Strata Title Body Corporate Tax Return and Australian Taxation Office Ato Gov 2014

What is the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov?

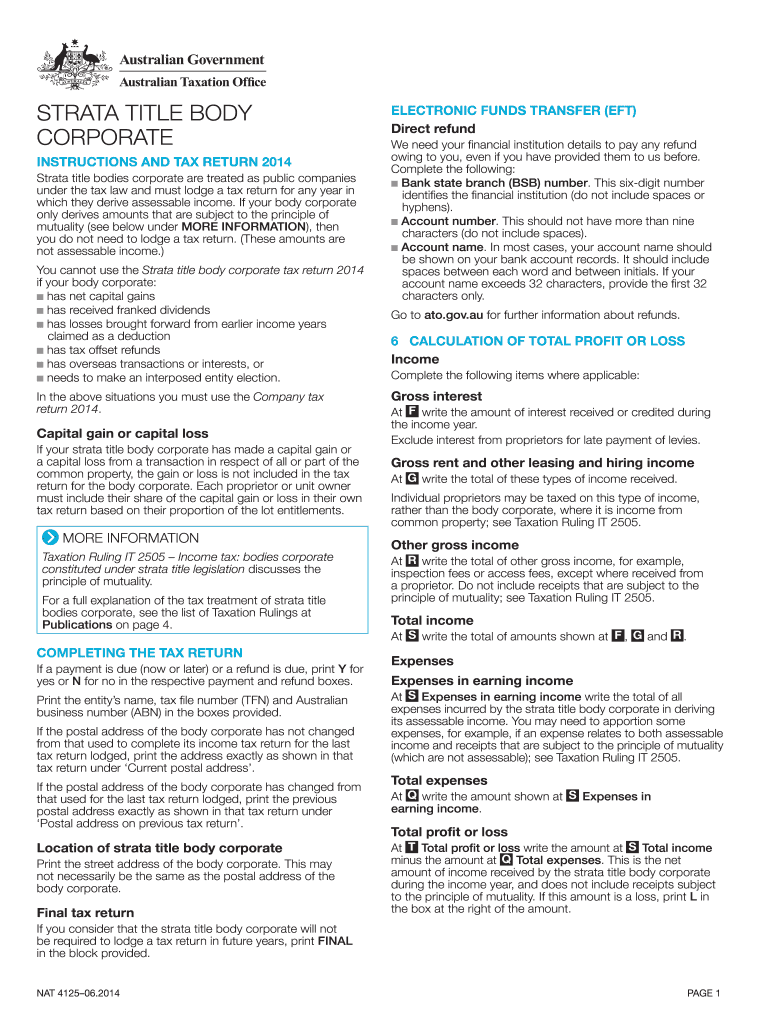

The Strata Title Body Corporate Tax Return is a specific tax form required for entities managing strata titles in Australia. This form is essential for reporting income and expenses associated with the management of common property within a strata scheme. The Australian Taxation Office (ATO) oversees the compliance and submission of this form, ensuring that all strata bodies adhere to the relevant tax laws and regulations. The form captures financial details that help determine the tax obligations of the body corporate, including any deductions available for operational costs.

Steps to Complete the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov

Completing the Strata Title Body Corporate Tax Return involves several critical steps to ensure accuracy and compliance. Start by gathering all necessary financial records, including income statements, expenditure reports, and any supporting documentation related to property management. Next, accurately fill out the form, ensuring that all required fields are completed with precise information. It is advisable to review the completed form for any errors before submission. Once satisfied, submit the form electronically through the ATO's online portal or by mail, depending on your preference and the requirements set by the ATO.

Required Documents for the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov

When preparing to file the Strata Title Body Corporate Tax Return, several documents are crucial. These typically include:

- Financial statements detailing income and expenses

- Invoices and receipts for operational costs

- Bank statements for the body corporate's accounts

- Any relevant tax documents from previous years

Having these documents organized and readily available will facilitate a smoother completion process and help ensure compliance with ATO regulations.

Legal Use of the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov

The legal use of the Strata Title Body Corporate Tax Return is governed by Australian tax law, which mandates that bodies corporate must accurately report their financial activities. Failing to submit this form can lead to penalties and legal repercussions. It is important for strata corporations to understand their obligations under the law, including maintaining proper records and ensuring that all information reported is truthful and complete. This form serves as a legal document that can be audited by the ATO, reinforcing the need for accuracy and compliance in its completion.

Filing Deadlines for the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov

Filing deadlines for the Strata Title Body Corporate Tax Return are crucial for compliance. Typically, the return must be submitted by the end of the financial year, which in Australia is June 30. However, extensions may be available under certain circumstances. It is essential for bodies corporate to be aware of these deadlines to avoid late fees and penalties. Keeping track of these dates ensures that the body corporate remains in good standing with the ATO and avoids any potential legal issues.

Penalties for Non-Compliance with the Strata Title Body Corporate Tax Return and Australian Taxation Office ATO Gov

Non-compliance with the requirements of the Strata Title Body Corporate Tax Return can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. The ATO takes non-compliance seriously, particularly in cases of fraudulent reporting or failure to submit the form altogether. It is crucial for bodies corporate to maintain accurate records and adhere to filing deadlines to mitigate these risks and ensure compliance with Australian tax laws.

Quick guide on how to complete strata title body corporate tax return and australian taxation office ato gov

A brief guide on how to prepare your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov

Finding the appropriate template can be difficult when you need to submit official international documents. Even if you possess the required form, it may be cumbersome to swiftly prepare it according to all the specifications if you use physical copies instead of handling everything digitally. airSlate SignNow is the online eSignature service that assists you in overcoming these obstacles. It allows you to acquire your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov and promptly complete and sign it on-site without the need to reprint documents if you make an error.

Here are the steps you must follow to prepare your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov using airSlate SignNow:

- Hit the Get Form button to upload your document to our editor immediately.

- Begin with the first blank field, enter your details, and proceed with the Next tool.

- Complete the empty boxes using the Cross and Check tools from the menu above.

- Choose the Highlight or Line options to emphasize the most important information.

- Click on Image and add one if your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov needs it.

- Utilize the right pane to add extra fields for yourself or others to complete if necessary.

- Review your inputs and confirm the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and selecting your file-sharing preferences.

Once your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov is prepared, you can share it as you wish - send it to your recipients through email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Stop wasting time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct strata title body corporate tax return and australian taxation office ato gov

Create this form in 5 minutes!

How to create an eSignature for the strata title body corporate tax return and australian taxation office ato gov

How to create an eSignature for your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov online

How to generate an eSignature for your Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov in Google Chrome

How to generate an electronic signature for signing the Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov in Gmail

How to create an eSignature for the Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov right from your smartphone

How to create an eSignature for the Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov on iOS

How to generate an eSignature for the Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov on Android

People also ask

-

What is a Strata Title Body Corporate Tax Return?

A Strata Title Body Corporate Tax Return is a specific tax return required for bodies corporate managing common property in a strata scheme. This tax return ensures compliance with obligations set by the Australian Taxation Office (ATO), addressing how income from common property is taxed. Properly filing your Strata Title Body Corporate Tax Return can help avoid penalties and ensure smooth operations.

-

How does airSlate SignNow assist with Strata Title Body Corporate Tax Return filing?

airSlate SignNow provides an efficient platform to electronically sign and send documents related to your Strata Title Body Corporate Tax Return. Its user-friendly interface simplifies the process, saving you time and reducing the hassle of paperwork. Moreover, integrating airSlate SignNow into your workflow ensures all necessary documents are securely managed and submitted on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including plans suitable for small bodies corporate all the way to larger enterprises. Each plan includes features designed to streamline your Strata Title Body Corporate Tax Return and other eSigning needs. It's important to choose a plan that fits your specific requirements for seamless document management.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow provides a robust set of features tailored for tax documentation, including customizable templates, automated reminders, and secure storage options. These features enhance the management of your Strata Title Body Corporate Tax Return by ensuring all documents are readily accessible and compliant with Australian Taxation Office (ATO) regulations. This leads to better organization and timely submissions.

-

Can airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow can integrate seamlessly with popular accounting software used for managing finances and preparing Strata Title Body Corporate Tax Returns. This integration ensures that all data flows smoothly, minimizing errors and saving time during tax season. With these integrations, you can focus more on compliance with the Australian Taxation Office (ATO) rather than manual data entry.

-

Is eSigning with airSlate SignNow secure?

Absolutely, eSigning with airSlate SignNow is highly secure, employing multiple layers of encryption to protect your documents, including those related to your Strata Title Body Corporate Tax Return. The platform complies with leading security standards, ensuring that sensitive data remains confidential and secure. You can confidently engage with the Australian Taxation Office (ATO) knowing your information is safe.

-

What benefits does airSlate SignNow provide for Strata Title bodies corporate?

Using airSlate SignNow presents numerous benefits for Strata Title bodies corporate, including reduced paperwork, faster transaction times, and improved compliance with tax obligations. With an easy-to-use solution, you can efficiently manage your Strata Title Body Corporate Tax Return while ensuring all documentation meets Australian Taxation Office (ATO) standards. This leads to enhanced productivity and cost savings.

Get more for Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov

Find out other Strata Title Body Corporate Tax Return And Australian Taxation Office Ato Gov

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement