing the It 370 Form electronically. With our easy-to-use platform, users can eSign this form securely and store it in the cloud for easy access. This not only saves time but also enhances the accuracy of your tax-related submissions.

-

Is airSlate SignNow affordable for small businesses needing the It 370 Form?

Yes, airSlate SignNow offers competitive pricing plans suitable for small businesses needing to handle the It 370 Form. Our scalable solutions ensure that you only pay for what you need, helping you manage costs while allowing for efficient document handling. You can also start with a free trial to evaluate our services.

-

What features does airSlate SignNow offer for the It 370 Form?

AirSlate SignNow provides a range of features essential for managing the It 370 Form, including eSignature tools, document templates, and secure storage options. Our platform also allows for real-time tracking of document status, ensuring you stay updated on any changes made. These features streamline the workflow involved in tax documentation.

-

Is it easy to integrate airSlate SignNow with other applications for the It 370 Form?

Certainly! AirSlate SignNow is designed for easy integration with various applications, streamlining your work on the It 370 Form. Whether you use CRM systems, cloud storage solutions, or other productivity tools, our platform allows seamless connectivity. This ease of integration enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for tax documents like the It 370 Form?

Using airSlate SignNow for tax documents such as the It 370 Form brings numerous benefits, including faster turnaround times and improved compliance. Our user-friendly interface simplifies the process of collecting signatures and sharing documents securely. Additionally, it signNowly reduces the likelihood of errors during form submission.

-

Can I access the It 370 Form from multiple devices with airSlate SignNow?

Yes, you can access the It 370 Form from multiple devices using airSlate SignNow. Our cloud-based platform ensures that your documents are available anytime and anywhere, allowing for flexibility while managing your tax paperwork. This accessibility is particularly beneficial for users on the go or those working from different locations.

Get more for It 370 Form

Find out other It 370 Form

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online