Louisiana Form it 540 Instructions

What is the Louisiana Form It 540 Instructions

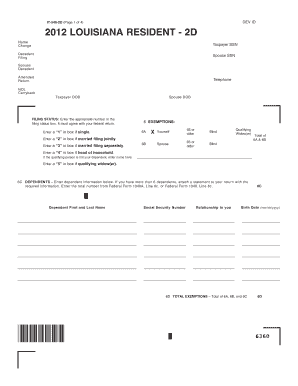

The Louisiana Form It 540 is a state income tax form used by residents to report their income and calculate their state tax liability. This form is essential for ensuring compliance with Louisiana tax laws. The instructions accompanying the form provide detailed guidance on how to accurately complete it, including information on income sources, deductions, and credits available to taxpayers. Understanding these instructions is crucial for filing a correct and timely tax return.

Steps to complete the Louisiana Form It 540 Instructions

Completing the Louisiana Form It 540 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and other income statements. Next, carefully read the instructions provided with the form to understand the requirements for reporting income and claiming deductions. Fill out the form systematically, starting with your personal information, followed by income details, deductions, and credits. Finally, review the completed form for errors before submitting it.

Legal use of the Louisiana Form It 540 Instructions

The legal use of the Louisiana Form It 540 is governed by state tax regulations. It is important to follow the instructions precisely to ensure that the form is completed correctly and submitted on time. Failure to comply with the guidelines can lead to penalties, including fines or interest on unpaid taxes. The form must be signed and dated by the taxpayer or their authorized representative to be considered valid.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the Louisiana Form It 540. Typically, the form is due on May fifteenth of each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each tax year to avoid late penalties.

Required Documents

To complete the Louisiana Form It 540, taxpayers must gather several required documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits being claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure accuracy when filling out the form.

Form Submission Methods (Online / Mail / In-Person)

The Louisiana Form It 540 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing services, which can expedite processing and reduce errors. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete louisiana form it 540 instructions

Effortlessly Prepare Louisiana Form It 540 Instructions on Any Device

The management of documents online has become increasingly favored by both organizations and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Louisiana Form It 540 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any documentation process today.

How to Modify and eSign Louisiana Form It 540 Instructions with Ease

- Acquire Louisiana Form It 540 Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Louisiana Form It 540 Instructions and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana form it 540 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the IT 540 2D form?

The IT 540 2D form is specifically designed for Louisiana residents to file their state income tax returns. It allows taxpayers to report their income, deductions, and credits in a straightforward manner, making the filing process easier. Utilizing airSlate SignNow, businesses can efficiently complete and eSign this form to ensure compliance.

-

How can airSlate SignNow help with IT 540 2D form submissions?

airSlate SignNow streamlines the submission process for the IT 540 2D form by allowing users to electronically sign and send their documents securely. This feature saves time and reduces the risk of errors in the submission. With its easy-to-use interface, airSlate SignNow empowers users to focus on their tax preparation rather than paperwork.

-

What are the key features of airSlate SignNow related to the IT 540 2D form?

Key features of airSlate SignNow for the IT 540 2D form include eSignature capabilities, template creation, and document tracking. Users can easily create custom templates for repetitive tasks, ensuring that the IT 540 2D form is always completed accurately. Additionally, document tracking helps monitor the status of submissions.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore its features, including those relevant to the IT 540 2D form, without commitment. During the trial, you can experience firsthand how easy it is to eSign and manage documents. Take advantage of this opportunity to see how airSlate SignNow can simplify your tax filing process.

-

What benefits does airSlate SignNow provide for businesses filing the IT 540 2D?

For businesses, airSlate SignNow offers signNow benefits when filing the IT 540 2D form, including enhanced compliance and reduced paperwork. By streamlining the eSigning process, companies can avoid costly mistakes and ensure that their submissions meet state requirements. Additionally, it improves collaboration among team members in managing tax documents.

-

Can airSlate SignNow integrate with other tools for filing the IT 540 2D form?

Absolutely! airSlate SignNow easily integrates with various accounting and tax software, simplifying the filing process for the IT 540 2D form. This means users can leverage existing tools alongside airSlate SignNow to enhance their document workflow. Streamlined integration features facilitate seamless data transfer and management.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for various business needs, ensuring that filing the IT 540 2D form remains cost-effective. Pricing tiers are designed to cater to different user requirements, allowing businesses to choose a package that fits their needs and budget. Consider exploring the options to find the best fit for your organization.

Get more for Louisiana Form It 540 Instructions

- Transnet jobs form

- Vehicle licence renewal post office 2001 form

- Coid registration form 2020 pdf

- Non academic merit form stellenbosch university

- Sadtu membership form

- Standard bank proof of residence form download

- Signaling status with luxury goods the role of brand prominence pdf form

- Unisa appeal form

Find out other Louisiana Form It 540 Instructions

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast