Gst 101 PDF 2017

What is the GST 101 PDF?

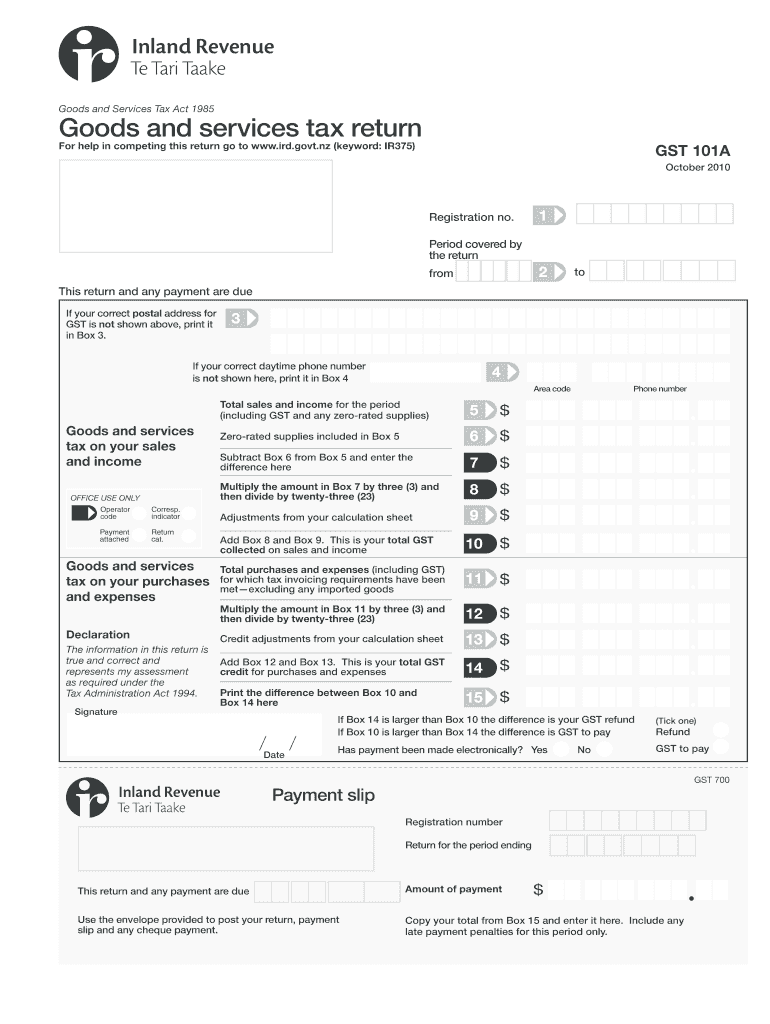

The GST 101 PDF is a crucial document used for reporting and managing specific tax obligations within the United States. This form is primarily utilized by businesses to provide necessary information regarding their goods and services tax liabilities. The GST 101 PDF serves as a standardized method for taxpayers to report their tax information accurately, ensuring compliance with federal regulations. Understanding the purpose of this form is essential for any business owner or tax professional involved in tax reporting and compliance.

How to Obtain the GST 101 PDF

Obtaining the GST 101 PDF is a straightforward process. The form can typically be accessed through the official IRS website or other authorized tax resources. Users can download the GST 101 PDF directly to their devices for easy access. It is important to ensure that the most current version of the form is used, as tax regulations may change over time. Additionally, consulting with a tax professional can provide guidance on obtaining the correct form and understanding its requirements.

Steps to Complete the GST 101 PDF

Completing the GST 101 PDF involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information related to your business operations, including sales data and tax identification numbers. Next, fill out the form with the required details, ensuring that all entries are accurate and complete. It is advisable to double-check for any errors before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person, as specified by the IRS guidelines.

Legal Use of the GST 101 PDF

The legal use of the GST 101 PDF is governed by various tax regulations and guidelines established by the IRS. To ensure that the form is legally binding, it must be filled out accurately and submitted within the required deadlines. Additionally, electronic signatures may be accepted under certain conditions, provided they comply with the ESIGN and UETA acts. Understanding these legal frameworks is crucial for businesses to avoid penalties and ensure that their tax filings are valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the GST 101 PDF are critical for compliance. Businesses must be aware of specific dates when the form is due to avoid penalties. Typically, the IRS sets annual filing deadlines, which may vary based on the type of business entity. It is essential to keep track of these important dates and plan accordingly to ensure timely submission. Marking these deadlines on a calendar can help businesses stay organized and compliant with tax regulations.

Required Documents

To complete the GST 101 PDF, several documents may be required. These typically include financial statements, sales records, and any previous tax filings that pertain to the goods and services tax. Having these documents readily available can streamline the completion process and ensure that all necessary information is included in the form. It is advisable to maintain organized records throughout the year to facilitate easier tax reporting.

Quick guide on how to complete gst 101 pdf

Finish Gst 101 Pdf effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delay. Handle Gst 101 Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to adjust and eSign Gst 101 Pdf with ease

- Obtain Gst 101 Pdf and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Gst 101 Pdf and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gst 101 pdf

Create this form in 5 minutes!

How to create an eSignature for the gst 101 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst101a and how does it benefit my business?

gst101a is an intuitive digital signing solution that streamlines document management for businesses. By using gst101a, companies can quickly send, sign, and store documents securely, enhancing workflow efficiency and eliminating the need for paper.

-

How much does gst101a cost?

gst101a offers competitive pricing plans tailored to meet various business needs. Depending on the features and number of users required, businesses can choose a plan that best fits their budget, ensuring a cost-effective solution.

-

What features are included with gst101a?

gst101a includes features such as customizable templates, real-time tracking of document statuses, and a user-friendly interface. These features empower businesses to manage eSigning processes efficiently and enhance collaboration among teams.

-

Is gst101a easy to integrate with other tools?

Yes, gst101a seamlessly integrates with a variety of popular business tools and applications. This flexibility allows users to enhance their existing workflows and improve overall productivity without needing to disrupt their current systems.

-

Can I access gst101a on mobile devices?

Absolutely! gst101a is optimized for mobile use, allowing users to send and sign documents from anywhere at any time. This mobile-friendly approach ensures that businesses can stay agile and responsive to client needs.

-

What types of documents can I send using gst101a?

gst101a supports a wide range of document types including contracts, agreements, and legal forms. This versatility makes it an ideal solution for businesses across different industries looking to streamline their document processes.

-

Is there a free trial available for gst101a?

Yes, gst101a offers a free trial, allowing businesses to explore its features without any commitment. This trial period enables prospective users to evaluate its suitability for their specific needs before making a purchase.

Get more for Gst 101 Pdf

- Gpa verifiers school code form

- Smarts electronic authorization form

- Metro civil rights policy ampamp civil rights complaint form metro civil rights policy ampamp civil rights complaint form

- June 2020 civil rights policy civ 5 civil rights metro form

- Blue ink please form

- Ucc 3 connecticut filing forms

- Sba 7 form rev 02 12 sots ct

- Dps 164 c form

Find out other Gst 101 Pdf

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms