Form Tax Filing

What is the Form Tax Filing

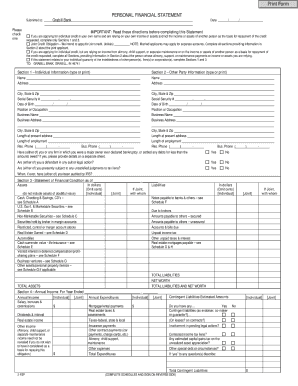

The Form Tax Filing is a crucial document that individuals and businesses in the United States must complete to report their income, expenses, and other tax-related information to the Internal Revenue Service (IRS). This form is essential for determining tax liability and ensuring compliance with federal tax laws. The most common form for individual taxpayers is the Form 1040, which allows for various deductions and credits that can reduce the overall tax burden.

Steps to Complete the Form Tax Filing

Completing the Form Tax Filing involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and eligibility for certain credits. After that, fill out the form by entering your income, deductions, and credits. It is important to double-check all entries for accuracy. Finally, sign and date the form before submitting it to the IRS.

Legal Use of the Form Tax Filing

The legal use of the Form Tax Filing is governed by IRS regulations, which specify how the form should be completed and submitted. To be considered valid, the form must be signed by the taxpayer, and any electronic submissions must comply with eSignature laws such as the ESIGN Act and UETA. Additionally, maintaining accurate records and documentation is essential to support the information reported on the form in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form Tax Filing are critical for compliance. Typically, individual taxpayers must submit their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, but it is important to note that this only extends the filing deadline, not the payment deadline for any taxes owed.

Required Documents

To complete the Form Tax Filing accurately, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Records of any other income, such as interest or dividends

- Previous year’s tax return for reference

Having these documents organized will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Form Tax Filing, each with its own advantages. Taxpayers can file online using approved e-filing software, which often provides guidance and ensures compliance with current tax laws. Alternatively, forms can be mailed directly to the IRS; however, this method may take longer for processing. In-person filing is available at certain IRS offices, where assistance may be provided by tax professionals.

Quick guide on how to complete form tax filing

Complete Form Tax Filing effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form Tax Filing on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Form Tax Filing without hassle

- Locate Form Tax Filing and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, by email, text message (SMS), or through an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Tax Filing and ensure seamless communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is return filing and how can airSlate SignNow help?

Return filing refers to the process of submitting necessary documents and information for tax purposes. With airSlate SignNow, you can easily prepare and eSign all required documents, ensuring a smooth and efficient return filing experience for your business.

-

How much does airSlate SignNow cost for return filing services?

airSlate SignNow offers flexible pricing plans that cater to various business needs, starting at an affordable monthly rate. Each plan provides essential features for return filing, making it a cost-effective solution suitable for businesses of all sizes.

-

What features does airSlate SignNow offer for effective return filing?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools enhance your return filing process, allowing you to streamline documentation and ensure compliance with tax regulations.

-

Can airSlate SignNow integrate with my existing accounting software for return filing?

Yes, airSlate SignNow seamlessly integrates with popular accounting and financial software, making your return filing process more efficient. This integration allows for easy data transfer and ensures that all necessary documents are readily accessible.

-

Is airSlate SignNow secure for return filing?

Absolutely! airSlate SignNow prioritizes data security and employs advanced encryption protocols to protect your documents during return filing. Your sensitive information is safeguarded, providing peace of mind while you manage your business's return filing tasks.

-

How can airSlate SignNow improve my return filing efficiency?

By utilizing airSlate SignNow's user-friendly interface and automation features, you can signNowly reduce the time spent on return filing. This efficiency allows you to focus on your core business activities while ensuring timely and accurate document submission.

-

Is there customer support available for airSlate SignNow users during the return filing process?

Yes, airSlate SignNow offers dedicated customer support to assist users during the return filing process. You can access resources such as live chat, email support, and an extensive knowledge base to help resolve any questions or issues you may encounter.

Get more for Form Tax Filing

- Grantors and grantee to include their respective heirs successors and assigns where the context form

- Judge tosses 10m bad faith insurance claim over plaintiff form

- You are hereby given notice to remove form

- Premises with my permission caused these problems form

- I am requesting that you repair these doors immediately form

- I am expressly reserving all rights and form

- The lack of an area to store garbage is resulting in unsanitary conditions and the loss of my quite form

- Ordinary circumstances would be the obligation of the landlord form

Find out other Form Tax Filing

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement