Psbank Home Loan 2013

What is the Psbank Home Loan

The Psbank Home Loan is a financial product designed to assist individuals in purchasing or refinancing a home. It offers various options tailored to meet the needs of borrowers, including competitive interest rates and flexible repayment terms. This loan can be utilized for different purposes, such as buying a new home, renovating an existing property, or consolidating debt.

How to obtain the Psbank Home Loan

To obtain a Psbank Home Loan, potential borrowers must first assess their eligibility based on income, credit score, and existing financial obligations. The application process typically involves submitting necessary documentation, such as proof of income, credit history, and identification. Once the application is reviewed, the bank will provide a decision, which may include an approval, denial, or request for additional information.

Steps to complete the Psbank Home Loan

Completing the Psbank Home Loan involves several key steps:

- Gather required documents, including income verification and identification.

- Submit the loan application through the bank's online portal or in person.

- Await the bank's review and decision on the application.

- If approved, review the loan terms and conditions carefully.

- Sign the loan agreement and complete any additional paperwork.

- Receive the funds and proceed with your home purchase or project.

Legal use of the Psbank Home Loan

The Psbank Home Loan is legally binding once all parties involved have signed the loan agreement. It is essential for borrowers to understand the terms of the loan, including interest rates, repayment schedules, and any penalties for late payments. Compliance with local and federal regulations is necessary to ensure that the loan remains valid and enforceable.

Required Documents

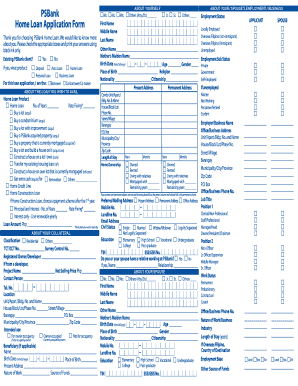

When applying for a Psbank Home Loan, borrowers must prepare several key documents, including:

- Proof of income (pay stubs, tax returns)

- Credit report

- Identification (driver's license, passport)

- Property details (purchase agreement, appraisal report)

- Bank statements for the past few months

Eligibility Criteria

To qualify for a Psbank Home Loan, applicants generally need to meet specific eligibility criteria, which may include:

- A minimum credit score, typically around 620 or higher.

- Stable employment history with a reliable income source.

- A debt-to-income ratio that does not exceed a certain percentage.

- Legal residency or citizenship in the United States.

Application Process & Approval Time

The application process for a Psbank Home Loan can vary in duration but typically takes a few weeks. After submitting the application, the bank will review the information provided, conduct a credit check, and verify the applicant's financial status. The approval time can be influenced by the completeness of the application and the bank's workload, but applicants can generally expect a response within one to three weeks.

Quick guide on how to complete psbank home loan

Complete Psbank Home Loan seamlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Psbank Home Loan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Psbank Home Loan with ease

- Obtain Psbank Home Loan and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Psbank Home Loan and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct psbank home loan

Create this form in 5 minutes!

How to create an eSignature for the psbank home loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PSBank home loan?

A PSBank home loan is a financial product offered by PSBank that enables individuals to finance their dream home or property. It provides competitive interest rates and flexible repayment terms, making it accessible for a wide range of borrowers.

-

What are the requirements to apply for a PSBank home loan?

To apply for a PSBank home loan, you'll typically need to provide proof of income, valid identification, and other relevant financial documents. It is important to meet the bank's creditworthiness criteria to ensure a smooth application process.

-

What interest rates are available for the PSBank home loan?

PSBank offers competitive interest rates for its home loans, which can vary based on a borrower's credit profile and loan amount. It's advisable to check the latest rates on the PSBank website to get the most accurate information.

-

Can I prepay my PSBank home loan without penalty?

Yes, PSBank allows borrowers to make prepayments on their home loans without incurring penalties. This flexibility helps you save on interest costs and pay off your loan faster.

-

What are the benefits of choosing a PSBank home loan?

A PSBank home loan offers benefits such as competitive interest rates, flexible payment options, and personalized customer service. Additionally, the bank provides tools and resources to assist you throughout your home loan journey.

-

How can I start my application for a PSBank home loan?

To start your application for a PSBank home loan, visit the PSBank website or your nearest branch. There, you will find resources and guidance to assist you in completing the application form and submitting the necessary documents.

-

Are there additional fees associated with a PSBank home loan?

Yes, like most financial institutions, PSBank may charge additional fees related to processing, appraisal, and insurance when you secure a home loan. It's important to review all applicable fees and terms before committing to ensure transparency.

Get more for Psbank Home Loan

Find out other Psbank Home Loan

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile