Form it 201 2020

What is the Form It 201

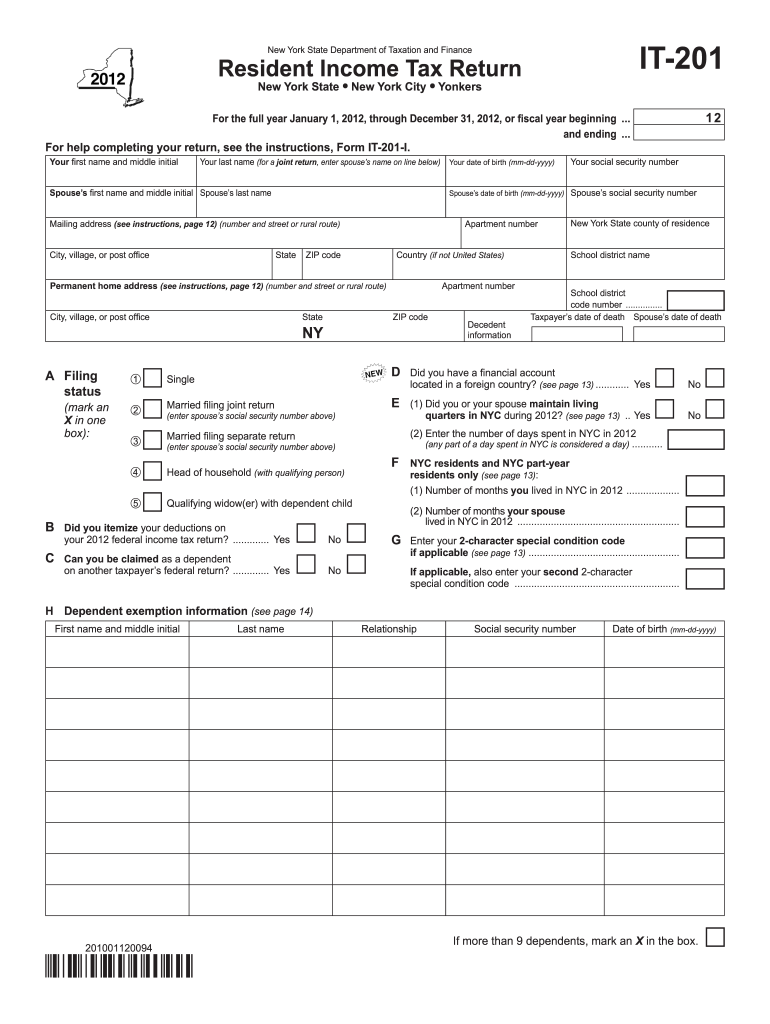

The Form It 201 is a specific document used primarily for tax purposes in the United States. It is designed to assist individuals and businesses in reporting certain financial information to the Internal Revenue Service (IRS). This form may be required for various tax-related activities, including income reporting and deductions. Understanding the purpose and requirements of the Form It 201 is essential for accurate tax filing and compliance with federal regulations.

How to obtain the Form It 201

Obtaining the Form It 201 is a straightforward process. Individuals can access the form directly from the IRS website, where it is available for download in PDF format. Additionally, physical copies of the form can often be found at local IRS offices or through tax preparation services. Ensuring you have the most current version of the form is crucial, as tax regulations may change annually.

Steps to complete the Form It 201

Completing the Form It 201 involves several key steps to ensure accurate reporting. Begin by gathering all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out each section of the form, providing accurate and complete information. It is important to double-check entries for errors before submission. Finally, sign and date the form, and choose a submission method that suits your needs.

Legal use of the Form It 201

The legal use of the Form It 201 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these regulations can lead to penalties or legal repercussions. It is essential to understand the legal implications of the information provided on the form, as it may be subject to audit by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 201 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is advisable to stay informed about any changes to these deadlines, as they can vary based on specific situations or updates from the IRS.

Required Documents

To complete the Form It 201 accurately, certain documents are required. These may include W-2 forms, 1099 forms, and any other relevant financial statements that provide proof of income and deductions. Having these documents ready will streamline the process and ensure that all information reported is accurate and complete.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form It 201 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the IRS. Understanding the importance of timely and accurate submission is crucial for avoiding these consequences and maintaining compliance with tax laws.

Quick guide on how to complete 2012 form it 201

Complete Form It 201 effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage Form It 201 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Form It 201 with ease

- Obtain Form It 201 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form It 201 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form it 201

Create this form in 5 minutes!

How to create an eSignature for the 2012 form it 201

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form It 201 and how does it work?

Form It 201 is an essential tool within airSlate SignNow that allows businesses to create, send, and eSign documents effortlessly. It streamlines the entire document workflow, making it simple to collect signatures digitally. By utilizing Form It 201, companies can enhance their operational efficiency and reduce turnaround times signNowly.

-

What features does Form It 201 offer?

Form It 201 offers a variety of features, including customizable templates, automatic reminders for signers, and secure document storage. Users can also track the status of their documents in real time, ensuring that every step of the signing process is accounted for. The robust features of Form It 201 make it a comprehensive solution for managing electronic signatures.

-

How much does Form It 201 cost?

The pricing for Form It 201 within airSlate SignNow is competitive and tailored to suit different business sizes and needs. We offer flexible subscription plans, including monthly and annual billing options, which allow you to choose the plan that best fits your budget. Investing in Form It 201 can lead to signNow savings on paper and administrative costs.

-

Can Form It 201 integrate with other software?

Yes, Form It 201 seamlessly integrates with various third-party applications such as CRM systems, project management tools, and cloud storage services. This integration capability enhances your existing workflows and ensures a smoother document management process. Leveraging integrations with Form It 201 can further streamline your operations.

-

What industries can benefit from using Form It 201?

Form It 201 can benefit a wide range of industries, including healthcare, real estate, education, and finance. Any business that relies on document signing and approvals can improve its efficiency by implementing Form It 201. Its versatility makes it an ideal solution for various sectors looking to simplify their contract management.

-

Is Form It 201 secure for handling sensitive information?

Absolutely, Form It 201 prioritizes security, utilizing encryption and compliance with industry standards like GDPR and HIPAA. This ensures that your documents and data remain protected throughout the signing process. You can trust Form It 201 to handle your sensitive information with the highest level of security.

-

How does Form It 201 improve document workflows?

Form It 201 enhances document workflows by automating repetitive tasks, reducing the need for paper-based processes, and ensuring that documents are completed swiftly. With features like automated notifications and easy tracking, Form It 201 saves time and minimizes the risk of errors. By optimizing workflows, businesses can focus more on their core activities.

Get more for Form It 201

- Llc contribution agreement llc capital contributions form

- Dilations and scale factors independent practice worksheet 517711039 form

- Chinese gender calendar form

- How to write an appeal letter for parking ticket form

- Avery 5160 template blank fillable form

- Postal vote application form postal vote application form

- Create fillable pdf forms online pdf editorpdf cannot save form information or can only save blank pdf to fillable3 ways to

- If you are eligible to apply for a blue card please see disqualified person and negative notice holder definition on page 4 form

Find out other Form It 201

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe