Group Loan Application Form

What is the Group Loan Application Form

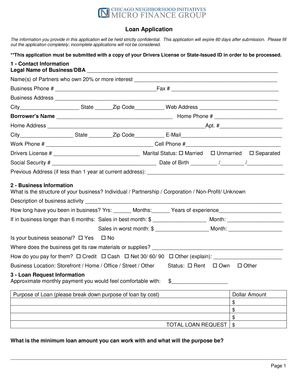

The group loan application form is a document used by individuals seeking to apply for a loan as a collective entity. This type of form is particularly useful for groups, such as community organizations or cooperatives, that wish to secure financing for shared projects or initiatives. The form typically requires detailed information about each member of the group, the purpose of the loan, and the proposed repayment plan. Understanding the structure and requirements of this form is essential for successful loan applications.

Key Elements of the Group Loan Application Form

When filling out a group loan application form, certain key elements must be included to ensure completeness and accuracy. These elements typically encompass:

- Group Information: This section includes the name of the group, its purpose, and contact details.

- Member Details: Each member's name, address, and financial information must be provided.

- Loan Purpose: A clear explanation of why the loan is needed and how the funds will be used.

- Repayment Plan: Details on how the group intends to repay the loan, including timelines and payment methods.

- Signatures: All members must sign the form to indicate their consent and commitment.

Steps to Complete the Group Loan Application Form

Completing the group loan application form involves several important steps to ensure all necessary information is accurately captured. Here are the recommended steps:

- Gather all required information from each group member, including personal and financial details.

- Clearly define the purpose of the loan and how the funds will benefit the group.

- Outline a realistic repayment plan that considers the group’s financial capacity.

- Fill out the application form, ensuring all sections are completed accurately.

- Review the form collectively to verify that all information is correct before submission.

- Obtain signatures from all group members to finalize the application.

Legal Use of the Group Loan Application Form

The legal validity of the group loan application form hinges on compliance with applicable laws and regulations. It is crucial to ensure that the form adheres to local and federal lending guidelines. This includes providing accurate information and obtaining necessary signatures from all members. Additionally, using a reputable digital signature platform can enhance the form's legal standing by providing a secure and verifiable method of signing.

How to Obtain the Group Loan Application Form

The group loan application form can typically be obtained through various channels, depending on the lender. Common methods include:

- Visiting the lender's website, where downloadable forms may be available.

- Contacting the lender directly to request a physical or digital copy of the form.

- Consulting with financial institutions or community organizations that may provide templates or guidance.

Form Submission Methods

Once the group loan application form is completed, it can be submitted through several methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer online portals for submitting applications, allowing for quick processing.

- Mail: The completed form can be sent via postal service to the lender's designated address.

- In-Person: Some groups may choose to deliver the application directly to the lender's office for immediate assistance.

Quick guide on how to complete loan application form

Complete loan application form seamlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and safely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without delays. Handle sample of loan application form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign loan forms sample effortlessly

- Obtain sample of loan form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign sample loan form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to group loan agreement form

Create this form in 5 minutes!

How to create an eSignature for the group loan application form format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask loan forms sample

-

What is a loan application form and how does it work?

A loan application form is a document that borrowers fill out to request a loan from a lender. It typically includes personal information, financial details, and the loan amount requested. With airSlate SignNow, you can easily create, manage, and electronically sign loan application forms to streamline the borrowing process.

-

How can airSlate SignNow improve my loan application form process?

airSlate SignNow simplifies the loan application form process by allowing you to customize forms, automate workflows, and send documents for eSignature. This ensures a quicker turnaround time for approvals and enhances the overall applicant experience. By using our solution, you can eliminate paperwork and reduce processing delays.

-

Are there any costs associated with using airSlate SignNow for loan application forms?

Yes, there are costs involved with using airSlate SignNow for managing loan application forms, but they are quite competitive compared to other solutions. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get value for your investment. It's best to check our website for specific pricing details and any available promotions.

-

What features does airSlate SignNow offer for loan application forms?

airSlate SignNow offers a range of features for loan application forms, including customizable templates, automated workflows, and secure eSigning capabilities. You can also track the status of your documents in real-time and ensure compliance with industry regulations. These features make managing loan applications more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other software for loan applications?

Absolutely! airSlate SignNow provides integrations with various third-party applications, which enhances the functionality of your loan application forms. You can connect with CRM systems, payment platforms, and more, ensuring a seamless experience across all your business tools.

-

How secure is the loan application form process with airSlate SignNow?

Security is paramount at airSlate SignNow. Our platform uses advanced encryption and authentication measures to protect all loan application forms and sensitive data. This ensures that your information, as well as the applicants', remains confidential and secure throughout the signing process.

-

Can borrowers access their loan application form on mobile devices?

Yes, with airSlate SignNow, borrowers can easily access their loan application forms from any mobile device. Our mobile-friendly platform allows users to complete and sign documents on-the-go, making it convenient for both lenders and applicants. This flexibility encourages faster submissions and more efficient processing.

Get more for sample of loan form

Find out other sample loan form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document