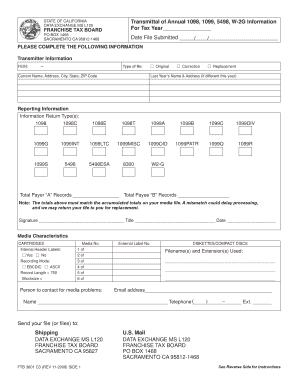

Ftb 3601 2008-2026

What is the FTB 5498 Form?

The FTB 5498 form is a tax document used by the California Franchise Tax Board to report contributions to various retirement accounts, including Individual Retirement Accounts (IRAs). This form provides essential information regarding the contributions made during the tax year, including the type of account and the total amount contributed. It is crucial for taxpayers to understand this form as it helps them track their retirement savings and ensures compliance with IRS regulations.

Key Elements of the FTB 5498 Form

The FTB 5498 form includes several key elements that taxpayers need to be aware of:

- Taxpayer Information: This section includes the taxpayer’s name, address, and Social Security number.

- Account Information: Details about the type of retirement account, such as traditional IRAs, Roth IRAs, or SEP IRAs.

- Contribution Amounts: The total contributions made to the account during the tax year, including any rollovers or conversions.

- Valuation Information: The fair market value of the account at the end of the tax year.

Steps to Complete the FTB 5498 Form

Completing the FTB 5498 form involves several straightforward steps:

- Gather all relevant information regarding your retirement accounts, including contributions and account types.

- Fill in your personal information accurately, ensuring that your name and Social Security number are correct.

- Indicate the type of retirement account and enter the total contributions made during the tax year.

- Provide the fair market value of your account as of December thirty-first of the tax year.

- Review the completed form for accuracy before submission.

Form Submission Methods

Taxpayers can submit the FTB 5498 form using various methods:

- Online Submission: Many taxpayers opt to file their forms electronically through tax preparation software that supports e-filing.

- Mail: The form can be printed and mailed to the California Franchise Tax Board at the designated address.

- In-Person: Taxpayers may also choose to deliver the form in person at a local Franchise Tax Board office.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the FTB 5498 form to avoid penalties:

- Annual Filing Deadline: The FTB 5498 form must be submitted by the tax filing deadline, typically April fifteenth of the following year.

- Amendments: If corrections are needed after submission, amendments should be filed as soon as possible to ensure compliance.

Penalties for Non-Compliance

Failure to file the FTB 5498 form or inaccuracies in reporting can result in penalties. Taxpayers may face:

- Fines: The California Franchise Tax Board may impose fines for late filing or failure to report accurate information.

- Increased Scrutiny: Non-compliance may lead to increased scrutiny of future tax filings, potentially resulting in audits.

Quick guide on how to complete ftb 3601

Complete Ftb 3601 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without interruptions. Manage Ftb 3601 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Ftb 3601 effortlessly

- Locate Ftb 3601 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Alter and electronically sign Ftb 3601 and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 3601

Create this form in 5 minutes!

How to create an eSignature for the ftb 3601

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the FTB 5498 form and why do I need it?

The FTB 5498 form is a crucial document for reporting certain transactions related to individual retirement accounts. It's important for taxpayers to accurately disclose contributions, rollovers, and the fair market value of their accounts. If you have these accounts, completing the FTB 5498 form is essential for your tax return compliance.

-

How does airSlate SignNow help in signing the FTB 5498 form?

airSlate SignNow provides a seamless platform to draft, send, and eSign the FTB 5498 form securely. With its user-friendly interface, users can easily fill in necessary information and obtain electronic signatures, ensuring your documents are processed efficiently and comply with legal standards.

-

Is there a cost associated with using airSlate SignNow for the FTB 5498 form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. Each plan includes access to all features necessary for efficiently managing and signing documents like the FTB 5498 form. Review our pricing options to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other applications when working on the FTB 5498 form?

Absolutely! airSlate SignNow supports various integrations with popular applications like Google Drive, Dropbox, and more. This allows users to easily import or export the FTB 5498 form and streamline their filing process across multiple platforms.

-

What features does airSlate SignNow offer for managing the FTB 5498 form?

airSlate SignNow includes features such as customizable templates, digital signature options, and document tracking, specifically beneficial for handling the FTB 5498 form. These tools enhance the efficiency of filling out and submitting your tax-related documents, making the entire process smoother.

-

Is it safe to use airSlate SignNow to eSign the FTB 5498 form?

Yes, your data safety is our priority at airSlate SignNow. The platform employs advanced encryption and security measures to protect documents, including the FTB 5498 form, ensuring that your personal and financial information remains confidential and secure.

-

How can I get customer support while using airSlate SignNow for the FTB 5498 form?

airSlate SignNow offers comprehensive customer support through various channels, including live chat, email, and detailed resources in the help center. If you encounter any issues while working on your FTB 5498 form, our support team is readily available to assist you.

Get more for Ftb 3601

Find out other Ftb 3601

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe