City of Detroit Treasury Form Dw3

What is the City Of Detroit Treasury Form Dw3

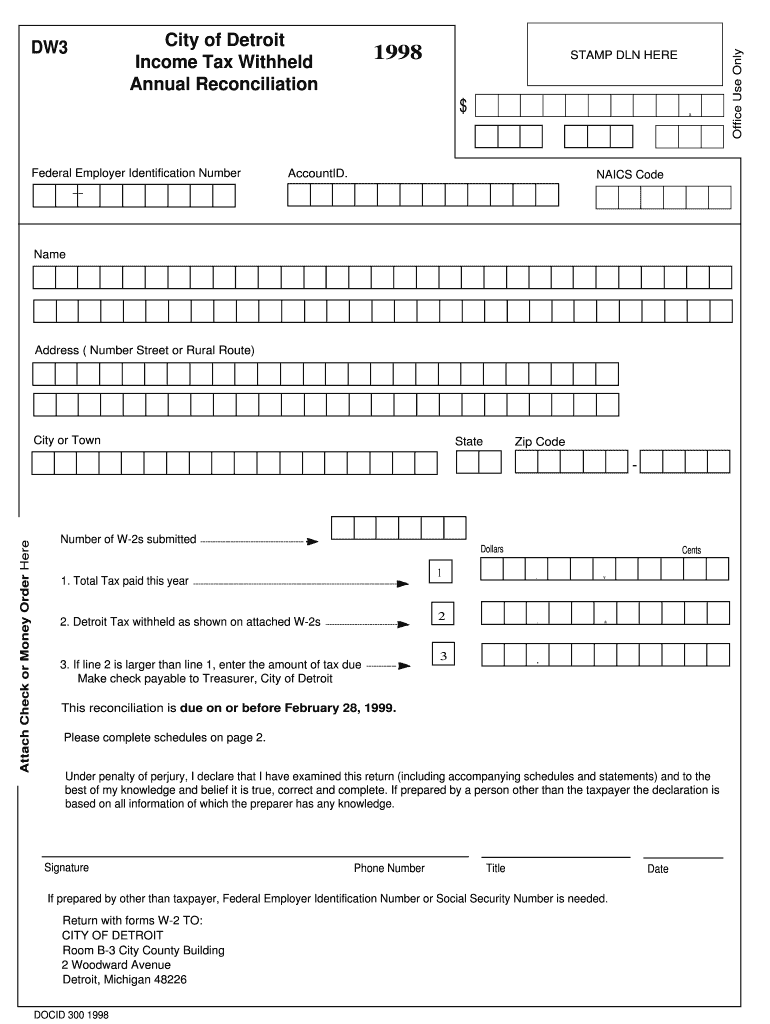

The City of Detroit Treasury Form DW3 is a tax form used primarily for reporting income and withholding information for employees and contractors working within the city. This form is essential for ensuring compliance with local tax regulations and helps the city manage its revenue collection effectively. The DW3 form is specifically designed to capture the necessary details about the taxpayer, including their identification information and the amount of tax withheld, if applicable.

How to use the City Of Detroit Treasury Form Dw3

Using the City of Detroit Treasury Form DW3 involves several steps to ensure accurate completion. First, gather all necessary personal and financial information, such as your Social Security number, employer details, and income data. Next, download the form from the official City of Detroit website or obtain a physical copy from a local treasury office. Fill out the form carefully, ensuring all information is correct and complete. Finally, submit the form according to the instructions provided, either electronically or by mail, to ensure it is processed in a timely manner.

Steps to complete the City Of Detroit Treasury Form Dw3

Completing the City of Detroit Treasury Form DW3 requires attention to detail. Follow these steps:

- Obtain the DW3 form from the City of Detroit's website or treasury office.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your employer or contracting entity, including their name and address.

- Indicate the type of income you are reporting and the amount of tax withheld, if applicable.

- Review the completed form for accuracy and completeness.

- Sign and date the form where required.

- Submit the form as instructed, ensuring it reaches the appropriate department by the deadline.

Legal use of the City Of Detroit Treasury Form Dw3

The City of Detroit Treasury Form DW3 holds legal significance as it is used for tax reporting purposes. When completed accurately, it serves as a formal declaration of income and tax withholding, which can be used by the city for auditing and compliance checks. It is essential to ensure that the information provided on the form is truthful and accurate, as discrepancies may lead to penalties or legal issues. Utilizing a reliable platform for digital submission can enhance the security and compliance of the process.

Form Submission Methods

The City of Detroit Treasury Form DW3 can be submitted through various methods to accommodate different preferences. You can choose to submit the form online through the City of Detroit's official tax portal, which allows for a quick and efficient process. Alternatively, you may print the completed form and mail it to the designated treasury office. In-person submissions are also accepted at local treasury offices, providing an option for those who prefer direct interaction. Ensure that you follow the submission guidelines to avoid delays.

Penalties for Non-Compliance

Failure to submit the City of Detroit Treasury Form DW3, or submitting it with incorrect information, can result in penalties. The city may impose fines for late submissions or inaccuracies, which can add financial stress to taxpayers. Additionally, non-compliance may lead to further scrutiny from tax authorities, potentially resulting in audits or additional legal ramifications. It is crucial to adhere to all filing deadlines and ensure the accuracy of the information provided to avoid these penalties.

Quick guide on how to complete city of detroit treasury form dw3

Effortlessly Prepare City Of Detroit Treasury Form Dw3 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option compared to conventional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow supplies all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage City Of Detroit Treasury Form Dw3 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign City Of Detroit Treasury Form Dw3 with Ease

- Find City Of Detroit Treasury Form Dw3 and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Finished button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of Detroit Treasury Form Dw3 and ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of detroit treasury form dw3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Detroit Treasury Form DW3 2012?

The city of Detroit Treasury Form DW3 2012 is an important document required for individuals and businesses when filing specific taxes in Detroit. This form helps in reporting withholding exemptions and ensuring compliance with local tax laws. Understanding and accurately completing this form is essential for avoiding potential penalties.

-

How can airSlate SignNow assist with the city of Detroit Treasury Form DW3 2012?

airSlate SignNow simplifies the process of completing the city of Detroit Treasury Form DW3 2012 by providing an intuitive e-signature and document management platform. Users can easily fill out, sign, and send this form electronically, streamlining the workflow. This digital solution helps ensure that your form submission is efficient and compliant.

-

Is there a cost associated with using airSlate SignNow for the city of Detroit Treasury Form DW3 2012?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, allowing customers to choose the right solution for managing documents like the city of Detroit Treasury Form DW3 2012. The cost is affordable, making it a cost-effective choice for individuals and businesses. Detailed pricing information is available on the website.

-

Can I integrate airSlate SignNow with other software to manage the city of Detroit Treasury Form DW3 2012?

Absolutely! airSlate SignNow supports integration with a variety of other software applications, enhancing your ability to manage the city of Detroit Treasury Form DW3 2012 seamlessly. This capability enables users to streamline their workflows by connecting different tools and systems, increasing overall productivity.

-

What features does airSlate SignNow provide for handling the city of Detroit Treasury Form DW3 2012?

airSlate SignNow features a user-friendly interface for filling out documents, advanced e-signature options, and secure cloud storage—all crucial for managing the city of Detroit Treasury Form DW3 2012. These features ensure that your documents are completed accurately and stored safely for easy access and compliance purposes.

-

How secure is airSlate SignNow when dealing with sensitive documents like the city of Detroit Treasury Form DW3 2012?

Security is a top priority for airSlate SignNow, particularly when handling sensitive documents such as the city of Detroit Treasury Form DW3 2012. The platform uses state-of-the-art encryption and security protocols to protect your information. You can trust that your documents are safe while being processed and stored.

-

Can I track the status of my city of Detroit Treasury Form DW3 2012 submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your submissions for the city of Detroit Treasury Form DW3 2012 in real-time. This tracking feature enables you to see when the document has been viewed, signed, and completed. It adds a level of transparency that is beneficial for managing your filing process.

Get more for City Of Detroit Treasury Form Dw3

- Address line 1 address line 2 city state postal code 4 mta form

- I have reviewed the letter dated d a t e that you received from the department of mental form

- Enclosed is our firm check no form

- Us 0346ltrdocx instruction this is a model letter adapt to fit your form

- Us post office refused to send my amz packagen general selling form

- Has requested that we contact you regarding a savings form

- Ampquotenclosed please findampquot means you lost it business writing form

- Sample referral request letter dreamtechme form

Find out other City Of Detroit Treasury Form Dw3

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document