Form M 4868 Instructions

What is the Form M 4868 Instructions

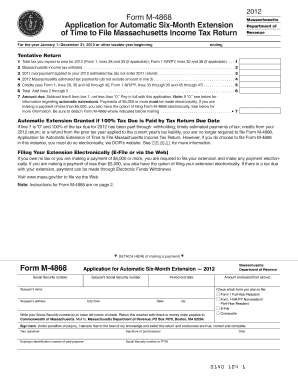

The Form M 4868 Instructions provide guidance for taxpayers seeking an automatic extension for filing their federal income tax returns. This form is essential for individuals who need additional time to prepare their tax documents without incurring penalties. The instructions detail the eligibility criteria, necessary information, and the process for submitting the form. Understanding these instructions ensures compliance with IRS regulations while allowing taxpayers to manage their financial responsibilities effectively.

Steps to Complete the Form M 4868 Instructions

Completing the Form M 4868 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including your name, address, and Social Security number.

- Determine the amount of tax you owe, if any, to ensure accurate reporting.

- Fill out the form, providing all required details, including any payments made.

- Review the form for accuracy before submission to avoid delays.

- Submit the form electronically or via mail by the specified deadline.

Legal Use of the Form M 4868 Instructions

The legal use of the Form M 4868 Instructions is crucial for ensuring that the extension request is valid. By following the guidelines set forth in the instructions, taxpayers can avoid penalties associated with late filing. The IRS recognizes eSignatures as legally binding, provided the electronic submission complies with established regulations. This means that using a reliable eSignature solution can streamline the process while maintaining legal integrity.

Filing Deadlines / Important Dates

Timely filing of the Form M 4868 is essential to avoid penalties. The IRS typically requires that the form be submitted by the original due date of your tax return. For most taxpayers, this date falls on April 15. However, if the due date falls on a weekend or holiday, the deadline may shift to the next business day. It is important to stay informed about any changes in deadlines that may occur due to legislative updates or IRS announcements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form M 4868. The form can be filed electronically through the IRS website or using authorized e-filing software. This method is often the quickest and most efficient. Alternatively, taxpayers can print the form and mail it to the appropriate IRS address. In-person submissions are generally not recommended for this form, as electronic filing offers greater convenience and immediate confirmation of receipt.

Who Issues the Form

The Form M 4868 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides the form along with detailed instructions to assist taxpayers in understanding their obligations. It is important for taxpayers to use the most current version of the form, as outdated forms may not be accepted.

Quick guide on how to complete form m 4868 instructions

Complete Form M 4868 Instructions effortlessly on any device

Managing documents online has gained signNow traction with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form M 4868 Instructions on any platform using airSlate SignNow apps for Android or iOS and streamline any document-oriented process today.

How to alter and electronically sign Form M 4868 Instructions with ease

- Obtain Form M 4868 Instructions and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form M 4868 Instructions and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 4868 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form M 4868 instructions 2020?

The Form M 4868 instructions 2020 provide essential guidance on how to file for an automatic extension of time to file individual income tax returns. This form is crucial for taxpayers who need more time to prepare their returns without incurring penalties. Understanding the instructions can help ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form M 4868 instructions 2020?

airSlate SignNow offers a user-friendly platform to electronically sign and send your Form M 4868, streamlining the filing process. With our cost-effective solution, you can easily manage document workflows while adhering to the Form M 4868 instructions 2020. This can save you time and reduce the stress of meeting deadlines.

-

Is there a cost associated with using airSlate SignNow for Form M 4868?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, all of which are competitively priced. The cost provides access to robust features designed for efficient document management, including those related to Form M 4868 instructions 2020. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for managing tax forms like Form M 4868?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage, all of which are beneficial for managing tax forms like Form M 4868. These features comply with the Form M 4868 instructions 2020, ensuring a smooth filing experience. The platform also allows for easy collaboration among users.

-

Can I integrate airSlate SignNow with my existing software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications used for tax management, enhancing your workflow regarding Form M 4868 instructions 2020. These integrations enable you to import, sign, and share documents directly from your preferred software, simplifying the process.

-

What benefits does eSigning my Form M 4868 offer?

eSigning your Form M 4868 through airSlate SignNow provides convenience and efficiency. It ensures that your form is completed and submitted quickly, adhering to the Form M 4868 instructions 2020. Additionally, it offers secure storage and easy access to your documents whenever needed.

-

Are there any support resources available for using airSlate SignNow with Form M 4868 instructions 2020?

Yes, airSlate SignNow provides comprehensive support resources, including tutorials and customer service assistance, to help users navigate the service while following the Form M 4868 instructions 2020. Whether you're new to eSigning or have specific queries, our support team is ready to assist you.

Get more for Form M 4868 Instructions

Find out other Form M 4868 Instructions

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe