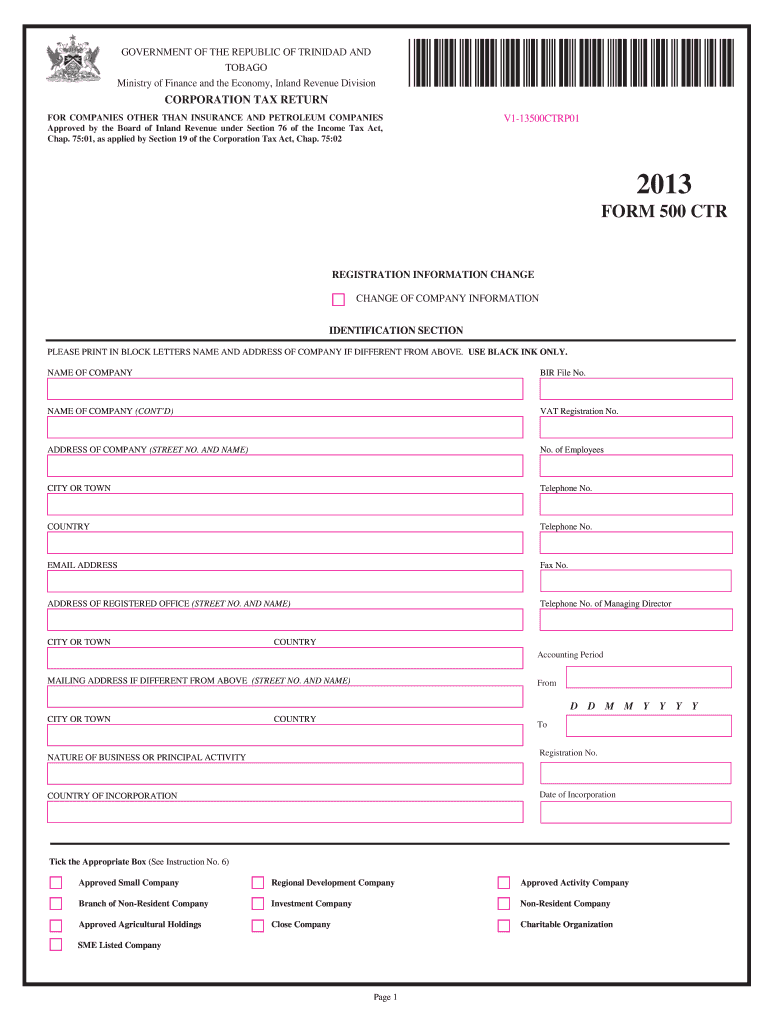

FORM 500 CTR Inland Revenue Division 2013

What is the FORM 500 CTR Inland Revenue Division

The FORM 500 CTR Inland Revenue Division is a crucial document used primarily for reporting certain financial transactions to the relevant tax authorities. This form is designed to ensure compliance with federal regulations concerning financial transparency and anti-money laundering efforts. It typically involves the reporting of cash transactions exceeding a specified threshold, thus helping to maintain the integrity of the financial system.

How to use the FORM 500 CTR Inland Revenue Division

Using the FORM 500 CTR involves several steps to ensure accurate reporting. First, gather all necessary information regarding the transaction, including the identities of the parties involved and the amount of cash exchanged. Next, complete each section of the form thoroughly, ensuring that all details are accurate and complete. Once filled out, the form must be submitted to the appropriate tax authority within the specified timeframe to avoid penalties.

Steps to complete the FORM 500 CTR Inland Revenue Division

Completing the FORM 500 CTR involves a systematic approach:

- Identify the transaction that requires reporting.

- Collect all relevant information, including names, addresses, and transaction details.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form to the Inland Revenue Division by the deadline.

Legal use of the FORM 500 CTR Inland Revenue Division

The legal use of the FORM 500 CTR is governed by federal regulations that mandate its submission for specific cash transactions. It serves as a protective measure against financial crimes and ensures that individuals and businesses comply with tax laws. Failure to use this form correctly can result in significant penalties, including fines and legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 500 CTR are critical to maintaining compliance. Typically, the form must be submitted within a specified period following the transaction date. It is essential to consult the relevant tax authority or official guidelines to determine the exact deadlines, as these can vary based on the nature of the transaction and the jurisdiction involved.

Form Submission Methods (Online / Mail / In-Person)

The FORM 500 CTR can be submitted through various methods, depending on the regulations set by the Inland Revenue Division. Common submission methods include:

- Online submission through the official tax authority portal.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, where applicable.

Quick guide on how to complete form 500 ctr inland revenue division

Complete FORM 500 CTR Inland Revenue Division effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage FORM 500 CTR Inland Revenue Division on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign FORM 500 CTR Inland Revenue Division with ease

- Find FORM 500 CTR Inland Revenue Division and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign FORM 500 CTR Inland Revenue Division and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 500 ctr inland revenue division

Create this form in 5 minutes!

How to create an eSignature for the form 500 ctr inland revenue division

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is FORM 500 CTR Inland Revenue Division?

FORM 500 CTR Inland Revenue Division is a crucial form required by businesses for compliance purposes. It helps organizations manage their tax obligations efficiently while ensuring adherence to regulations set by the Inland Revenue Division.

-

How can airSlate SignNow assist with FORM 500 CTR Inland Revenue Division?

With airSlate SignNow, users can easily eSign and send the FORM 500 CTR Inland Revenue Division securely. Our platform streamlines the document management process, making it quicker and simpler to handle your tax-related documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring affordability. Each plan includes features that support the efficient management of documents, including the FORM 500 CTR Inland Revenue Division.

-

What features does airSlate SignNow offer for eSigning documents?

airSlate SignNow provides robust features for eSigning documents, including customizable signing workflows and secure storage options. These features enhance the handling of important forms like the FORM 500 CTR Inland Revenue Division.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with popular business applications, allowing for efficient workflows. This means you can easily share and manage the FORM 500 CTR Inland Revenue Division alongside your other business documents.

-

What are the benefits of using airSlate SignNow for FORM 500 CTR Inland Revenue Division?

Using airSlate SignNow for the FORM 500 CTR Inland Revenue Division provides businesses with time-saving efficiencies and greater security. The platform simplifies the eSigning process, ensuring compliance and accuracy for your tax forms.

-

Is airSlate SignNow compliant with legal eSignature regulations?

Absolutely! airSlate SignNow is compliant with eSignature laws, ensuring that your signed documents, including the FORM 500 CTR Inland Revenue Division, are legally binding. This compliance gives you peace of mind as you manage your tax-related tasks.

Get more for FORM 500 CTR Inland Revenue Division

- Flcourts family law forms

- Sshs ecboe form

- Lat 11watercraft 20 personal property tax form

- Sales ampamp use taxshreveport la official website form

- Ohio it 1040 and sd100 formsdepartment of taxation

- Ohio it 1040 do not staple or paper clip hio form

- Sworn deposes and says that 101780456 form

- Office use onlyp o box 530columbus oh 43216 0 form

Find out other FORM 500 CTR Inland Revenue Division

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document