Vat 7 Form PDF

What is the VAT 7 Form PDF?

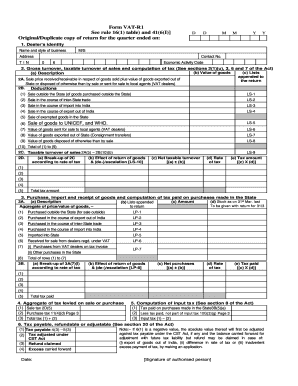

The VAT 7 Form PDF is a crucial document used for reporting value-added tax (VAT) in the United States. This form allows businesses to declare their VAT liabilities and claim any refunds due. It is essential for maintaining compliance with tax regulations and ensuring accurate reporting of taxable sales and purchases. The VAT 7 Form is typically required for businesses that are registered for VAT and need to submit their returns periodically, usually quarterly or annually, depending on their specific circumstances.

How to Use the VAT 7 Form PDF

Using the VAT 7 Form PDF involves several steps to ensure accurate completion and submission. First, download the form from a reliable source. Once you have the form, gather all necessary financial records, including sales invoices and purchase receipts. Carefully fill out the form by entering your business information, VAT collected on sales, and VAT paid on purchases. After completing the form, review it for accuracy before submission. You can submit the completed VAT 7 Form either electronically or via mail, depending on the requirements of your local tax authority.

Steps to Complete the VAT 7 Form PDF

Completing the VAT 7 Form PDF requires attention to detail. Follow these steps:

- Download the VAT 7 Form PDF from an official source.

- Gather all financial documents related to sales and purchases.

- Input your business information, including name, address, and VAT registration number.

- Calculate the total VAT collected from sales and enter this amount in the appropriate section.

- Calculate the total VAT paid on purchases and enter this amount.

- Determine the net VAT payable or refundable by subtracting the VAT paid from the VAT collected.

- Review the form for errors and ensure all calculations are correct.

- Submit the form according to your local tax authority's guidelines.

Legal Use of the VAT 7 Form PDF

The VAT 7 Form PDF is legally binding when completed and submitted according to the regulations set forth by tax authorities. It serves as an official record of your VAT reporting and can be used to verify compliance during audits. To ensure the form's legal validity, it is important to follow all instructions carefully and provide accurate information. Additionally, using a reliable e-signature solution can enhance the legal standing of your submission, ensuring that it meets all necessary electronic signature requirements.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 7 Form PDF vary based on your business's reporting period. Typically, businesses must submit their VAT returns quarterly or annually. It is crucial to be aware of these deadlines to avoid penalties. For quarterly filers, returns are usually due one month after the end of the quarter. Annual filers may have a specific deadline set by their local tax authority. Keeping track of these dates helps ensure timely compliance and prevents any late fees or interest charges.

Form Submission Methods (Online / Mail / In-Person)

The VAT 7 Form PDF can be submitted through various methods, depending on your local tax authority's regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic filing through their official websites, which can expedite processing times.

- Mail: You can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some businesses may choose to deliver the form in person to their local tax office for immediate confirmation of receipt.

Quick guide on how to complete vat 7 form pdf

Effortlessly Create Vat 7 Form Pdf on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right template and securely save it online. airSlate SignNow provides all the tools required to generate, alter, and electronically sign your documents swiftly and without delays. Manage Vat 7 Form Pdf on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Method to Modify and Electronically Sign Vat 7 Form Pdf

- Find Vat 7 Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vat 7 Form Pdf while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 7 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an online VAT return form, and why is it important?

An online VAT return form is a digital document used by businesses to report their VAT taxable sales and purchases to tax authorities. It is important because it ensures compliance with tax regulations and helps avoid penalties. By using an online VAT return form, businesses can streamline their tax filing processes and easily maintain accurate records.

-

How can airSlate SignNow help with my online VAT return form?

airSlate SignNow simplifies the process of completing and submitting your online VAT return form. Our platform allows you to easily fill out, sign, and send the form securely, reducing the likelihood of errors. By using airSlate SignNow, you can ensure timely submissions and maintain compliance with tax regulations.

-

Is there a fee for using the online VAT return form feature?

Yes, airSlate SignNow offers a cost-effective pricing plan for using the online VAT return form feature. The pricing structure is designed to accommodate businesses of all sizes, ensuring that you have access to a powerful tool without breaking the bank. For a detailed breakdown of our pricing, you can visit our pricing page.

-

What features does airSlate SignNow provide for online VAT return forms?

airSlate SignNow provides several features for managing your online VAT return forms, including customizable templates, eSignature capabilities, and real-time tracking. You can create, edit, and send forms quickly, making the VAT return process seamless. Additionally, our platform ensures that your documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other accounting software for VAT returns?

Yes, airSlate SignNow offers integrations with various accounting and finance software, enhancing your ability to manage online VAT return forms. These integrations allow for seamless data transfer, ensuring that your financial records are up-to-date and accurate. Whether you use QuickBooks, Xero, or other platforms, we have solutions to fit your needs.

-

What are the benefits of using an online VAT return form through airSlate SignNow?

Using an online VAT return form through airSlate SignNow offers numerous benefits, such as improved efficiency, reduced paperwork, and enhanced accuracy. Our secure platform allows you to complete forms digitally, saving time and effort. Furthermore, eSigning features ensure that your submissions are legally binding and compliant with regulations.

-

How can I ensure that my online VAT return form is submitted on time?

To ensure timely submission of your online VAT return form, use airSlate SignNow's reminders and scheduling features to stay organized. Our platform allows you to set deadlines and track the status of your forms, so you never miss an important date. By planning ahead and using our tools, you can confidently submit your returns on time.

Get more for Vat 7 Form Pdf

Find out other Vat 7 Form Pdf

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document