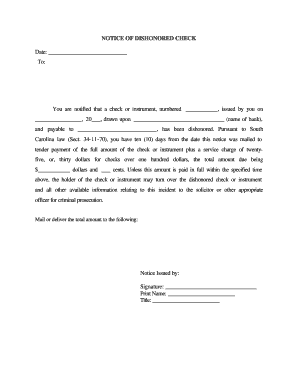

Bounced Check Letter Form

What is the bounced check letter?

A bounced check letter is a formal notification sent to a check issuer when a check they wrote cannot be processed due to insufficient funds in their account. This letter serves as a record of the transaction and informs the issuer of the returned check, often including details such as the check number, amount, and the reason for the bounce. It is important for both the recipient and the issuer to understand the implications of a bounced check, as it can affect banking relationships and credit ratings.

Key elements of the bounced check letter

When drafting a bounced check letter, several key elements should be included to ensure clarity and legal compliance:

- Sender's Information: Include your name, address, and contact information at the top of the letter.

- Date: The date on which the letter is written should be clearly stated.

- Recipient's Information: The name and address of the check issuer must be included.

- Check Details: Specify the check number, amount, and date it was issued.

- Reason for Bouncing: Clearly state why the check was returned, such as "insufficient funds."

- Request for Payment: Politely request that the issuer rectify the situation by providing payment for the bounced check.

- Consequences: Mention any potential fees or legal actions that may result from non-payment.

Steps to complete the bounced check letter

Completing a bounced check letter involves a series of straightforward steps:

- Gather all relevant information, including the check details and the recipient's contact information.

- Draft the letter, ensuring to include all key elements mentioned above.

- Review the letter for accuracy and clarity, making sure there are no errors.

- Sign the letter to authenticate it.

- Send the letter via a reliable method, such as certified mail, to ensure it is received.

Legal use of the bounced check letter

The bounced check letter can serve as an important legal document in the event of disputes. It acts as a formal record of the transaction and the issuer's failure to meet their financial obligation. In many jurisdictions, sending a bounced check letter is a necessary step before pursuing legal action for recovery of funds. It is advisable to retain a copy of the letter and any related correspondence for your records.

Examples of using the bounced check letter

Here are a few scenarios where a bounced check letter may be used:

- A landlord may send a bounced check letter to a tenant who has failed to pay rent via check.

- A business may issue a bounced check letter to a client who provided a check for services rendered but did not have sufficient funds.

- A service provider may use a bounced check letter to inform a customer of a returned payment for services.

State-specific rules for the bounced check letter

Each state may have specific regulations regarding bounced checks and the corresponding letters. It is important to be aware of these rules, as they can affect the content and delivery of the letter. Some states may require specific language or additional information to be included in the letter. Checking local laws can help ensure compliance and protect your rights when dealing with bounced checks.

Quick guide on how to complete bounced check letter

Effectively manage Bounced Check Letter on any device

Digital document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Manage Bounced Check Letter on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The simplest way to alter and electronically sign Bounced Check Letter with ease

- Locate Bounced Check Letter and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Bounced Check Letter to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bounced check letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a returned check notice?

A returned check notice is a formal notification issued to inform a customer that their check could not be processed due to insufficient funds or other reasons. Understanding this notice is essential for businesses that handle transactions frequently, as it can impact cash flow and customer relationships.

-

How can airSlate SignNow help with sending returned check notices?

airSlate SignNow provides a streamlined process for creating and sending returned check notices electronically. This allows businesses to quickly notify customers while keeping a secure record of correspondence, ensuring compliance and clear communication.

-

What features does airSlate SignNow offer for managing returned check notices?

With airSlate SignNow, users have access to customizable templates for returned check notices, automated reminders, and secure document storage. These features save time and reduce errors, making it easier for businesses to manage their communications effectively.

-

Is there a cost associated with using airSlate SignNow for returned check notices?

Yes, airSlate SignNow offers various pricing tiers depending on the features needed, including those for managing returned check notices. Evaluating these options can help businesses choose the right plan that fits their needs and budget.

-

Can I integrate airSlate SignNow with other applications for handling returned check notices?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the process of managing returned check notices. This integration allows businesses to connect their accounting systems or CRMs, ensuring a cohesive workflow.

-

What benefits does eSigning a returned check notice provide?

eSigning a returned check notice ensures that the document is legally binding and provides a clear record of acceptance. This not only speeds up the communication process but also enhances accountability and transparency between the business and its customers.

-

How does airSlate SignNow ensure the security of returned check notices?

airSlate SignNow employs robust security measures, including encryption and secure storage, to protect returned check notices and sensitive information. This allows businesses to communicate effectively without compromising data integrity.

Get more for Bounced Check Letter

- Letters of recommendation package california form

- California mechanics lien form

- Ca assist form

- Storage business package california form

- Child care services package california form

- Special or limited power of attorney for real estate sales transaction by seller california form

- Special or limited power of attorney for real estate purchase transaction by purchaser california form

- Limited power of attorney where you specify powers with sample powers included california form

Find out other Bounced Check Letter

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament