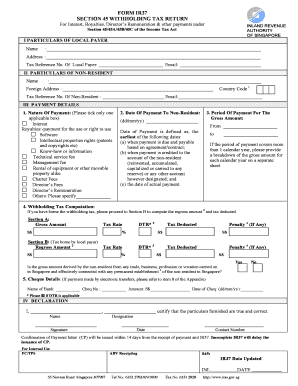

Ir37 Form

What is the IR37?

The IR37 is a tax form used in the United States for reporting income earned by individuals who are self-employed or receive income from sources other than traditional employment. This form is essential for accurately reporting earnings to the Internal Revenue Service (IRS) and ensuring compliance with tax obligations. It is particularly relevant for freelancers, contractors, and other independent workers who must report their earnings and pay self-employment taxes.

How to use the IR37

Using the IR37 involves several steps to ensure that all income is reported correctly. First, gather all relevant financial documents, including invoices, bank statements, and any other records of income. Next, fill out the form by entering your total income, deductions, and any applicable credits. It is crucial to ensure that all information is accurate to avoid potential penalties. Once completed, the form can be submitted to the IRS either electronically or by mail.

Steps to complete the IR37

Completing the IR37 requires careful attention to detail. Follow these steps:

- Collect all necessary financial documents, such as income statements and receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include both cash and non-cash payments.

- List any deductions you are eligible for, such as business expenses or self-employment tax deductions.

- Review the form for accuracy before submission.

Legal use of the IR37

The IR37 is legally binding when completed and submitted according to IRS guidelines. It is crucial to comply with all tax laws to avoid legal repercussions. The information reported on this form must be truthful and accurate, as any discrepancies can lead to audits or penalties. Ensuring that the form is filled out correctly helps maintain compliance with federal tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IR37 are critical for avoiding penalties. Typically, the form must be submitted by April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to these deadlines to ensure timely filing.

Who Issues the Form

The IR37 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is essential to refer to the IRS for the most current version of the form and any updates regarding its use.

Penalties for Non-Compliance

Failure to comply with the requirements of the IR37 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to file the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help individuals prioritize their tax responsibilities and maintain good standing with the IRS.

Quick guide on how to complete ir37

Complete Ir37 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Ir37 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Ir37 with ease

- Locate Ir37 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ir37 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir37

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ir37 and why is it important?

The form ir37 is a tax form used in the UK for declaring income from self-employment to HMRC. It’s important because correctly filing the form ir37 ensures that you meet your tax obligations, avoiding potential penalties. Using airSlate SignNow simplifies this process by allowing seamless electronic signatures on your form ir37.

-

How can airSlate SignNow help me with my form ir37?

airSlate SignNow streamlines the process of filling out and signing your form ir37 online. With our platform, you can easily create, edit, and send the form ir37 for eSignature from any device. This not only saves time but also enhances accuracy, ensuring your tax form is submitted correctly.

-

What are the pricing options for using airSlate SignNow for form ir37?

airSlate SignNow offers flexible pricing plans suited for individuals to large organizations looking to handle the form ir37 efficiently. Our plans are designed to be cost-effective, ensuring you only pay for what you need while providing you access to essential features. Visit our pricing page for detailed information on each plan.

-

Is airSlate SignNow compliant with legal standards for form ir37?

Yes, airSlate SignNow complies with legal standards and regulations necessary for handling documents like the form ir37. This includes ensuring data protection and the legality of electronic signatures, making it a trusted solution for your tax documentation needs. You can confidently utilize our platform for your form ir37.

-

Can I integrate airSlate SignNow with other tools for managing my form ir37?

Absolutely! airSlate SignNow offers integrations with various tools such as cloud storage services and project management software. This means you can easily link your workflow to access and manage your form ir37 alongside your other business documents. This integration enhances efficiency and streamlines your document processing.

-

What features does airSlate SignNow offer for filling out the form ir37?

airSlate SignNow provides a range of features for efficiently completing the form ir37, including customizable templates, advanced editing tools, and electronic signature capabilities. These features enable users to fill out and send the form ir37 quickly and accurately, improving overall productivity. Explore our platform to see all the available tools.

-

How does eSigning the form ir37 work with airSlate SignNow?

eSigning the form ir37 with airSlate SignNow is straightforward. After you complete the form, you can invite others to review and sign electronically, eliminating the need for printing and scanning. Our secure signing process ensures that your form ir37 is handled confidentially and efficiently.

Get more for Ir37

- Notice of filing of a proposed rule change to amend the certificate of form

- Proxy statements strategy amp form

- Convertible note agreement legal formalllaw

- Location of the incident form

- Deed of trustmortgage form

- 30 day notice of termination form

- Special needs trust elder law ampamp medicaid planning attorneys form

- Instructions for schedule m 3 form 1120s 2018internal revenue

Find out other Ir37

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form