Instructions and Tax ReturnAustralian Taxation Office 2020-2026

What is the 2015 body corporate tax return?

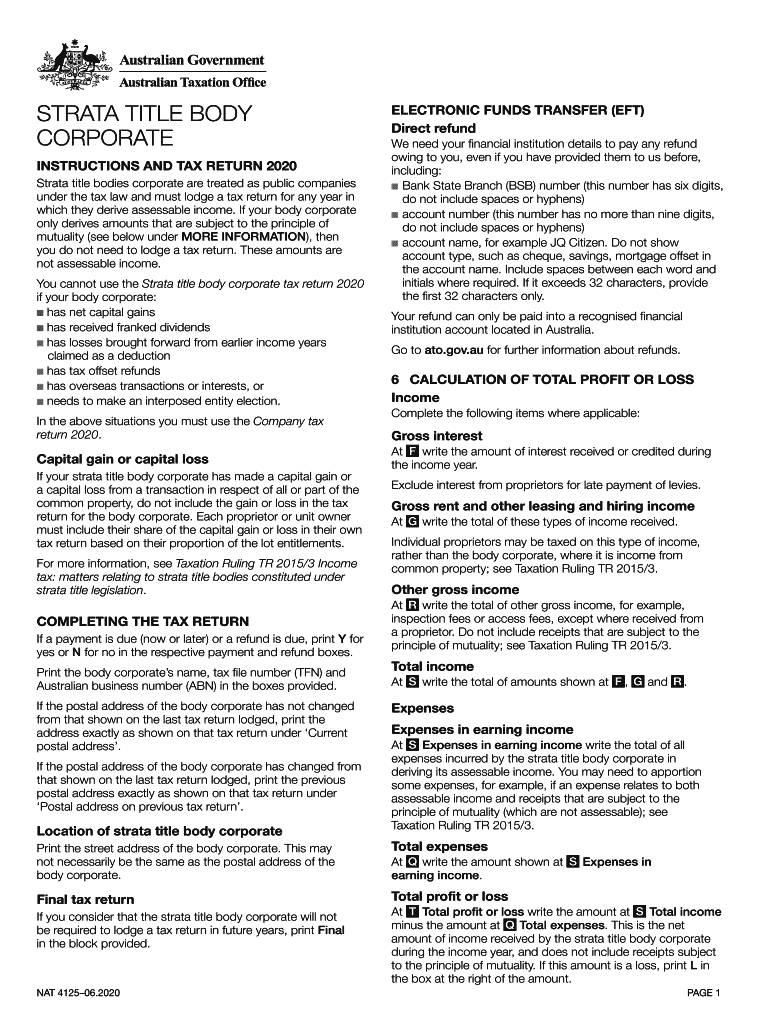

The 2015 body corporate tax return is a specific form used in Australia for reporting income and expenses related to body corporate entities. These entities manage common property in strata-titled developments. The return must detail the income generated from the property, including fees collected from owners and any other revenue sources. Additionally, it requires a comprehensive account of expenses incurred, such as maintenance and management fees. This form is crucial for ensuring compliance with the Australian Taxation Office (ATO) regulations.

Steps to complete the 2015 body corporate tax return

Completing the 2015 body corporate tax return involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with precise figures, ensuring all income and expenses are accurately reported. It is essential to review the completed form for any discrepancies before submission. Finally, submit the form electronically or via mail, adhering to the ATO's guidelines for submission methods.

Key elements of the 2015 body corporate tax return

The 2015 body corporate tax return includes several key elements that must be addressed. These elements consist of the entity's name, Australian Business Number (ABN), and details of income and expenses. It is also important to include any deductions that the body corporate is entitled to claim. The form requires accurate categorization of income sources and expenses to facilitate proper assessment by the ATO. Ensuring that these key elements are correctly reported is vital for compliance and avoiding penalties.

Filing deadlines for the 2015 body corporate tax return

Filing deadlines for the 2015 body corporate tax return are critical to ensure compliance with ATO regulations. Typically, the deadline for submission is set for October 31 of the financial year. However, if the body corporate is using a registered tax agent, they may be eligible for an extension. It is essential to be aware of these deadlines to avoid late fees and penalties. Keeping track of filing dates helps ensure that all necessary documentation is submitted on time.

Penalties for non-compliance with the 2015 body corporate tax return

Failure to comply with the requirements of the 2015 body corporate tax return can result in significant penalties. The ATO may impose fines for late submission, inaccuracies, or failure to file altogether. These penalties can vary based on the severity of the non-compliance. It is important for body corporate entities to understand these potential consequences and take proactive measures to ensure timely and accurate filing of their tax returns.

Required documents for the 2015 body corporate tax return

To successfully complete the 2015 body corporate tax return, several documents are required. These documents include financial statements that outline income and expenses, receipts for any deductible expenses, and records of any income received from owners or tenants. Additionally, having the body corporate's ABN and other identification details readily available will streamline the filing process. Collecting these documents in advance can help ensure a smooth completion of the tax return.

Quick guide on how to complete instructions and tax returnaustralian taxation office

Prepare Instructions And Tax ReturnAustralian Taxation Office effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Instructions And Tax ReturnAustralian Taxation Office across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Instructions And Tax ReturnAustralian Taxation Office with ease

- Obtain Instructions And Tax ReturnAustralian Taxation Office and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Instructions And Tax ReturnAustralian Taxation Office and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions and tax returnaustralian taxation office

Create this form in 5 minutes!

How to create an eSignature for the instructions and tax returnaustralian taxation office

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the 2018 strata tax and how does it affect my property?

The 2018 strata tax refers to specific tax regulations applied to strata properties in that year. Understanding this tax is crucial as it may impact your property’s overall costs and finances. It's advisable for property owners to familiarize themselves with the 2018 strata tax to avoid any surprises during tax season.

-

How can airSlate SignNow help with managing documents related to the 2018 strata tax?

airSlate SignNow offers a streamlined solution for managing documents that pertain to the 2018 strata tax. By providing easy eSigning capabilities, you can quickly complete and send necessary documents to ensure compliance with tax regulations. This not only saves time but also reduces the risk of errors in your tax filings.

-

What are the pricing options for airSlate SignNow if I'm dealing with the 2018 strata tax?

airSlate SignNow offers various pricing plans that can accommodate your needs while managing the 2018 strata tax. Our plans are designed to be cost-effective, ensuring you get the most value for your money. It's recommended to review the pricing page for specific details and find a plan that meets your budget.

-

Can I integrate airSlate SignNow with accounting software for handling the 2018 strata tax?

Yes, airSlate SignNow integrates seamlessly with several accounting software solutions. This integration is particularly beneficial for managing the 2018 strata tax, as it allows for easy transmission of signed documents and tax data. Streamlining your document workflow can enhance your overall efficiency during tax season.

-

What features does airSlate SignNow offer that can assist with 2018 strata tax compliance?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and secure document storage, all of which can signNowly assist with 2018 strata tax compliance. By utilizing these features, you can ensure that your documents are correctly completed and securely stored for future reference. This simplifies the tax preparation process considerably.

-

Is airSlate SignNow suitable for small businesses dealing with the 2018 strata tax?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses facing the challenges of the 2018 strata tax. Our platform helps small business owners manage their documents efficiently without overwhelming costs. This ensures that you can focus on growing your business while staying compliant.

-

How does airSlate SignNow ensure the security of documents related to the 2018 strata tax?

airSlate SignNow prioritizes document security to protect sensitive information, including those associated with the 2018 strata tax. We employ advanced encryption methods and comply with industry standards to ensure that your documents remain secure during the signing process. You can confidently use our platform knowing your information is safe.

Get more for Instructions And Tax ReturnAustralian Taxation Office

Find out other Instructions And Tax ReturnAustralian Taxation Office

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document