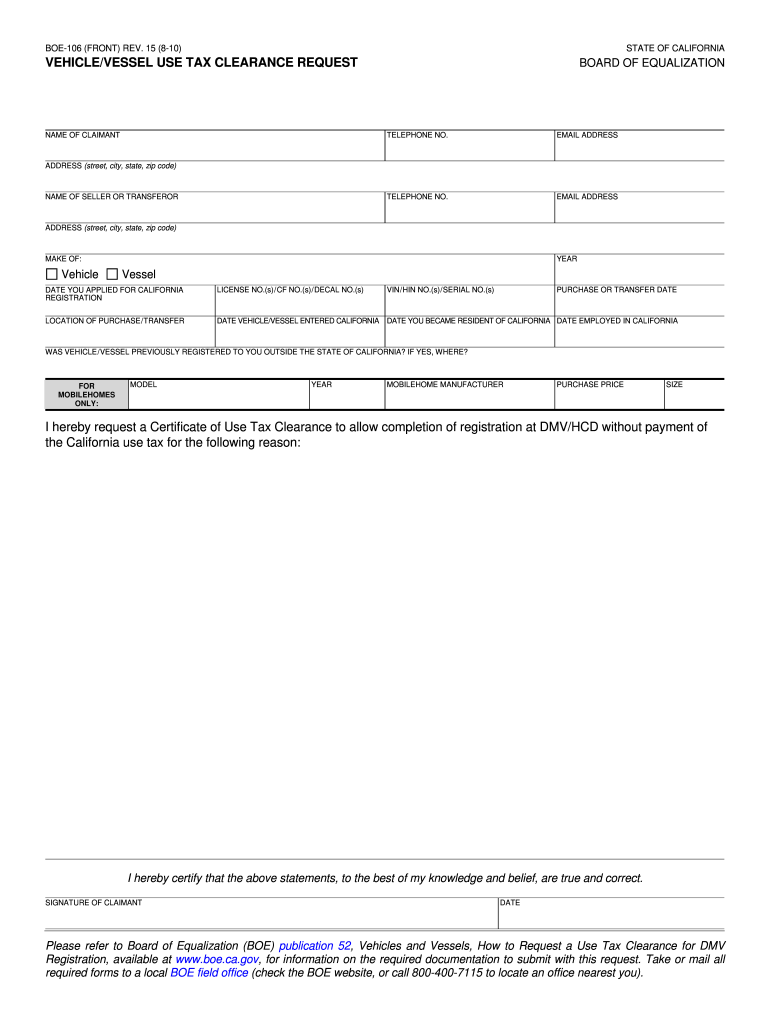

Boe 111 Form

What is the CDTFA 111 Form?

The CDTFA 111 form, also known as the California Department of Tax and Fee Administration Form 111, is a crucial document used for reporting and paying use tax in California. This form is specifically designed for individuals and businesses that have purchased tangible personal property for use in California without paying the appropriate sales tax at the time of purchase. The CDTFA 111 form helps ensure compliance with state tax laws and allows taxpayers to remit the use tax owed to the state.

How to Use the CDTFA 111 Form

Using the CDTFA 111 form involves several steps to accurately report and pay the use tax. First, gather all relevant purchase information, including the date of purchase, description of the items, purchase price, and the seller's details. Next, fill out the form by entering the required information in the designated fields. Ensure that all calculations are accurate to avoid discrepancies. Once completed, the form can be submitted either online or via mail, depending on your preference.

Steps to Complete the CDTFA 111 Form

Completing the CDTFA 111 form requires careful attention to detail. Follow these steps:

- Download the CDTFA 111 form from the official CDTFA website or access it through a digital platform.

- Fill in your personal information, including your name, address, and contact details.

- Provide details about the purchases made, including item descriptions, purchase prices, and dates of purchase.

- Calculate the total use tax owed based on the purchase price and applicable tax rate.

- Review the form for accuracy before submitting it.

Legal Use of the CDTFA 111 Form

The CDTFA 111 form is legally binding when completed accurately and submitted in compliance with California tax laws. It serves as a formal declaration of use tax liability and must be filed by the due date to avoid penalties. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all necessary requirements for electronic documentation.

Form Submission Methods

The CDTFA 111 form can be submitted through various methods to accommodate taxpayer preferences:

- Online Submission: Taxpayers can complete and submit the form electronically through the CDTFA's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate CDTFA address.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at a local CDTFA office.

Required Documents

When completing the CDTFA 111 form, it is essential to have certain documents on hand to ensure accurate reporting. These may include:

- Receipts or invoices for the purchases made.

- Any previous correspondence with the CDTFA regarding use tax.

- Records of sales tax paid on other purchases, if applicable.

Quick guide on how to complete ca 111form

Complete Boe 111 effortlessly on any device

Virtual document management has gained prominence among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Boe 111 using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Boe 111 with ease

- Find Boe 111 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Boe 111 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What are the fastest ways to make money online?

Blogging is the fastest way through which you can make thousands of dollars per month without any investment.I am sharing many ways in Quora to make money without any investment.BloggingBlogging is the best way to make money. You can write much about your hobbies, about your personal interest and many more like that. Your content and images should be attractive for getting visitors to your blog. You can create free blogs from Google’s Blogger or WordPress.How to make money through blogging?You can make thousands of dollar from your blog. You just need to display some ads on your blog. You will earn money on each natural click on ads.How to get ads?For getting ads you need to signup as publisher at StudAds.com.Verify your account by providing them with your ID proof and confirm your mail by single click on the confirmation link from your mailbox.Once you create an account, login to your account. Then, from left menu click on “Ad Code Wizard,” to generate the ads code.Make sure to leave the field “Filler Contents URL” to empty, copy the HTML code that was generated and paste it in any space on your blog where ever you want to show ads. The ads will start appearing instantly.Can I show ads on more than one site?Yes, you can show ads on any number of websites or blogs. And you do not need to create a separate ad units for each website or blog.You can use the very same ad units you create at any number of websites and/or blogs. You are also free to create different ad units and different channels.How are payments made?Payments are sent via Bank wire Transfer on a monthly basis, within 30 days after the end of each calendar month.When do I get paid?Marketing And Advertising NetWork will issue payment 30 days after the end of each month that your earning balance is US $10 or more. If your account's balance is not $10 at the end of a month, the balance will be carried over into the next month and paid out once you have earned $10 or more.Thank You and Best Of Luck !

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the CA CPT form offline?

To apply for CA CPT offline you need to grow through the following procedure:Download CPT Registration Form from the pdf link above.CPT registration fee is to be paid in the form of Demand Draft drawn in favor of “The Secretary, The Institute of Chartered Accountants of India, payable at concerned Regional Office i.e. Mumbai, Chennai, Kolkata, Kanpur or New Delhi”. If Registration Form is downloaded from the Institute’s website, add Rs. 100/- or US $10 along with Common Proficiency Course (CPC) Registration fee for supply of a copy of the Prospectus along with the study package. For fees related details you check this excellent article CA CPT Registration fees.You should fill following details Name in full (As per SSC X certificates)Sex Date of Birth Mother’s Name and Father’s Name Address Category: General, ST / SC, OBC, Backward Class or Disabled Nationality: Indian or Foreign National Medium of study: English or Hindi Educational Qualifications Details: 10th and 12th Annual income of Parents Demand draft details Affix recent passport size photoPrint out your registration form, attached the documents required and send it to ICAI. Check here for CA CPT Registration required document.For full details on CA CPT registration form offline check here: CA CPT registraiton form offline

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

Create this form in 5 minutes!

How to create an eSignature for the ca 111form

How to make an eSignature for the Ca 111form in the online mode

How to make an eSignature for your Ca 111form in Chrome

How to make an electronic signature for putting it on the Ca 111form in Gmail

How to generate an eSignature for the Ca 111form straight from your smartphone

How to create an eSignature for the Ca 111form on iOS

How to generate an electronic signature for the Ca 111form on Android

People also ask

-

What is Boe 111 and how does it relate to airSlate SignNow?

Boe 111 refers to a specific document management requirement that many businesses need to comply with. airSlate SignNow provides a streamlined solution for creating, signing, and managing documents, including those that fall under Boe 111 regulations. With our platform, you can ensure that all your documents meet compliance standards efficiently.

-

How does airSlate SignNow help with Boe 111 compliance?

airSlate SignNow simplifies the process of achieving Boe 111 compliance by offering features such as secure electronic signatures and customizable templates. These tools enable businesses to create compliant documents quickly while maintaining a high level of security. Plus, our audit trail feature ensures that you have a clear record of all document interactions.

-

What are the pricing options for airSlate SignNow if I need to handle Boe 111 documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes handling Boe 111 documents. Our plans are designed to be cost-effective, ensuring you can access essential features without overspending. Check out our website for detailed pricing and find the perfect option for your needs.

-

Can airSlate SignNow integrate with other tools for managing Boe 111 documents?

Yes, airSlate SignNow seamlessly integrates with various tools and applications, allowing you to manage Boe 111 documents more effectively. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect and streamline your document workflows. This integration capability enhances productivity and simplifies compliance.

-

What features of airSlate SignNow are beneficial for Boe 111 document management?

Key features of airSlate SignNow that support Boe 111 document management include eSigning, document templates, and real-time collaboration. These tools allow you to create, edit, and sign documents efficiently while ensuring compliance with Boe 111 standards. Additionally, our user-friendly interface makes it easy for your team to adopt these features quickly.

-

Is airSlate SignNow secure for handling sensitive Boe 111 documents?

Absolutely, airSlate SignNow prioritizes security when it comes to handling sensitive Boe 111 documents. Our platform employs advanced encryption and secure access controls to protect your data throughout the signing process. You can trust that your documents are safe with us, ensuring compliance and confidentiality.

-

How can airSlate SignNow enhance my business's workflow for Boe 111 documents?

By using airSlate SignNow, businesses can signNowly enhance their workflow for Boe 111 documents through automation and streamlined processes. Our platform reduces the time spent on manual tasks, allowing your team to focus on more strategic initiatives. This efficiency leads to quicker turnaround times and improved overall productivity.

Get more for Boe 111

Find out other Boe 111

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document