Ahis Gap Form

What is the Ahis Gap

The Ahis Gap refers to a specific insurance coverage provided by American Heritage Insurance Services. This gap insurance is designed to protect policyholders from financial losses that may arise when a vehicle is totaled or stolen. It covers the difference between the amount owed on a vehicle and its actual cash value at the time of loss. This type of insurance is particularly beneficial for individuals who have financed or leased their vehicles, as it ensures they are not left with a significant financial burden in the event of an unfortunate incident.

How to use the Ahis Gap

Using the Ahis Gap involves understanding the terms and conditions of the policy. Policyholders should first ensure that they have the coverage in place at the time of purchasing or leasing their vehicle. In the event of a total loss, the policyholder must file a claim with their insurance provider. This process typically requires submitting documentation, such as the vehicle’s title and any relevant police reports, to substantiate the claim. Once the claim is approved, the Ahis Gap insurance will cover the remaining balance owed on the vehicle, providing financial relief.

Steps to complete the Ahis Gap

Completing the Ahis Gap insurance process involves several important steps:

- Review your current vehicle financing or leasing agreement to determine if you need gap coverage.

- Contact American Heritage Insurance Services to inquire about the Ahis Gap policy details and pricing.

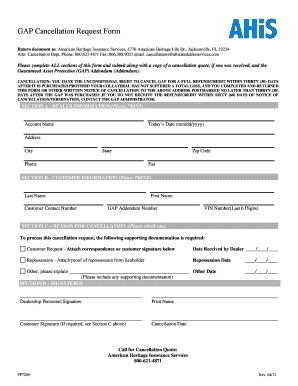

- Fill out the application form for the Ahis Gap insurance, providing necessary information about your vehicle and financing.

- Submit the application and any required documentation to finalize your coverage.

- Keep a copy of your policy and any related documents for your records.

Legal use of the Ahis Gap

The legal use of the Ahis Gap insurance is governed by state regulations and the terms outlined in the insurance policy. It is essential for policyholders to understand their rights and obligations under the policy. The Ahis Gap insurance is legally binding once the policy is purchased and the premium is paid. In the event of a claim, the insurer is obligated to fulfill the terms of the policy, provided all conditions are met. This includes timely reporting of incidents and adherence to any documentation requirements.

Required Documents

To successfully utilize the Ahis Gap insurance, several documents are typically required:

- The original vehicle purchase or lease agreement.

- Proof of insurance coverage on the vehicle.

- Documentation of the vehicle's current value, such as an appraisal or valuation report.

- Any police reports or accident reports related to the claim.

Who Issues the Form

The Ahis Gap insurance form is issued by American Heritage Insurance Services. This organization specializes in providing various insurance products, including gap insurance. To obtain the form, individuals should directly contact American Heritage Insurance Services or visit their official website. It is important to ensure that the form is filled out accurately and submitted according to the guidelines provided by the insurer.

Quick guide on how to complete ahis gap

Effortlessly Prepare Ahis Gap on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without hassle. Manage Ahis Gap on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Ahis Gap with Ease

- Obtain Ahis Gap and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ahis Gap and guarantee exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ahis gap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ahis gap and how does it relate to airSlate SignNow?

The ahis gap refers to the discrepancy in managing digital signatures and document workflows efficiently. airSlate SignNow bridges this gap by providing a seamless, easy-to-use interface for eSigning documents while ensuring compliance and security.

-

How does airSlate SignNow address the ahis gap for businesses?

airSlate SignNow helps businesses close the ahis gap by offering a cost-effective solution for sending, receiving, and managing eSigned documents. This user-friendly platform streamlines document workflows, reducing the time and complexity typically involved in handling paper-based signatures.

-

What features does airSlate SignNow provide to help with the ahis gap?

To address the ahis gap, airSlate SignNow offers features like real-time tracking, customizable templates, and an easy-to-navigate dashboard. These tools empower users to manage their document signing processes efficiently, ensuring a smoother experience overall.

-

Is airSlate SignNow a cost-effective solution for overcoming the ahis gap?

Yes, airSlate SignNow is designed to be a highly cost-effective option for businesses seeking to overcome the ahis gap. By minimizing the need for physical paperwork and reducing operational overhead, organizations can save signNowly on both time and costs.

-

Can airSlate SignNow integrate with other tools to further reduce the ahis gap?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications, including CRMs and cloud storage services. This interoperability helps businesses eliminate the ahis gap by simplifying document management and enhancing overall productivity.

-

What industries benefit the most from using airSlate SignNow to close the ahis gap?

Various industries can benefit from using airSlate SignNow to close the ahis gap, particularly those that rely heavily on contracts and agreements, such as real estate, legal, and financial services. The platform's versatility allows it to meet the unique needs of diverse sectors.

-

How does airSlate SignNow ensure compliance while addressing the ahis gap?

airSlate SignNow adheres to key compliance standards and regulations, such as eIDAS and ESIGN Act, which directly addresses the ahis gap concerning security and legality of electronic signatures. This commitment to compliance gives businesses peace of mind when collecting digital signatures.

Get more for Ahis Gap

- Mi 1040cr 2 2016 form

- Principal residence exemption pre audit questionnaire principal residence exemption pre audit questionnaire form

- D 1040nr 2015 form

- Reciprocity exemptionaffidavit of residency for tax year 2017 form

- M1prx amended homestead credit refund for homeowners form

- 2005 form mo ptc property tax credit claim formsend

- Pennsylvania exemption certificate rev 1220 pa department of form

- Bill of sale missouri print 2009 form

Find out other Ahis Gap

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report