it 201 Tax Form 2020

What is the IT 201 Tax Form

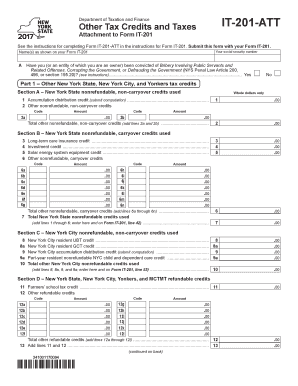

The IT 201 Tax Form is a state income tax return used by residents of New York to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, allowing them to claim deductions and credits applicable to their situation. It is designed for single filers, married couples filing jointly, and heads of household. Understanding the specifics of the IT 201 is crucial for ensuring compliance with state tax laws.

How to use the IT 201 Tax Form

Using the IT 201 Tax Form involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form accurately, ensuring all income sources and deductions are reported. After completing the form, review it for any errors, as mistakes can lead to delays or penalties. Finally, submit the form either electronically or via mail, depending on your preference and the submission methods available.

Steps to complete the IT 201 Tax Form

Completing the IT 201 Tax Form requires careful attention to detail. Follow these steps:

- Gather all income documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim any eligible deductions, such as those for education or medical expenses.

- Calculate your total tax liability using the provided tax tables.

- Review the completed form for accuracy.

- Submit the form electronically or by mail.

Legal use of the IT 201 Tax Form

The IT 201 Tax Form is legally binding when completed accurately and submitted in accordance with New York state tax laws. It is important to ensure that all information is truthful and complete, as providing false information can result in penalties, including fines or audits. The form must be signed and dated to validate its submission, and electronic signatures are accepted if using an approved eSignature platform.

Filing Deadlines / Important Dates

Filing deadlines for the IT 201 Tax Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. If April fifteenth falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, which must be requested prior to the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The IT 201 Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers choose to file electronically through approved software or platforms, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate state tax office. Ensure that the correct postage is applied and that it is sent well before the deadline.

- In-Person: Some individuals may opt to deliver their forms directly to a local tax office, though this method may be less common.

Quick guide on how to complete it 201 tax form 2012

Effortlessly Complete It 201 Tax Form on Any Gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to produce, edit, and electronically sign your documents quickly without delays. Manage It 201 Tax Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign It 201 Tax Form with Ease

- Locate It 201 Tax Form and then click Get Form to initiate.

- Use the tools we provide to finalize your document.

- Emphasize crucial sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional pen-and-ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, exhausting form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign It 201 Tax Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 201 tax form 2012

Create this form in 5 minutes!

How to create an eSignature for the it 201 tax form 2012

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the IT 201 Tax Form?

The IT 201 Tax Form is a New York State personal income tax return form used by residents to report their income and calculate their tax obligations. Proper submission of the IT 201 Tax Form is essential for compliance with state tax laws and to ensure you receive any eligible refunds.

-

How can airSlate SignNow help me with my IT 201 Tax Form?

airSlate SignNow offers an intuitive platform to eSign and send your IT 201 Tax Form securely and efficiently. With our solution, you can streamline the signing process, ensuring that your tax documents are processed quickly and accurately.

-

Is airSlate SignNow affordable for filing the IT 201 Tax Form?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses needing to manage their IT 201 Tax Form. Our pricing plans are designed to provide excellent value, allowing you to handle multiple documents without breaking the bank.

-

What features does airSlate SignNow offer for the IT 201 Tax Form?

Our platform includes robust features such as customizable templates, in-app collaboration, and secure cloud storage to simplify the process of managing your IT 201 Tax Form. Additionally, you can track the status of your documents in real-time for a seamless experience.

-

Can I integrate airSlate SignNow with other tax software for my IT 201 Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various tax software, enabling you to import and manage your IT 201 Tax Form alongside your other financial documents. This integration enhances efficiency by ensuring all your tax data is accessible in one place.

-

What are the benefits of using airSlate SignNow for my IT 201 Tax Form?

Using airSlate SignNow for your IT 201 Tax Form provides numerous benefits, including time savings, ease of use, and enhanced security. Our electronic signature capabilities eliminate the need for printing and mailing, allowing you to complete your tax filings in a fraction of the time.

-

How secure is airSlate SignNow when handling the IT 201 Tax Form?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect your IT 201 Tax Form and other sensitive documents, ensuring that your personal and financial information remains confidential.

Get more for It 201 Tax Form

- Pennsylvania disclosure 495565830 form

- Instructions for completing dh form 684 florida department of

- Subnetworks reform nc5embedded generation facilit

- Vaform pdf

- Www coursehero comstanley brown safety planpdfstanley brown safety plan pdf sample safety plan step 1 form

- Application for disabled person license plate placard and form

- Apro 60 form 615448296

- Special inspection overtime request request form

Find out other It 201 Tax Form

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple