Credit Union Application Form

What is the Credit Union Application Form

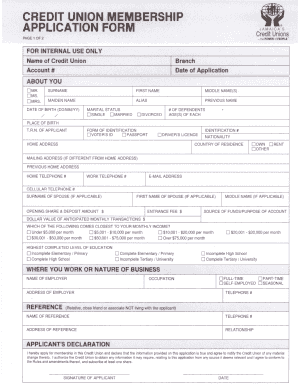

The credit union application form is a crucial document that individuals must complete to become a member of a credit union. This form collects essential information about the applicant, including personal details, financial history, and employment information. By filling out this form, individuals express their intent to join the credit union and access its services, such as loans, savings accounts, and other financial products.

Steps to Complete the Credit Union Application Form

Completing the credit union application form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, such as identification and proof of income. Next, fill out the form with your personal information, including your full name, address, social security number, and employment details. Be sure to review the form for any errors before submission. Finally, submit the application either online, by mail, or in person, depending on the credit union's requirements.

Legal Use of the Credit Union Application Form

The legal use of the credit union application form is essential for establishing a binding agreement between the applicant and the credit union. The form must comply with various regulations, such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and submissions are legally recognized, provided that the process meets specific criteria for authenticity and security.

Required Documents

When completing the credit union application form, applicants typically need to provide several supporting documents. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport

- Proof of address, like a utility bill or lease agreement

- Social security number or taxpayer identification number

- Proof of income, such as pay stubs or tax returns

Having these documents ready can facilitate a smoother application process.

Eligibility Criteria

Eligibility criteria for joining a credit union can vary based on the institution's membership requirements. Generally, applicants must meet specific conditions, such as:

- Being a resident of a particular geographic area

- Working for a specific employer or industry

- Belonging to a particular organization or association

Understanding these criteria is essential for ensuring that your application is accepted.

Form Submission Methods

There are various methods for submitting the credit union application form, each offering different levels of convenience. Common submission methods include:

- Online: Many credit unions provide an online portal for easy submission.

- Mail: Applicants can print the form and send it via postal service.

- In-person: Submitting the form directly at a credit union branch allows for immediate assistance.

Choosing the right method can enhance the application experience.

Quick guide on how to complete credit union application form

Easily Prepare Credit Union Application Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle Credit Union Application Form on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Effortlessly Modify and eSign Credit Union Application Form

- Find Credit Union Application Form and click on Get Form to initiate the process.

- Use the tools we present to fill out your document.

- Emphasize important sections of the documents or redact private information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Credit Union Application Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit union application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st bess credit union's pricing structure for loans and services?

st bess credit union offers competitive pricing for its loan products and membership services. They provide various loan options with attractive interest rates, enabling members to choose according to their financial needs. Additionally, st bess credit union ensures transparency in fees, making it easy for members to understand their commitments.

-

What features does st bess credit union offer for its members?

Members of st bess credit union can benefit from various features, including online banking, mobile apps, and eStatements. These tools provide easy access to accounts and facilitate seamless financial management. Additionally, st bess credit union offers personalized financial advice to enhance member services.

-

What are the benefits of joining st bess credit union?

Joining st bess credit union provides members with access to lower loan rates, higher savings yields, and personalized customer service. As a member-owned institution, st bess credit union prioritizes members’ financial success and community involvement. Moreover, joining offers a sense of belonging and shared financial goals.

-

How does st bess credit union integrate with other financial tools?

st bess credit union seamlessly integrates with popular accounting and financial management software to enhance user experience. This integration allows members to efficiently manage their finances without the hassle of switching between platforms. By using these integrated tools, customers can track spending and budgets more effectively.

-

Can I open an account online with st bess credit union?

Yes, st bess credit union provides the convenience of opening accounts online. The online application process is straightforward and user-friendly, ensuring that potential members can quickly join and start enjoying benefits. All necessary documentation can be submitted digitally, allowing for a secure and efficient onboarding experience.

-

What types of loans does st bess credit union offer?

st bess credit union offers a variety of loan types, including personal loans, auto loans, and home equity loans. Each loan product is designed to cater to different financial needs and goals. By providing flexible repayment options, st bess credit union ensures members find suitable loan solutions.

-

Is there a mobile app for st bess credit union?

Yes, st bess credit union has a user-friendly mobile app available for both iOS and Android devices. This app allows members to manage their accounts, pay bills, and transfer funds at their convenience. The mobile app enhances accessibility, making banking with st bess credit union easier than ever.

Get more for Credit Union Application Form

Find out other Credit Union Application Form

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free