Form it 2663 IInstructions for Form it 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny 2020

What is the Form IT 2663?

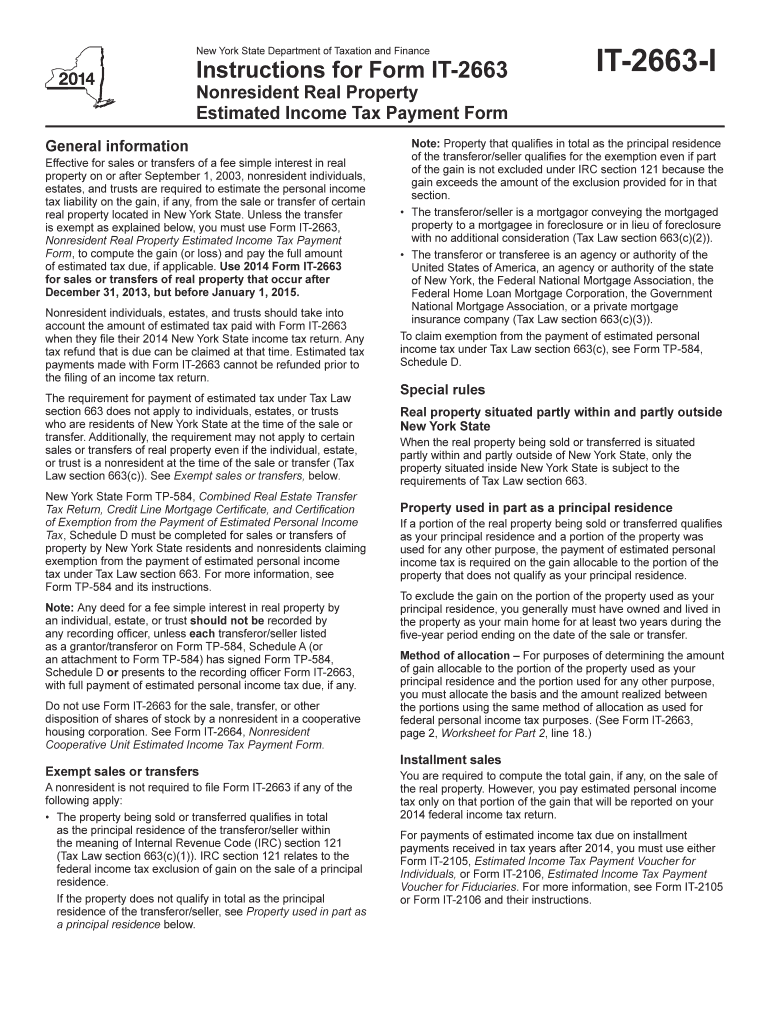

The Form IT 2663 is a tax document used by nonresident individuals and entities to report estimated income tax payments related to real property transactions in New York. This form is essential for those who earn income from real estate investments in the state but do not reside there. By submitting this form, nonresidents ensure compliance with New York state tax regulations, avoiding potential penalties and interest on unpaid taxes.

Steps to Complete the Form IT 2663

Completing the Form IT 2663 involves several key steps:

- Gather necessary information: Collect details about your real estate transactions, including property addresses and income amounts.

- Fill out the form: Input your personal information, including your name, address, and taxpayer identification number.

- Calculate estimated tax: Use the provided guidelines to determine your estimated tax liability based on your expected income from the property.

- Review for accuracy: Ensure all information is correct and complete to avoid delays in processing.

- Submit the form: Choose your preferred method of submission, whether online, by mail, or in person.

Legal Use of the Form IT 2663

The Form IT 2663 is legally binding when filled out correctly and submitted in accordance with New York state tax laws. It is crucial for nonresidents to understand that electronic signatures are valid under U.S. law, provided they meet specific criteria. Using a reliable eSignature solution can enhance the legal standing of your submission, ensuring compliance with regulations such as ESIGN and UETA.

Filing Deadlines / Important Dates

Timely filing of the Form IT 2663 is essential to avoid penalties. Generally, the estimated income tax payments are due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is advisable to check the New York State Department of Taxation and Finance for any updates or changes to these deadlines.

Form Submission Methods

The Form IT 2663 can be submitted through various methods:

- Online: Many taxpayers prefer to file electronically through authorized e-filing services, which can streamline the process.

- By Mail: Completed forms can be mailed to the appropriate New York tax office, ensuring that they are postmarked by the due date.

- In Person: Taxpayers may also choose to deliver their forms directly to a local tax office for immediate processing.

Key Elements of the Form IT 2663

Important components of the Form IT 2663 include:

- Taxpayer Information: Name, address, and identification number of the nonresident taxpayer.

- Property Details: Information about the real property generating income.

- Estimated Tax Calculation: A section for calculating the estimated tax owed based on projected income.

- Signature: A declaration confirming the accuracy of the information provided, which may require an electronic signature for e-filing.

Quick guide on how to complete form it 2663 i2014instructions for form it 2663 nonresident real property estimated income tax payment formit2663i tax ny

Effortlessly Prepare Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny with Ease

- Locate Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to preserve your modifications.

- Choose your preferred method of submitting your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, time-consuming form searching, or errors that necessitate the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and electronically sign Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2663 i2014instructions for form it 2663 nonresident real property estimated income tax payment formit2663i tax ny

Create this form in 5 minutes!

How to create an eSignature for the form it 2663 i2014instructions for form it 2663 nonresident real property estimated income tax payment formit2663i tax ny

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Form IT 2663?

Form IT 2663 is the Nonresident Real Property Estimated Income Tax Payment Form used in New York. This form allows nonresidents to report and pay estimated income tax on income gained from real property in the state. Understanding the requirements of Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny is essential for compliance.

-

How can I easily complete Form IT 2663?

You can easily complete Form IT 2663 through airSlate SignNow's user-friendly platform. It simplifies the process by providing templates and step-by-step guidance to ensure you fill out the form correctly. Utilize airSlate SignNow to manage the Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny with ease.

-

What features does airSlate SignNow offer for handling Form IT 2663?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage for managing Form IT 2663. These features streamline the tax form process, ensuring efficiency and security. By using airSlate SignNow, you gain access to tools specifically designed to navigate the complexities of Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny.

-

Is airSlate SignNow cost-effective for managing tax forms like IT 2663?

Yes, airSlate SignNow is a cost-effective solution for managing various tax forms, including Form IT 2663. With affordable pricing plans tailored to your needs, you can access all essential features without breaking the bank. Utilizing airSlate SignNow can save your business time and money while handling the Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny.

-

Can I integrate airSlate SignNow with other software to manage Form IT 2663?

Absolutely! airSlate SignNow offers various integrations with popular software to help you manage Form IT 2663 efficiently. You can connect it with your existing systems to streamline workflows and ensure seamless document processing. This integration enhances your tools when dealing with Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny.

-

What are the benefits of using airSlate SignNow for Form IT 2663?

Using airSlate SignNow to manage Form IT 2663 offers several benefits, including increased efficiency and enhanced security. The platform allows for easy sharing and tracking of documents while providing legally binding eSignatures. With airSlate SignNow, navigating the Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny becomes seamless.

-

Can airSlate SignNow help with compliance for Form IT 2663?

Yes, airSlate SignNow is designed to help ensure compliance when filling out and submitting Form IT 2663. The platform provides guidance and reminders about important deadlines, helping you stay on track with your tax obligations. This makes managing Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny easier and compliant.

Get more for Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny

Find out other Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Property Estimated Income Tax Payment FormIT2663I Tax Ny

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online