St 28f Form

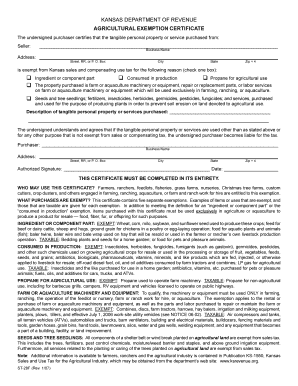

What is the ST 28F?

The ST 28F form is a state-specific document used primarily in the United States for tax exemption purposes. It allows certain entities, such as non-profit organizations and government agencies, to purchase goods and services without paying sales tax. This form is essential for organizations that qualify under specific criteria, ensuring compliance with state tax regulations while facilitating tax-exempt transactions.

How to Use the ST 28F

Using the ST 28F form involves several steps to ensure proper completion and acceptance. First, the organization must verify its eligibility for tax-exempt status. Once confirmed, the form can be filled out with relevant details, including the organization's name, address, and tax identification number. After completing the form, it should be presented to the vendor at the time of purchase to avoid sales tax charges. It is crucial to retain a copy of the completed form for the organization’s records.

Steps to Complete the ST 28F

Completing the ST 28F form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the organization’s legal name, address, and tax identification number.

- Indicate the purpose of the tax exemption clearly.

- Sign and date the form to validate it.

- Provide the completed form to the seller at the point of sale.

- Keep a copy of the form for your records in case of audits or inquiries.

Legal Use of the ST 28F

The ST 28F form must be used in accordance with state laws governing tax exemptions. Organizations must ensure that they meet the eligibility criteria set forth by the state. Misuse of the form, such as using it for ineligible purchases, can lead to penalties, including fines or loss of tax-exempt status. Therefore, it is essential to understand the legal implications and maintain accurate records of all transactions made using the ST 28F form.

Who Issues the Form

The ST 28F form is typically issued by state tax authorities. Each state may have its own version of the form, tailored to its specific tax laws and regulations. Organizations seeking to obtain the ST 28F should consult their state’s department of revenue or taxation website for the most accurate and up-to-date version of the form. This ensures compliance with state-specific requirements and facilitates proper use of the form.

Examples of Using the ST 28F

There are various scenarios in which the ST 28F form can be utilized. For instance, a non-profit organization purchasing office supplies for its operations can present the ST 28F to avoid sales tax on those purchases. Similarly, government agencies procuring equipment or services for public use can also use this form to ensure tax-exempt transactions. Understanding these examples can help organizations maximize their tax benefits while adhering to legal requirements.

Quick guide on how to complete st 28f

Easily prepare St 28f on any device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage St 28f on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to modify and eSign St 28f effortlessly

- Locate St 28f and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details using tools that airSlate SignNow offers for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign St 28f to maintain effective communication throughout any phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 28f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st 28f in relation to airSlate SignNow?

St 28f refers to a specific feature set within airSlate SignNow that enhances the eSignature experience. This designation ensures that users can efficiently manage documents while benefiting from streamlined workflows. The st 28f feature set helps businesses of all sizes reduce turnaround times and improve overall document handling.

-

How does pricing work for the st 28f features on airSlate SignNow?

The pricing for st 28f features on airSlate SignNow is designed to be affordable and scalable. Customers can choose from various subscription plans based on their specific needs and the number of users. Each plan offers different levels of functionality, ensuring businesses can select the best option for their budget.

-

What are the key benefits of using st 28f with airSlate SignNow?

Using st 28f with airSlate SignNow provides numerous benefits, including enhanced security and improved document workflows. Users can quickly send, sign, and manage documents, leading to increased productivity. The flexibility of the st 28f features allows companies to customize their document processes to fit unique requirements.

-

Can st 28f integrate with other tools?

Yes, st 28f is designed to integrate seamlessly with various third-party applications. This feature enhances the user experience by allowing businesses to connect their existing tools with airSlate SignNow, improving overall efficiency. Whether you use a CRM or project management software, st 28f can help streamline your processes.

-

Is training available for using st 28f on airSlate SignNow?

Absolutely! airSlate SignNow offers robust training resources for users looking to maximize the benefits of st 28f. This includes tutorials, webinars, and user guides that help customers understand how to best utilize the features. Support is also available to answer any specific questions you might have.

-

What industries benefit from st 28f on airSlate SignNow?

Various industries can benefit from using st 28f on airSlate SignNow, including healthcare, finance, and real estate. Each sector has unique document management challenges that st 28f can address effectively. By automating and streamlining eSignature processes, businesses in these industries can improve compliance and efficiency.

-

How secure is the st 28f feature within airSlate SignNow?

The security of st 28f in airSlate SignNow is top-notch, incorporating advanced encryption and authentication protocols. This ensures that all documents signed using st 28f are secure and comply with industry standards. Users can trust that their sensitive information is protected throughout the signing process.

Get more for St 28f

- Appraisal system evaluation form

- Employee action request wwwdocumentsdgscagov form

- Notification of workers compensation injuryillness form

- Kelley school of business undergraduate career services seven form

- Behavioral interview guide instructions form

- Duke university homehuman resources form

- Sublease for franchisor leased locations long form

- Denver public schools department of human resources form

Find out other St 28f

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed