1702q Form July

What is the 1702q Form July

The 1702q form, specifically the July version, is a tax document used by businesses in the United States to report their income and expenses for a specific tax year. It is essential for corporations, partnerships, and other business entities to accurately complete this form to comply with federal tax regulations. The form provides a comprehensive overview of a business's financial activities, allowing the Internal Revenue Service (IRS) to assess the correct amount of taxes owed. Understanding the purpose and structure of the 1702q form is crucial for any business entity aiming to maintain compliance and avoid penalties.

How to use the 1702q Form July

Using the 1702q form involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements, expense reports, and any other relevant records. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect the business's financial activities for the reporting period. It is important to double-check calculations and ensure that all required signatures are included. Once completed, the form can be submitted electronically or via mail, depending on the preferred filing method.

Filing Deadlines / Important Dates

Filing deadlines for the 1702q form are critical to avoid penalties and interest. Typically, the form must be filed by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable for businesses to mark these dates on their calendars and prepare their documentation in advance to ensure timely filing.

Steps to complete the 1702q Form July

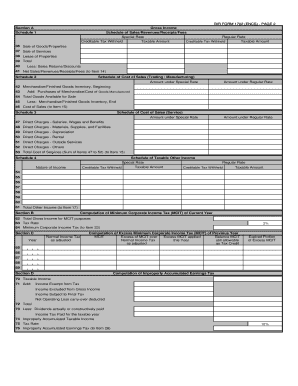

Completing the 1702q form requires a systematic approach to ensure accuracy. Begin by entering the business's identifying information, including the name, address, and Employer Identification Number (EIN). Next, report the total income earned during the tax year, followed by detailed listings of allowable deductions and expenses. After entering all financial data, review the form for completeness and accuracy. Finally, sign and date the form before submitting it to the IRS. Utilizing digital tools can streamline this process, making it easier to track and manage submissions.

Legal use of the 1702q Form July

The legal use of the 1702q form is governed by IRS regulations, which stipulate that businesses must file accurate and truthful information. Falsifying information on the form can lead to severe penalties, including fines and legal action. It is crucial for businesses to maintain accurate records and ensure that all entries on the form reflect actual financial activities. Compliance with tax laws not only protects the business from legal repercussions but also helps build trust with stakeholders and clients.

Required Documents

To complete the 1702q form, several supporting documents are necessary. These include financial statements, such as profit and loss statements, balance sheets, and records of any deductions claimed. Additionally, businesses should have receipts and invoices that substantiate reported expenses. Keeping organized records will facilitate the completion of the form and ensure that all information is readily available for review. Having these documents on hand will also help in case of an audit by the IRS.

Quick guide on how to complete 1702q form july

Complete 1702q Form July effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents since you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage 1702q Form July on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to edit and eSign 1702q Form July without any hassle

- Locate 1702q Form July and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from the device of your choice. Alter and eSign 1702q Form July and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1702q form july

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the deadline for when to file 1702Q?

The deadline for when to file 1702Q typically falls on or before the last day of the month following the end of the quarter. This means that you should ensure all necessary documentation is prepared and submitted in a timely manner to avoid penalties.

-

How can airSlate SignNow help me when to file 1702Q?

airSlate SignNow offers a seamless eSigning experience that enables you to manage and sign your 1702Q documents quickly. It streamlines the process so you can focus on ensuring compliance with all filing deadlines, including when to file 1702Q.

-

What are the features of airSlate SignNow that assist with tax filings like 1702Q?

AirSlate SignNow includes features such as document templates, real-time tracking, and secure storage. These features simplify the management and filing process, ensuring you know exactly when to file 1702Q and that your submissions are accurate.

-

Is there a cost associated with using airSlate SignNow when to file 1702Q?

Yes, there are pricing plans for airSlate SignNow that cater to different business needs. Investing in this solution can signNowly reduce the hassle of compliance and filing, particularly when it comes to knowing when to file 1702Q.

-

Can I integrate airSlate SignNow with other software to manage when to file 1702Q?

Absolutely! airSlate SignNow integrates with various third-party applications, enabling you to manage your tax deadlines effectively. These integrations can alert you when to file 1702Q and help centralize your workflow.

-

What benefits does airSlate SignNow provide for small businesses regarding when to file 1702Q?

For small businesses, airSlate SignNow offers an affordable solution that simplifies the document signing process. Benefits include enhanced compliance and timely submissions, ensuring you are well-informed about when to file 1702Q.

-

How does airSlate SignNow assure security for documents related to when to file 1702Q?

AirSlate SignNow guarantees high security through encryption and secure access controls for all your documents. This means that any documents related to when to file 1702Q are protected, providing peace of mind during the filing process.

Get more for 1702q Form July

- Online outpatient consent form rex hospital nc

- Cancer survivor participant form yuma regional medical center yumaregional

- 61 9pic 31185008 form

- 2013 cornhole league registration form garneriowaorg garneriowa

- Certificate requests vantreo form

- Employee census form

- Stanford university health intake form

- Ca workers compensation injury form

Find out other 1702q Form July

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form