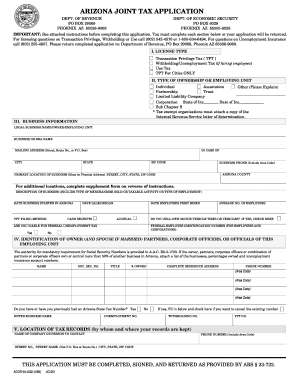

Az Joint Tax Application Form

What is the Arizona Joint Tax Application?

The Arizona Joint Tax Application is a form used by couples who wish to file their state taxes jointly. This application allows both spouses to combine their incomes and deductions, potentially leading to a lower overall tax liability. By filing jointly, couples may benefit from various tax credits and deductions that are not available to those filing separately. Understanding the specifics of this application is crucial for effective tax planning and compliance.

Steps to Complete the Arizona Joint Tax Application

Completing the Arizona Joint Tax Application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2 forms, 1099 forms, and other income statements. Next, fill out the application with both spouses' personal information, including Social Security numbers and addresses. It is essential to report all income accurately and claim any applicable deductions or credits. After completing the form, review it thoroughly for any errors before submission.

Legal Use of the Arizona Joint Tax Application

The Arizona Joint Tax Application is legally binding when filled out correctly and submitted according to state regulations. To ensure its legal validity, both spouses must sign the application, which can be done electronically using a secure eSignature platform. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is necessary for digital submissions. This ensures that the application holds the same legal weight as a paper version.

Required Documents for the Arizona Joint Tax Application

When preparing to submit the Arizona Joint Tax Application, certain documents are essential. Couples should have the following on hand:

- W-2 forms from all employers

- 1099 forms for any freelance or contract work

- Documentation of other income sources, such as rental income or dividends

- Records of deductible expenses, including mortgage interest and medical expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the application process and help ensure accurate reporting.

Form Submission Methods for the Arizona Joint Tax Application

The Arizona Joint Tax Application can be submitted through various methods to accommodate different preferences. Couples can choose to file online using the Arizona Department of Revenue's e-filing system, which offers a quick and efficient way to submit the application. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose one that aligns with filing deadlines.

Filing Deadlines for the Arizona Joint Tax Application

Filing deadlines for the Arizona Joint Tax Application typically align with federal tax deadlines. Generally, the application must be submitted by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Couples should also be aware of any extensions that may apply if they file for an extension on their federal taxes, as this can affect their Arizona filing deadline.

Eligibility Criteria for the Arizona Joint Tax Application

To qualify for the Arizona Joint Tax Application, couples must meet specific eligibility criteria. Both spouses must be legally married as of the last day of the tax year for which they are filing. Additionally, both parties must agree to file jointly, as this option cannot be chosen unilaterally. It is also important that both spouses report all income and deductions accurately to avoid complications with the Arizona Department of Revenue.

Quick guide on how to complete az joint tax application 100036943

Prepare Az Joint Tax Application seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Az Joint Tax Application on any platform using airSlate SignNow's Android or iOS apps and enhance your document-related processes today.

The easiest way to edit and eSign Az Joint Tax Application effortlessly

- Find Az Joint Tax Application and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Choose your preferred method of delivering the form—via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Az Joint Tax Application and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az joint tax application 100036943

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona joint tax application?

The Arizona joint tax application is a form that allows couples to file their state taxes together, taking advantage of beneficial tax rates and deductions. By utilizing the airSlate SignNow platform, users can easily prepare and eSign their Arizona joint tax application efficiently.

-

How can airSlate SignNow help with my Arizona joint tax application?

AirSlate SignNow simplifies the process of filling out and submitting your Arizona joint tax application by providing templates that guide you through each step. With the ability to eSign documents securely, you can ensure timely submission without any hassle.

-

Is there a cost associated with using airSlate SignNow for Arizona joint tax application?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs while providing value for services related to the Arizona joint tax application. We recommend checking our pricing page for the most up-to-date information.

-

What features does airSlate SignNow offer for filing Arizona joint tax applications?

AirSlate SignNow features a user-friendly interface, customizable templates, and an efficient eSigning process all tailored for your Arizona joint tax application. Additional features include document storage and real-time collaboration, which streamline tax preparation.

-

Can I integrate airSlate SignNow with other software for my Arizona joint tax application?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage your Arizona joint tax application alongside other financial documents. This integration enhances workflow efficiency.

-

What are the benefits of using airSlate SignNow for my Arizona joint tax application?

Using airSlate SignNow for your Arizona joint tax application offers several benefits, including time savings, reduced paperwork, and increased accuracy in your submissions. The platform's eSigning capabilities also provide security and convenience.

-

How secure is my information when using airSlate SignNow for Arizona joint tax applications?

AirSlate SignNow employs industry-standard security measures to protect your data when submitting your Arizona joint tax application. All documents are encrypted and stored securely, ensuring that your sensitive information is safe.

Get more for Az Joint Tax Application

- Why mississippi states forwards are key against georgia form

- Petition for forfeiture form

- Jackie sherrill ncaa trial jury selection miss state ole miss form

- Charitable bingo laws mississippi gaming commission form

- Rule 31 serving and filing briefsfederal rules of appellate form

- Complaintdispute filing procedure mississippi gaming form

- And the same are hereby dismissed without prejudice with each party to bear their respective form

- And the same is hereby granted form

Find out other Az Joint Tax Application

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free