Afgis Home Loan Documents Form

Understanding the ngif Home Loan Documents

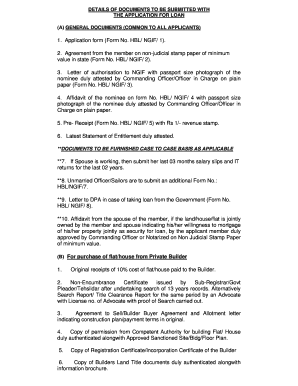

The ngif home loan documents are essential for anyone looking to secure a loan through the National Guard. These documents typically include the loan application, income verification forms, and any additional paperwork required by the lending institution. Each document serves a specific purpose, ensuring that all necessary information is collected to assess the borrower's eligibility and financial situation. It is crucial to understand each document's role in the loan process to facilitate a smooth application experience.

Steps to Complete the ngif Home Loan Documents

Completing the ngif home loan documents involves several key steps. First, gather all required personal and financial information, such as income statements, tax returns, and identification. Next, carefully fill out the loan application, ensuring that all fields are completed accurately. After completing the application, review all documents for any errors or missing information. It may be beneficial to have a trusted advisor or financial expert review the documents before submission to ensure everything is in order.

How to Obtain the ngif Home Loan Documents

To obtain the ngif home loan documents, interested individuals can visit the official ngif website or contact their local National Guard office. These resources provide access to the necessary forms and any additional information required for the application process. It is essential to ensure that the most current versions of the documents are used, as outdated forms may lead to delays or complications in the loan approval process.

Legal Use of the ngif Home Loan Documents

The ngif home loan documents must be completed and submitted in compliance with applicable laws and regulations. Electronic signatures are generally accepted, provided they meet the criteria set forth by the ESIGN Act and UETA. It is important to ensure that all signatures are obtained from the necessary parties and that the documents are stored securely to protect sensitive information. Legal compliance helps to validate the documents, making them enforceable in a court of law if necessary.

Required Documents for the ngif Home Loan

When applying for the ngif home loan, several documents are typically required. These may include:

- Completed loan application form

- Proof of income (pay stubs, tax returns)

- Credit report

- Identification (driver's license, Social Security card)

- Property information (if applicable)

Gathering these documents in advance can streamline the application process and help avoid delays.

Eligibility Criteria for the ngif Home Loan

Eligibility for the ngif home loan typically depends on several factors, including military service status, credit score, and income level. Applicants must generally be members of the National Guard or their dependents. Lenders may also consider debt-to-income ratios and employment history when assessing eligibility. Understanding these criteria can help applicants prepare their documentation and improve their chances of approval.

Quick guide on how to complete afgis home loan interest rate

Complete afgis home loan interest rate effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and ink-signed papers, allowing you to locate the correct form and safely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly, without any holdups. Handle ngif home loan on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign afgis official website with ease

- Locate afgis home loan and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign afgis home loan pdf and ensure superior communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to afgis loan

Create this form in 5 minutes!

How to create an eSignature for the afgis email address

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask afgis hbl loan application form

-

What is an ngif home loan?

An ngif home loan is a specialized mortgage designed to help individuals purchase their homes with competitive interest rates and favorable terms. It often includes unique features tailored to suit various buyer needs, making it a popular choice for first-time homeowners. Understanding the ngif home loan can help you make informed decisions about your financing options.

-

What are the advantages of applying for an ngif home loan?

The ngif home loan offers several advantages, including lower down payments and flexible credit requirements. Additionally, it can provide access to various loan programs that cater to different income levels and financial situations. These benefits make the ngif home loan an attractive option for prospective homeowners.

-

How do I qualify for an ngif home loan?

To qualify for an ngif home loan, you typically need to meet certain income and credit requirements, which can vary by lender. It's essential to provide documentation, such as proof of income and credit history, to demonstrate your financial stability. Consulting with a mortgage advisor can help you understand the specific qualifications for the ngif home loan.

-

What is the typical interest rate for an ngif home loan?

Interest rates for ngif home loans can vary widely based on factors like credit score, loan term, and market conditions. Generally, it's advisable to shop around to find competitive rates and the best terms. Regularly monitoring market trends can help you secure a favorable interest rate for your ngif home loan.

-

Are there any hidden fees associated with an ngif home loan?

When applying for an ngif home loan, it's important to inquire about all potential fees, including origination and closing costs. While some lenders may advertise low rates, undisclosed fees can affect the overall cost of the loan. Always read the fine print and ask your lender for a detailed breakdown of all charges associated with the ngif home loan.

-

Can I refinance my ngif home loan?

Yes, refinancing your ngif home loan is a possibility if you want to take advantage of lower interest rates or change your loan terms. It can help you reduce monthly payments or access equity for other financial needs. Be sure to compare lenders and their refinancing options to find the best deal for your ngif home loan.

-

What features should I look for in an ngif home loan?

Key features to consider in an ngif home loan include flexible repayment terms, options for fixed or adjustable rates, and the possibility of additional funds for renovations or improvements. Additionally, features like portability can allow you to transfer your loan to a new home without penalty. Evaluating these aspects can help you choose the right ngif home loan for your situation.

Get more for afgis hbl application pdf format

- Enduring power of attorney qld form 9

- First piece approval format

- Sinp ef 002 publicationsgovskca form

- Living trust missouri form

- Clarion county 911 address form

- Cat adoption application template 40818401 form

- Certificate of occupancy application amp checklist logan township logan twp form

- A housing authority attn admissions 712 north 16 th street philadelphia pa 19130 form

Find out other afgis hbl loan

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation