Oregon Form Oq

What is the Oregon Form Oq

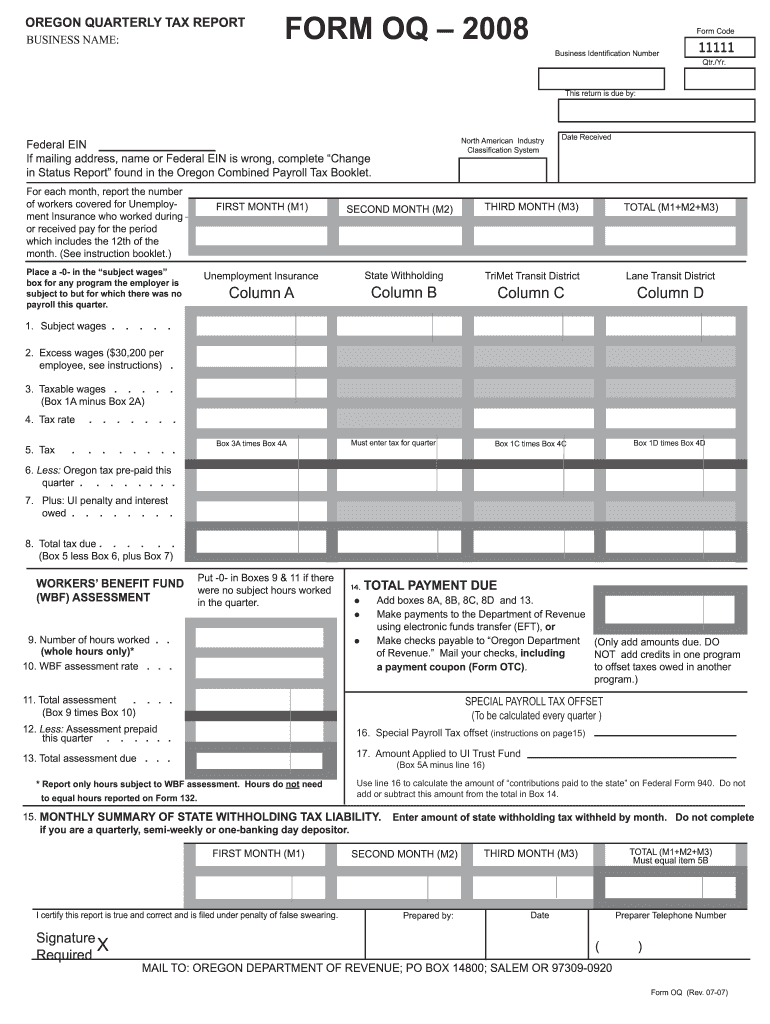

The Oregon Form Oq is a quarterly tax report that businesses operating in Oregon are required to submit. This form is essential for reporting income and calculating tax liabilities for various business entities, including corporations and partnerships. It is designed to ensure compliance with state tax regulations and provides a structured way to report earnings, deductions, and credits. Understanding the specifics of the Oregon Form Oq is crucial for maintaining compliance and avoiding penalties.

Steps to complete the Oregon Form Oq

Completing the Oregon Form Oq involves several key steps that ensure accuracy and compliance. Here are the main steps to follow:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form with accurate figures, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Sign the form to certify that the information provided is true and complete.

- Submit the form by the designated deadline to avoid late fees.

Legal use of the Oregon Form Oq

The Oregon Form Oq is legally binding when completed accurately and submitted on time. It complies with state tax laws, which require businesses to report their earnings quarterly. Failure to adhere to these requirements can result in penalties, including fines and interest on unpaid taxes. It is essential to use a reliable method for completing and submitting the form, ensuring that all information is verifiable and compliant with Oregon tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form Oq are critical for maintaining compliance. Generally, the form must be submitted quarterly, with specific due dates for each quarter. The deadlines typically fall on the last day of the month following the end of each quarter. For example:

- Q1 (January - March): Due April 30

- Q2 (April - June): Due July 31

- Q3 (July - September): Due October 31

- Q4 (October - December): Due January 31

It is important to mark these dates on your calendar to avoid late submissions and associated penalties.

Who Issues the Form

The Oregon Form Oq is issued by the Oregon Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that businesses adhere to Oregon tax laws. The Department provides resources and guidance to help businesses understand their obligations and complete the form accurately. For any questions or clarifications regarding the form, businesses can reach out directly to the Department of Revenue.

Required Documents

To complete the Oregon Form Oq accurately, several documents are typically required. These may include:

- Income statements detailing revenue earned during the reporting period.

- Expense records to substantiate deductions claimed.

- Previous tax filings for reference and consistency.

- Any relevant financial statements that provide insight into the business's financial health.

Having these documents ready will facilitate a smoother completion process and help ensure that the information reported is accurate and complete.

Quick guide on how to complete oregon form oq 397442697

Complete Oregon Form Oq effortlessly on any gadget

Online document organization has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the right form and securely keep it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Manage Oregon Form Oq on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to edit and eSign Oregon Form Oq without difficulty

- Find Oregon Form Oq and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Oregon Form Oq and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon form oq 397442697

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon form OQ and how does it work?

The Oregon form OQ is a critical document for businesses operating in Oregon, used to manage compliance and reporting. With airSlate SignNow, sending and eSigning the Oregon form OQ becomes effortless and secure, ensuring that your transactions are compliant with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Oregon form OQ?

Yes, airSlate SignNow offers various pricing plans that accommodate businesses of all sizes looking to manage documents like the Oregon form OQ. The cost-effective solution ensures that you receive valuable features without overspending, making it a great choice for your document signing needs.

-

What features does airSlate SignNow offer for signing the Oregon form OQ?

airSlate SignNow provides a range of features including template creation, customizable workflows, and real-time tracking for documents like the Oregon form OQ. These features streamline the signing process, enhance productivity, and ensure that you have complete visibility over your document's status.

-

Are there any integrations available for the Oregon form OQ in airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to easily manage the Oregon form OQ alongside other tools your business uses. This functionality enhances your workflow, providing a cohesive solution for handling documents and streamlining operations.

-

How secure is the airSlate SignNow platform for handling the Oregon form OQ?

The security of your documents, including the Oregon form OQ, is a top priority for airSlate SignNow. The platform uses advanced encryption and complies with various security standards to ensure that your sensitive information remains safe during the signing process.

-

Can I use airSlate SignNow on mobile when dealing with the Oregon form OQ?

Absolutely! airSlate SignNow offers a mobile-friendly platform that allows you to manage, send, and eSign the Oregon form OQ from anywhere. This flexibility means you can handle your important documents on-the-go, making your business operations even more efficient.

-

What are the benefits of using airSlate SignNow for the Oregon form OQ?

Using airSlate SignNow for the Oregon form OQ streamlines the document signing process, reducing time and effort spent on paperwork. Additionally, it enhances accuracy and compliance, ensuring that your business meets all necessary requirements while enjoying a user-friendly experience.

Get more for Oregon Form Oq

- 2014 ne form 1040n

- 941n 2011 form

- 2013 nebraska 1040n form

- Nebraska individual income tax return form 1040n

- Form 6 nebraska salesuse tax and tire fee statement for motor vehicle and trailer sales 82012

- Real estate transfer form 521 2000

- Form 941n 2013

- Form 12n 2012 nebraska nonresident income tax agreement

Find out other Oregon Form Oq

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement