Trid Compliance Checklist 2015

What is the Trid Compliance Checklist

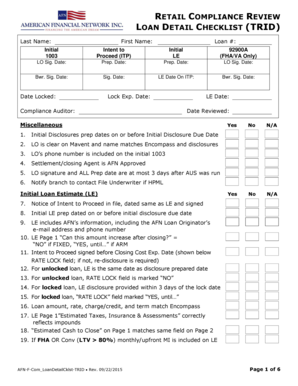

The Trid compliance checklist is a vital tool used in the real estate industry to ensure adherence to the TILA-RESPA Integrated Disclosure (TRID) regulations. These regulations aim to simplify and enhance the transparency of the mortgage loan process for consumers. The checklist includes key elements such as the Loan Estimate and Closing Disclosure, which provide borrowers with critical information about the terms and costs associated with their loans. By utilizing this checklist, lenders can verify that all necessary disclosures are provided to borrowers in a timely manner, fostering a clearer understanding of the mortgage process.

How to use the Trid Compliance Checklist

Using the Trid compliance checklist involves several steps to ensure that all regulatory requirements are met. Start by reviewing the checklist before initiating the loan process. This helps identify all necessary documents and disclosures required under TRID. As you progress through the loan application, check off each item on the list to confirm that it has been addressed. This includes ensuring that the Loan Estimate is provided within three business days of receiving a loan application and that the Closing Disclosure is delivered at least three business days before closing. Regularly updating the checklist as you move through the process helps maintain compliance and avoid potential issues.

Key elements of the Trid Compliance Checklist

The Trid compliance checklist comprises several essential components that must be included in the loan documentation process. Key elements include:

- Loan Estimate: A three-page document that outlines the loan terms, projected payments, and closing costs.

- Closing Disclosure: A detailed statement of the final loan terms and closing costs, which must be provided to the borrower at least three business days before closing.

- Timing Requirements: Adherence to specific timelines for providing disclosures to borrowers.

- Accuracy of Information: Ensuring that all figures and terms are accurate and reflect the actual loan agreement.

Steps to complete the Trid Compliance Checklist

Completing the Trid compliance checklist involves a systematic approach to ensure all requirements are met. Follow these steps:

- Gather necessary documentation, including borrower information and loan details.

- Prepare the Loan Estimate and ensure it is delivered to the borrower within three business days.

- Review the Loan Estimate with the borrower to clarify any questions.

- Prepare the Closing Disclosure and deliver it to the borrower at least three business days before closing.

- Confirm that all items on the checklist are completed and documented appropriately.

Legal use of the Trid Compliance Checklist

The legal use of the Trid compliance checklist is crucial for lenders and borrowers alike. Compliance with TRID regulations helps protect consumers by ensuring they receive clear and accurate information about their loans. Failure to adhere to these regulations can result in significant penalties for lenders, including fines and legal repercussions. By using the checklist, lenders can demonstrate their commitment to compliance and transparency, ultimately fostering trust with their clients.

Examples of using the Trid Compliance Checklist

Practical examples of using the Trid compliance checklist can help illustrate its importance. For instance, a lender may use the checklist when processing a mortgage application for a first-time homebuyer. By ensuring that the Loan Estimate is provided promptly and that the Closing Disclosure is accurate, the lender can help the borrower understand their financial obligations clearly. Another example could involve a refinancing scenario, where the checklist ensures that the borrower is fully informed of any changes in loan terms and costs associated with the refinancing process.

Quick guide on how to complete trid compliance checklist

Effortlessly Prepare Trid Compliance Checklist on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to efficiently create, edit, and eSign your documents without delay. Manage Trid Compliance Checklist on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Edit and eSign Trid Compliance Checklist with Ease

- Obtain Trid Compliance Checklist and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Trid Compliance Checklist to guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct trid compliance checklist

Create this form in 5 minutes!

How to create an eSignature for the trid compliance checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TRID compliance checklist?

A TRID compliance checklist is a tool that ensures your lending documents adhere to the TILA-RESPA Integrated Disclosure (TRID) rules. It helps lenders and professionals review all required documents and information, improving accuracy and compliance. Utilizing a TRID compliance checklist can streamline your workflow and reduce the risk of errors.

-

How can airSlate SignNow help with TRID compliance?

airSlate SignNow simplifies the eSignature process while ensuring you meet TRID compliance requirements. By providing easy-to-use templates and workflows, you can create compliant documents without hassle. The platform also offers features to track document status, enhancing transparency throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for TRID compliance?

Yes, airSlate SignNow offers various pricing plans suited to businesses of all sizes. Each plan includes features that support TRID compliance, such as customizable templates and secure eSignatures. By investing in airSlate SignNow, you enhance your compliance processes while saving time and resources.

-

Can I customize the TRID compliance checklist in airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily customize your TRID compliance checklist to fit your organization's specific needs. By tailoring the checklist, you ensure that it includes all necessary documents and steps for compliance. This flexibility helps to streamline your processes and maintain compliance effectively.

-

Does airSlate SignNow integrate with other tools for TRID compliance?

Yes, airSlate SignNow offers seamless integrations with various industry-leading tools and software. This allows you to enhance your TRID compliance checklist by connecting it with your existing systems, such as CRM and document management software. Integrations help automate processes and streamline compliance monitoring.

-

What are the key benefits of using airSlate SignNow for TRID compliance?

Using airSlate SignNow for TRID compliance offers several benefits, including improved accuracy, efficiency, and ease of use. The platform simplifies the documentation process, ensuring all required forms adhere to compliance standards. Moreover, its intuitive interface makes it accessible for users at any level of technical expertise.

-

Is airSlate SignNow secure for handling TRID compliance documents?

Yes, airSlate SignNow prioritizes security, ensuring your TRID compliance documents are handled with the utmost care. The platform employs industry-standard encryption and security measures to protect sensitive information. You can confidently utilize airSlate SignNow, knowing that your compliance documents are secure.

Get more for Trid Compliance Checklist

- Michagan pistol sales record fillable form

- 1 petition for permission to test or retest please form

- Kansas state department of education school bus driver medical examination report form

- Wichita half fare card form

- Postnuptial agreement example mecklenburg county bar meckbar form

- Football registration form pdf

- Manatee county government administrative center honorable form

- Mdcps form fm 6743

Find out other Trid Compliance Checklist

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement