Quick Chek W2 Form

What is the Quick Chek W2

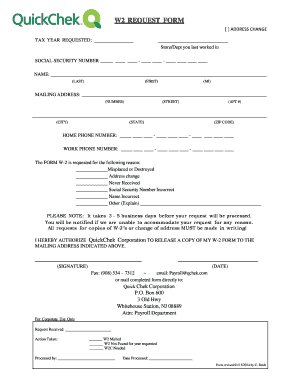

The Quick Chek W2 form is a tax document issued by employers to report an employee's annual wages and the amount of taxes withheld from their paychecks. This form is essential for employees when filing their income tax returns, as it provides crucial information regarding their earnings and tax contributions throughout the year. The Quick Chek W2 includes details such as the employee's Social Security number, employer identification number, and the total income earned during the tax year.

How to use the Quick Chek W2

Using the Quick Chek W2 form involves a few straightforward steps. First, employees should ensure they receive their W2 from their employer by the end of January each year. Once received, employees need to review the information for accuracy, including their name, Social Security number, and reported wages. After confirming the details, employees can use the Quick Chek W2 to complete their federal and state tax returns. This form can be submitted electronically or printed out for mailing, depending on the chosen filing method.

Steps to complete the Quick Chek W2

Completing the Quick Chek W2 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number and any previous tax documents.

- Review the W2 form for accuracy, ensuring all entries are correct and match your records.

- Fill out your tax return using the information provided on the W2, including wages and taxes withheld.

- Submit your tax return electronically or by mail, including a copy of your W2 if required.

Legal use of the Quick Chek W2

The Quick Chek W2 form is legally binding and must be used in compliance with IRS regulations. Employers are required to issue this form to their employees by specific deadlines to ensure that employees can accurately report their income. Additionally, employees must use the information on the W2 to file their taxes correctly. Failure to comply with these regulations can result in penalties for both employers and employees, making it crucial to handle this form with care.

Key elements of the Quick Chek W2

Several key elements are essential to the Quick Chek W2 form. These include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Wages and Tax Withheld: Total wages earned, federal income tax withheld, Social Security wages, and Medicare wages.

- State Information: State wages and state tax withheld, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the Quick Chek W2 form, including deadlines for employers to issue the form and requirements for employees to report their earnings. Employers must ensure that W2 forms are distributed to employees by January 31st of each year. Employees should retain their W2 forms for their records and use them to complete their tax returns accurately. Adhering to these guidelines helps prevent issues with tax filings and ensures compliance with federal tax laws.

Quick guide on how to complete quick chek w2

Effortlessly Prepare Quick Chek W2 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Quick Chek W2 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Edit and Electronically Sign Quick Chek W2 with Ease

- Find Quick Chek W2 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Quick Chek W2 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quick chek w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is quickchek w2 and how does it work?

Quickchek W2 is a service that allows users to manage and send W-2 forms electronically. Utilizing airSlate SignNow, businesses can seamlessly eSign and distribute W-2 documents, ensuring accuracy and compliance. This solution simplifies the process, making it quicker for both employers and employees.

-

How much does the quickchek w2 service cost?

The pricing for quickchek w2 services through airSlate SignNow is competitive and varies depending on the number of users and features needed. By offering a flexible pricing structure, businesses can choose a plan that suits their specific needs. Overall, it is a cost-effective solution for managing W-2 forms.

-

What features does airSlate SignNow offer for quickchek w2?

AirSlate SignNow offers robust features for quickchek w2, including templates for W-2 forms, templates for signatures, and secure storage. Additionally, real-time tracking and notifications ensure that you can monitor the status of your documents. These features streamline the process, making it efficient and user-friendly.

-

How can quickchek w2 benefit my business?

Using quickchek w2 can signNowly improve your business’s efficiency by reducing the time spent on paperwork. It ensures secure eSigning of W-2 forms, reducing the risk of errors and enhancing compliance. Overall, this service supports a better experience for both employers and employees alike.

-

Is quickchek w2 easy to integrate with other software?

Yes, quickchek w2 integrates smoothly with various HR and payroll software, making document management more streamlined. AirSlate SignNow provides API access to facilitate easy integration. This capability helps businesses retain their established workflows while enhancing document handling efficiency.

-

Can employees access their quickchek w2 forms online?

Absolutely! Employees can easily access their quickchek w2 forms online through the airSlate SignNow platform. This allows them to view, eSign, and download their W-2 forms at their convenience, ensuring they have what they need when they need it.

-

What security measures are in place for quickchek w2?

AirSlate SignNow prioritizes security and implements industry-leading protocols for quickchek w2 services. This includes encryption of documents during transmission and storage, along with secure user authentication. These measures protect sensitive data, ensuring compliance with regulations.

Get more for Quick Chek W2

- Amount corporation michigan form

- Michigan demand form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property michigan form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497311453 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property michigan form

- Michigan notice intent form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property michigan form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497311457 form

Find out other Quick Chek W2

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors