Nys 45 Mn Form

What is the NYS 45 MN?

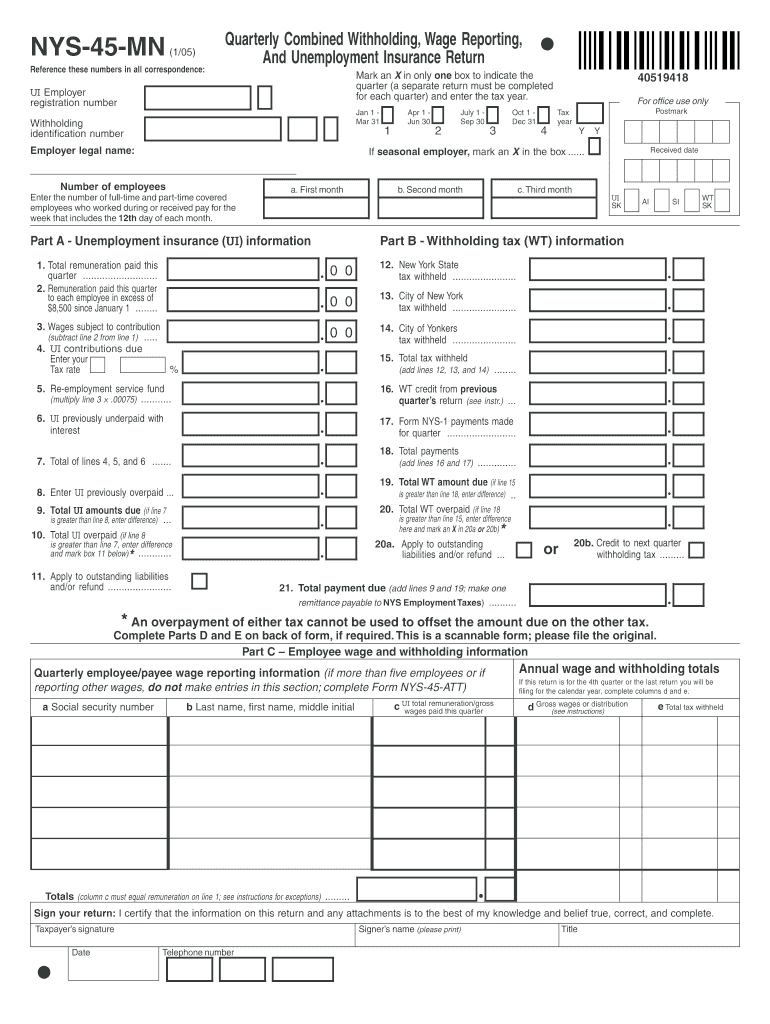

The NYS 45 MN form, officially known as the New York State Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, is a crucial document for employers in New York. It is used to report wages paid to employees, along with the corresponding taxes withheld for state income tax and unemployment insurance. This form is essential for ensuring compliance with state regulations and for maintaining accurate records of employee compensation.

Steps to Complete the NYS 45 MN

Completing the NYS 45 MN form involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather Employee Information: Collect necessary details such as employee names, Social Security numbers, and wages paid during the reporting period.

- Calculate Withholdings: Determine the total amount of state income tax withheld from each employee's wages.

- Fill Out the Form: Input the gathered information into the appropriate sections of the NYS 45 MN form. Ensure that all figures are accurate and reflect the correct reporting period.

- Review for Errors: Double-check all entries for accuracy to avoid potential penalties or issues with the New York State Department of Taxation and Finance.

- Submit the Form: File the completed NYS 45 MN form by the designated deadline, either electronically or via mail.

Legal Use of the NYS 45 MN

The NYS 45 MN form serves a legal purpose by documenting wage payments and tax withholdings for employees. Proper completion and timely submission of this form are vital for compliance with New York state laws regarding employment and taxation. Failure to adhere to these requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the NYS 45 MN form to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Who Issues the Form

The NYS 45 MN form is issued by the New York State Department of Taxation and Finance. This department oversees the collection of state taxes and ensures compliance with employment laws. Employers can access the form and related resources directly through the department's official website.

Form Submission Methods

Employers have several options for submitting the NYS 45 MN form, ensuring flexibility and convenience. The available methods include:

- Online Submission: Employers can file the form electronically through the New York State Department of Taxation and Finance's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the department.

- In-Person Submission: Employers may also choose to deliver the form in person at designated state offices.

Quick guide on how to complete nys 45 mn

Complete Nys 45 Mn effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Nys 45 Mn on any device using airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The most efficient way to modify and electronically sign Nys 45 Mn with ease

- Obtain Nys 45 Mn and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal confidential details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click on the Done button to save your amendments.

- Choose how you wish to deliver your form, either via email, text message (SMS), invitation link, or download it onto your computer.

Eliminate the issues of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nys 45 Mn and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 45 mn

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the NYS 45 PDF and why is it important?

The NYS 45 PDF is a crucial form for employers in New York State that reports employee wage information and unemployment insurance contributions. Ensuring accurate and timely submission of the NYS 45 PDF helps you remain compliant with state regulations, avoiding potential fines and issues.

-

How can airSlate SignNow help with the NYS 45 PDF?

airSlate SignNow allows you to easily fill, sign, and send the NYS 45 PDF electronically. Our platform enhances your workflow by simplifying the process, saving you time, and ensuring that your documents are securely signed and submitted.

-

Is there a cost associated with using airSlate SignNow for NYS 45 PDF submissions?

Yes, airSlate SignNow offers affordable pricing plans to suit various business needs when handling documents like the NYS 45 PDF. You can select a plan that matches your volume of usage and features required, making it a cost-effective solution.

-

What features does airSlate SignNow offer for the NYS 45 PDF?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure eSignature capabilities for the NYS 45 PDF. These features streamline the document management process, making it easier to handle important compliance forms.

-

Can I integrate airSlate SignNow with other tools for handling the NYS 45 PDF?

Absolutely! airSlate SignNow offers integrations with several popular tools such as Google Drive, Dropbox, and others. This means you can easily manage your NYS 45 PDF alongside other business documents and workflows without hassle.

-

How does airSlate SignNow ensure the security of the NYS 45 PDF?

The security of your documents, including the NYS 45 PDF, is a top priority for airSlate SignNow. We utilize state-of-the-art encryption, secure access controls, and compliance with legal standards to protect your sensitive information.

-

Can I track the status of my NYS 45 PDF submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your NYS 45 PDF submissions in real-time. You will receive notifications when documents are viewed and signed, ensuring you stay updated on your compliance needs.

Get more for Nys 45 Mn

- Summer enrichment program 2 pattonville school district psdr3 form

- St louis county police home form

- School volunteer request form fort zumwalt dardenne

- Authorization for routine health services for tennessee form

- Team professionalism rating report form

- Liability waiver and release parade doc form

- The tom and betty cloyd scholarship deadline for form

- Preservation program kcha form

Find out other Nys 45 Mn

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now