Depository Authorization USDA Rural Development Rurdev Usda Form

What is the Depository Authorization USDA Rural Development Rurdev Usda

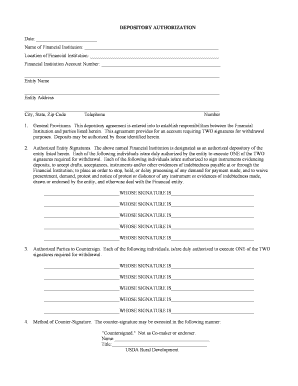

The Depository Authorization USDA Rural Development Rurdev Usda form is a crucial document that allows individuals or entities to designate a financial institution for the deposit of federal funds. This form is primarily used in conjunction with programs administered by the USDA Rural Development, which supports rural communities through various financial initiatives. By completing this form, applicants can ensure that their funds are directed to the appropriate bank or credit union, facilitating smoother transactions and financial management.

How to use the Depository Authorization USDA Rural Development Rurdev Usda

Using the Depository Authorization USDA Rural Development Rurdev Usda form involves several key steps. First, gather all necessary information, including your personal details and the banking institution’s information where you want the funds deposited. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Once the form is complete, it must be submitted to the relevant USDA Rural Development office for processing. It's important to keep a copy of the submitted form for your records.

Steps to complete the Depository Authorization USDA Rural Development Rurdev Usda

Completing the Depository Authorization USDA Rural Development Rurdev Usda form requires attention to detail. Follow these steps:

- Obtain the form from the USDA Rural Development website or your local office.

- Fill in your name, address, and contact information in the designated sections.

- Provide the name and address of the financial institution where the funds will be deposited.

- Include your account number and any additional required banking information.

- Sign and date the form to validate your authorization.

- Submit the completed form to the appropriate USDA office, either online or by mail.

Key elements of the Depository Authorization USDA Rural Development Rurdev Usda

Several key elements make the Depository Authorization USDA Rural Development Rurdev Usda form effective and legally binding. These include:

- Identification Information: Personal details of the applicant and the designated bank.

- Account Information: Specific account numbers and types to ensure accurate deposits.

- Signature: The applicant's signature is necessary to confirm the authorization.

- Date of Authorization: This indicates when the authorization becomes effective.

Legal use of the Depository Authorization USDA Rural Development Rurdev Usda

The legal use of the Depository Authorization USDA Rural Development Rurdev Usda form is governed by federal regulations that ensure its validity. To be legally binding, the form must be completed accurately and signed by the authorized individual. Additionally, it must comply with the standards set by the USDA and relevant financial regulations. This ensures that the funds are deposited securely and that the authorization can be upheld in case of disputes.

Eligibility Criteria

To complete the Depository Authorization USDA Rural Development Rurdev Usda form, applicants must meet specific eligibility criteria. Generally, this includes being a recipient of USDA Rural Development funds or a related program. Applicants may include individuals, businesses, or organizations that are eligible for financial assistance from the USDA. It is essential to verify eligibility before submitting the form to avoid complications in processing.

Quick guide on how to complete depository authorization usda rural development rurdev usda

Effortlessly prepare Depository Authorization USDA Rural Development Rurdev Usda on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly and without hassle. Handle Depository Authorization USDA Rural Development Rurdev Usda on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Depository Authorization USDA Rural Development Rurdev Usda with ease

- Obtain Depository Authorization USDA Rural Development Rurdev Usda and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether it be via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Depository Authorization USDA Rural Development Rurdev Usda and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the depository authorization usda rural development rurdev usda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Depository Authorization USDA Rural Development Rurdev Usda?

Depository Authorization USDA Rural Development Rurdev Usda is a crucial process that allows organizations to manage the electronic transfer of funds for USDA Rural Development projects. This authorization ensures that funds are efficiently deposited and tracked, streamlining the financial management of these initiatives.

-

How do I obtain Depository Authorization USDA Rural Development Rurdev Usda?

To obtain Depository Authorization USDA Rural Development Rurdev Usda, you'll need to submit specific documentation to the USDA, including your organization’s bank details and project information. airSlate SignNow can help you prepare and sign documents electronically, making the submission process quicker and easier.

-

What are the benefits of using airSlate SignNow for Depository Authorization USDA Rural Development Rurdev Usda?

Using airSlate SignNow for your Depository Authorization USDA Rural Development Rurdev Usda needs simplifies the process of sending and eSigning your documents. With an intuitive interface and robust security features, you can expedite approvals and keep track of your submissions more efficiently.

-

Is there a cost associated with using airSlate SignNow for Depository Authorization USDA Rural Development Rurdev Usda?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While the specific costs depend on the selected plan, the platform is designed to provide a cost-effective solution for managing your Depository Authorization USDA Rural Development Rurdev Usda documents.

-

Can airSlate SignNow integrate with other systems for Managing Depository Authorization USDA Rural Development Rurdev Usda?

Absolutely! airSlate SignNow provides seamless integrations with popular business applications that can enhance the management of your Depository Authorization USDA Rural Development Rurdev Usda processes. This ensures that your workflows are efficient and that all systems work harmoniously.

-

How secure is airSlate SignNow for handling Depository Authorization USDA Rural Development Rurdev Usda?

AirSlate SignNow prioritizes security, implementing advanced measures to protect your data during the signing and submission process. With industry-standard encryption and compliance with data protection regulations, you can trust that your Depository Authorization USDA Rural Development Rurdev Usda documents are safe.

-

How does airSlate SignNow improve the efficiency of my Depository Authorization USDA Rural Development Rurdev Usda process?

By utilizing electronic signatures and automated workflows, airSlate SignNow signNowly reduces the time needed for managing Depository Authorization USDA Rural Development Rurdev Usda documents. This helps organizations focus more on their core missions rather than being bogged down by paperwork.

Get more for Depository Authorization USDA Rural Development Rurdev Usda

Find out other Depository Authorization USDA Rural Development Rurdev Usda

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors