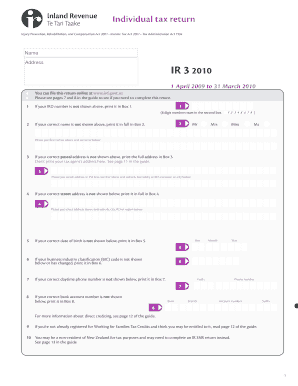

Ir3r Form

What is the ir3r Form

The ir3r form is a tax document used primarily for reporting rental income in the United States. It is essential for landlords and property owners who need to declare income received from rental properties. This form enables the Internal Revenue Service (IRS) to track rental income and ensure compliance with tax regulations. Properly completing the ir3r form helps individuals avoid penalties and ensures that they are accurately reporting their income.

How to use the ir3r Form

Using the ir3r form involves several key steps. First, gather all necessary information regarding your rental properties, including income received and any associated expenses. Next, download the ir3r form from a reliable source. Fill out the form accurately, ensuring that all income and expenses are documented. Once completed, review the form for any errors before submitting it to the IRS. It is advisable to keep a copy for your records.

Steps to complete the ir3r Form

Completing the ir3r form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents related to your rental properties.

- Download the ir3r form from an official source.

- Fill in your personal information at the top of the form.

- Report your total rental income accurately in the designated section.

- Document any allowable expenses related to your rental properties.

- Double-check all entries for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the ir3r Form

The legal use of the ir3r form is crucial for compliance with U.S. tax laws. This form must be filed accurately to avoid legal repercussions, such as fines or audits. The IRS requires that all income, including rental income, is reported correctly. Failure to do so can lead to penalties, including back taxes and interest on unpaid amounts. Understanding the legal implications of the ir3r form helps ensure that taxpayers fulfill their obligations responsibly.

Filing Deadlines / Important Dates

Filing deadlines for the ir3r form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if you file for an extension, you may have until October fifteenth to submit the form. It is important to stay informed about any changes to deadlines to ensure timely compliance with IRS regulations.

Required Documents

To complete the ir3r form accurately, certain documents are required. These include:

- Records of rental income received throughout the year.

- Receipts or documentation for any deductible expenses related to the rental property.

- Previous tax returns, if applicable, for reference.

- Any relevant legal documents pertaining to property ownership.

Who Issues the Form

The ir3r form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines for completing the form and ensures that it meets all legal requirements. Taxpayers can access the form through the IRS website or other authorized sources to ensure they are using the most current version.

Quick guide on how to complete ir3r form

Effortlessly Prepare Ir3r Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Ir3r Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Ir3r Form with ease

- Find Ir3r Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ir3r Form to guarantee excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir3r form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir3 and how does it relate to airSlate SignNow?

The term ir3 refers to the innovative features that airSlate SignNow offers for document signing and management. With ir3, users can streamline their eSignature processes, ensuring that signing documents is quick and efficient. Discover how ir3 enhances collaboration and improves productivity for businesses of all sizes.

-

How much does airSlate SignNow cost and what value does ir3 provide?

airSlate SignNow offers competitive pricing plans that cater to different business needs, with the ir3 feature set providing additional value. With affordable plans, businesses can benefit from advanced eSignature capabilities without breaking the bank. Investing in airSlate SignNow means gaining access to ir3, which simplifies document workflows considerably.

-

What key features does airSlate SignNow include with ir3?

The ir3 features of airSlate SignNow enable users to create customizable templates, manage workflows, and ensure compliance. Users can leverage these features to improve efficiency in document handling and signing processes. By using ir3, teams can collaborate seamlessly and speed up their decision-making.

-

How does airSlate SignNow enhance user experience with ir3?

The user experience is signNowly enhanced with the ir3 capabilities of airSlate SignNow, allowing for intuitive navigation and simplified document signing. Users can easily access functionalities such as reminders, notifications, and document tracking. The ease of use fosters greater adoption among team members and clients alike.

-

Can airSlate SignNow's ir3 features be integrated with other tools?

Yes, airSlate SignNow supports seamless integrations with various platforms and tools, making the ir3 features even more powerful. Users can connect to CRM systems, cloud storage services, and project management tools for a more cohesive workflow. These integrations ensure that the ir3 functionalities fit smoothly into existing business processes.

-

What benefits does airSlate SignNow's ir3 offer to small businesses?

For small businesses, the ir3 features of airSlate SignNow provide cost-effective solutions to manage and sign documents efficiently. The simplicity of the platform allows small teams to work faster, reducing paperwork and ensuring a quicker turnaround for contracts. With ir3, these businesses can focus more on growth and less on administrative tasks.

-

Is airSlate SignNow secure enough for sensitive documents with ir3?

Absolutely, airSlate SignNow ensures the safety of sensitive documents through the robust security features integrated with ir3. Documents are encrypted in transit and at rest, ensuring confidentiality and integrity. Businesses can trust that their information is safeguarded while using airSlate SignNow for document management.

Get more for Ir3r Form

- Annual research prgoress report esup 5189 annual research prgoress report form

- Us student information sheetaid e3241 us student information sheet

- Kotak bank modification form

- Kotak modification form

- Kotak request form service

- Pu revaluation form

- Form da1 nomination form kotak mahindra bank

- Kotak bank da form

Find out other Ir3r Form

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement