American Opportunity Tax Credit Form

What is the American Opportunity Tax Credit Form

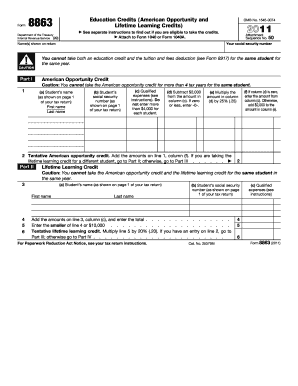

The American Opportunity Tax Credit (AOTC) form is a crucial document for eligible students and their families seeking to claim education tax credits on their federal tax returns. This form allows taxpayers to receive a credit for qualified education expenses incurred during the first four years of higher education. The AOTC can provide substantial financial relief, covering up to $2,500 per eligible student, making it an essential aspect of tax planning for those pursuing higher education.

Eligibility Criteria for the American Opportunity Tax Credit Form

To qualify for the AOTC, taxpayers must meet specific eligibility criteria. The student must be enrolled at least half-time in a degree or certificate program at an eligible institution. Additionally, the credit is available only for the first four years of post-secondary education. Income limits also apply; for example, the credit begins to phase out for individuals with modified adjusted gross income above $80,000 and for married couples filing jointly above $160,000. Meeting these criteria is vital to ensure that the AOTC can be claimed successfully.

Steps to Complete the American Opportunity Tax Credit Form

Completing the AOTC form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation, including Form 1098-T from the educational institution, which details the tuition paid. Next, fill out the appropriate sections of IRS Form 8863, which is used to claim education credits. Be sure to include the student's information, qualified expenses, and any applicable income details. Finally, review the form for completeness and accuracy before submitting it with your tax return.

How to Obtain the American Opportunity Tax Credit Form

The American Opportunity Tax Credit form can be obtained directly from the IRS website, where Form 8863 is available for download. Alternatively, taxpayers can access the form through tax preparation software that includes the necessary forms for filing. It is essential to ensure that you are using the most current version of the form to comply with any recent changes in tax law.

Legal Use of the American Opportunity Tax Credit Form

The legal use of the AOTC form requires adherence to IRS regulations regarding education credits. This includes accurately reporting qualifying expenses and ensuring that the student meets all eligibility requirements. Failing to comply with these regulations can lead to penalties or disallowance of the claimed credit. Utilizing a reliable electronic signature platform, like signNow, can help ensure that the completed form is submitted securely and in compliance with legal standards.

Required Documents for the American Opportunity Tax Credit Form

To successfully complete the AOTC form, taxpayers must gather specific documents. Key documents include Form 1098-T, which provides information on tuition payments made to the educational institution. Additionally, records of qualified expenses, such as books, supplies, and equipment required for courses, should be collected. Keeping thorough documentation is crucial for substantiating the claim in case of an IRS audit.

Quick guide on how to complete american opportunity tax credit form

Complete American Opportunity Tax Credit Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage American Opportunity Tax Credit Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and eSign American Opportunity Tax Credit Form with ease

- Obtain American Opportunity Tax Credit Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form hunting, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign American Opportunity Tax Credit Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the american opportunity tax credit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the American Opportunity Credit Form?

The American Opportunity Credit Form is a tax form used to claim the American Opportunity Tax Credit, which helps eligible students and their families pay for college expenses. By using airSlate SignNow, you can easily manage and eSign this important document, ensuring that all necessary information is accurately captured.

-

How can airSlate SignNow help with the American Opportunity Credit Form?

airSlate SignNow streamlines the process of completing the American Opportunity Credit Form by providing a user-friendly platform for document creation and eSigning. You can quickly fill out, share, and sign the form with ease, reducing the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the American Opportunity Credit Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is based on the features you select, enabling you to efficiently manage the American Opportunity Credit Form without overspending.

-

Are there specific features in airSlate SignNow that assist with the American Opportunity Credit Form?

Absolutely! airSlate SignNow includes features such as document templates, customizable fields, and secure eSigning, which are all beneficial for filling out the American Opportunity Credit Form. These tools ensure accuracy and compliance in your tax filing process.

-

Can I integrate airSlate SignNow with other applications when handling the American Opportunity Credit Form?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to easily import and export information related to the American Opportunity Credit Form. This connectivity enhances workflow efficiency and ensures all necessary data is readily available.

-

What are the benefits of using airSlate SignNow for education-related documents like the American Opportunity Credit Form?

Using airSlate SignNow for the American Opportunity Credit Form provides numerous benefits, including improved organization, enhanced security, and easy accessibility from anywhere. This ensures that your tax documents are safe and can be completed quickly, reducing stress during tax season.

-

Is it easy to modify the American Opportunity Credit Form in airSlate SignNow?

Yes, modifying the American Opportunity Credit Form in airSlate SignNow is straightforward. Our platform allows you to edit fields, add necessary information, and make adjustments seamlessly, ensuring the form meets all requirements before submission.

Get more for American Opportunity Tax Credit Form

Find out other American Opportunity Tax Credit Form

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now