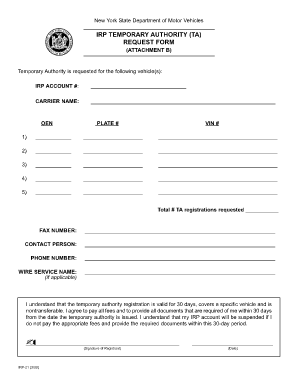

Irp 21 Form

What is the IRP 21 Form

The IRP 21 form is a document used primarily for reporting and managing certain tax-related information. It serves as a tool for businesses and individuals to ensure compliance with federal and state tax regulations. The form may be required for various purposes, including reporting income, deductions, and other financial details to the Internal Revenue Service (IRS). Understanding its function is crucial for accurate tax reporting and avoiding potential penalties.

How to use the IRP 21 Form

Using the IRP 21 form involves several straightforward steps. First, gather all necessary financial records, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information aligns with your financial documentation. After completing the form, review it for any errors or omissions. Finally, submit the form according to the instructions provided, either electronically or via mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the IRP 21 Form

Completing the IRP 21 form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all figures are correct.

- List any deductions you are eligible for, providing appropriate documentation.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline specified by the IRS.

Legal use of the IRP 21 Form

The IRP 21 form is legally binding when filled out correctly and submitted in accordance with IRS regulations. To ensure its legal validity, it is essential to provide accurate information and comply with all applicable laws. This includes adhering to deadlines and maintaining records of submission. Failure to comply can result in penalties or legal repercussions, making it vital to understand the legal implications of using this form.

Key elements of the IRP 21 Form

Several key elements are essential for the IRP 21 form to be considered complete and valid:

- Personal Information: Accurate details about the individual or business filing the form.

- Income Reporting: Clear documentation of all income sources.

- Deductions and Credits: A comprehensive list of applicable deductions and credits.

- Signature: A required signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the IRP 21 form can vary based on specific circumstances, such as the type of income reported. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. It is crucial to be aware of any extensions or changes in deadlines that may apply to your situation. Keeping track of these dates helps avoid late fees and ensures compliance with tax regulations.

Quick guide on how to complete irp 21 form

Easily prepare Irp 21 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, alter, and electronically sign your documents swiftly without any holdups. Manage Irp 21 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Irp 21 Form effortlessly

- Locate Irp 21 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or conceal confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your edits.

- Decide how you wish to share your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irp 21 Form to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irp 21 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRP 21 and how does airSlate SignNow assist with it?

IRP 21 refers to the 21st Iteration of the Internal Revenue Plan, which involves necessary documentation for compliance. airSlate SignNow empowers businesses to streamline the eSigning process, making it easier to manage and submit IRP 21 documents quickly and securely.

-

How does airSlate SignNow ensure the security of IRP 21 documents?

airSlate SignNow employs top-tier security measures, including encryption and multi-factor authentication, to safeguard your IRP 21 documents. This ensures that your sensitive information remains confidential and protected from unauthorized access.

-

What are the pricing options for airSlate SignNow when handling IRP 21?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of any size looking to manage IRP 21 documents. The cost-effective solution allows you to choose a plan that best fits your needs without sacrificing the quality of service.

-

Can I integrate airSlate SignNow with other tools for IRP 21 processing?

Yes, airSlate SignNow provides seamless integration with various third-party applications, enhancing the management of IRP 21. Whether it's connecting with CRM systems or project management tools, airSlate SignNow ensures a smooth workflow.

-

What features of airSlate SignNow are beneficial for handling IRP 21?

Key features of airSlate SignNow that benefit IRP 21 management include automated workflows, templates, and in-app document tracking. These features simplify the process, ensuring efficient and accurate handling of all required IRP 21 documents.

-

How can airSlate SignNow improve the efficiency of my IRP 21 submissions?

With airSlate SignNow, businesses can expedite their IRP 21 submissions through electronic signatures and real-time collaboration. This not only saves time but also reduces the risk of errors that commonly occur in paper-based processes.

-

Is there customer support available for questions regarding IRP 21 and airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist with any inquiries related to IRP 21. Their team is equipped to provide guidance and solutions tailored to your specific needs.

Get more for Irp 21 Form

- Customer information form cif razorpay fill and sign

- Guideline on preparation of din submissions canadaca form

- Illinois form llc 45 5 fill online printable fillable

- Tips in writing a reflective statement pdfexamples form

- Print display ampamp misc problems irs tax forms

- Doctors report c 43 of mmipermanent partial impairment form

- Limited company information form rbs international

- Get the free application for authority to certify lawyers form

Find out other Irp 21 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors