It 203 Form

What is the IT-203?

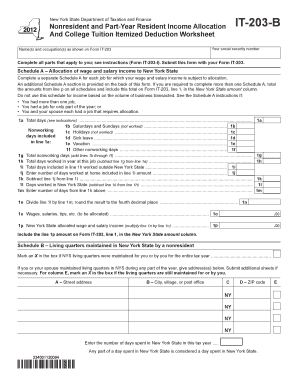

The IT-203 is a New York State tax form used by non-residents and part-year residents to report income earned within the state. This form is essential for individuals who have income from New York sources but do not reside in the state for the entire tax year. Understanding the IT-203 is crucial for accurate tax reporting and compliance with state tax laws.

Steps to Complete the IT-203

Completing the IT-203 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms and any 1099s related to income earned in New York. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income, deductions, and any credits you may qualify for. It is important to double-check all entries for accuracy before submission. Finally, sign and date the form to validate your submission.

Legal Use of the IT-203

The IT-203 is legally binding when filled out correctly and submitted on time. Compliance with New York State tax laws is critical, as failure to file or inaccuracies can lead to penalties. The form must be signed and dated to be considered valid. Additionally, using a reliable electronic signature solution can help ensure that your submission meets legal requirements.

Filing Deadlines / Important Dates

Timely filing of the IT-203 is essential to avoid penalties. The deadline for submitting the form typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the New York State Department of Taxation and Finance for any updates regarding specific deadlines.

Required Documents

To successfully complete the IT-203, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Your Social Security number and personal identification information

Having these documents ready will streamline the process and help ensure accuracy in your tax reporting.

Form Submission Methods

The IT-203 can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated tax offices. Online filing is often the most efficient method, providing immediate confirmation of receipt. If mailing the form, ensure it is sent to the correct address and postmarked by the filing deadline.

IRS Guidelines

While the IT-203 is a New York State form, it must be completed in accordance with IRS guidelines for reporting income. This includes accurate reporting of all income sources and adherence to federal tax laws. Understanding how the IT-203 interacts with federal tax obligations is essential for non-residents and part-year residents to avoid discrepancies and potential audits.

Quick guide on how to complete it 203

Complete It 203 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle It 203 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign It 203 with ease

- Find It 203 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign It 203 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 203 b in relation to airSlate SignNow?

The term 'it 203 b' refers to a specific functionality within the airSlate SignNow platform that enhances document signing processes. This feature allows users to manage and automate their eSignature workflows efficiently, making it easier for businesses to handle their documentation.

-

How does airSlate SignNow's it 203 b feature improve workflow efficiency?

The it 203 b feature in airSlate SignNow streamlines the eSigning process by automating repetitive tasks and providing templates for commonly used documents. By reducing the time spent on manual entries and signatures, businesses can focus on more important tasks and improve overall productivity.

-

What pricing options are available for the it 203 b functionality?

airSlate SignNow offers various pricing tiers that include the it 203 b feature, catering to different business needs. Each tier provides unique features, ensuring you can choose the best plan that fits your budget and usage requirements.

-

Can I integrate it 203 b with other applications?

Yes, the it 203 b feature in airSlate SignNow supports integration with several popular business applications, including CRM and document management systems. This capability ensures that your eSignature process can seamlessly fit into your existing workflows.

-

What are the key benefits of using it 203 b in airSlate SignNow?

The key benefits of the it 203 b feature include increased efficiency, enhanced security for documents, and improved collaboration among team members. These advantages help businesses reduce turnaround times for agreements and maintain compliance with eSignature regulations.

-

Is training available for using the it 203 b feature effectively?

Absolutely! airSlate SignNow provides various resources and training materials to help users understand and utilize the it 203 b functionality effectively. This support ensures that you can maximize the benefits of the platform.

-

How secure is the it 203 b eSignature process?

The it 203 b feature guarantees top-notch security for all eSignatures processed through airSlate SignNow. It employs industry-standard encryption and compliance with regulations to safeguard sensitive information, providing peace of mind for users.

Get more for It 203

- Pdf specific line instructions e form rs login

- 2021 california form 3801 cr passive activity credit limitations 2021 california form 3801 cr passive activity credit

- Nyc 210 tax form

- Tax year 2020 form mw508a annual employer withholding reconciliation report form mw508a annual employer withholding

- 1040 tax table 2022 form

- 2021 form 1 nrpy massachusetts nonresidentpart year

- Pdf schedule c massachusetts profit or loss from business 2021 form

- Pdf resident income tax massgov form

Find out other It 203

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document