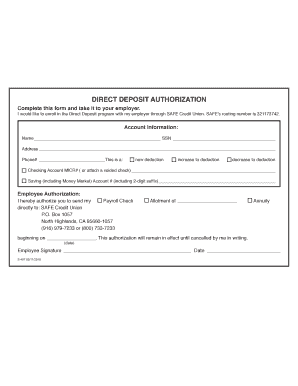

Safe Credit Union Direct Deposit Form

What is the Safe Credit Union Direct Deposit?

The safe credit union direct deposit is a secure method for transferring funds directly into a member's bank account. This process eliminates the need for paper checks and provides a reliable way to receive payments such as salaries, government benefits, and other forms of income. By using this system, members can access their funds quickly and efficiently, often on the same day they are deposited.

Steps to Complete the Safe Credit Union Direct Deposit

Completing the safe credit union direct deposit authorization form involves several key steps:

- Obtain the safe credit union direct deposit authorization form from your credit union's website or branch.

- Fill in your personal information, including your name, address, and account details.

- Provide the details of your employer or the entity sending the payments, including their name and address.

- Sign the form to authorize the direct deposit.

- Submit the completed form to your credit union or the payroll department of your employer.

Legal Use of the Safe Credit Union Direct Deposit

The safe credit union direct deposit is legally recognized as a valid method for transferring funds, provided it adheres to regulations set by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are legally binding, offering protection to both the depositor and the receiving institution.

Key Elements of the Safe Credit Union Direct Deposit

When filling out the safe credit union direct deposit authorization form, several key elements must be included:

- Account Information: Your bank account number and routing number are essential for accurate fund transfers.

- Authorization Signature: Your signature confirms that you permit the direct deposit of funds into your account.

- Employer Information: Details about the entity making the deposits are necessary for processing.

Form Submission Methods

Once the safe credit union direct deposit authorization form is completed, it can be submitted in various ways:

- Online: Many credit unions allow members to submit forms electronically through their secure portals.

- Mail: You can send the completed form via postal service to your credit union or employer.

- In-Person: Submitting the form directly at your credit union branch is also an option for those who prefer face-to-face interaction.

How to Obtain the Safe Credit Union Direct Deposit

To obtain the safe credit union direct deposit authorization form, visit your credit union's official website or contact their customer service. Most credit unions provide downloadable forms that can be filled out electronically or printed for manual completion. Additionally, forms are often available at local branches for members who prefer to pick them up in person.

Quick guide on how to complete safe credit union direct deposit

Complete Safe Credit Union Direct Deposit effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Safe Credit Union Direct Deposit on any device using airSlate SignNow apps for Android or iOS and streamline any document-focused process today.

The easiest way to modify and eSign Safe Credit Union Direct Deposit effortlessly

- Obtain Safe Credit Union Direct Deposit and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, either via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Safe Credit Union Direct Deposit and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the safe credit union direct deposit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a safe credit union direct deposit authorization form?

A safe credit union direct deposit authorization form is a document that allows your employer or any other payer to deposit funds directly into your credit union account. This form ensures that your sensitive banking information is securely handled and authorized. Using this form streamlines the payment process, making it easier and faster for you to receive your funds.

-

How can I obtain a safe credit union direct deposit authorization form?

You can easily obtain a safe credit union direct deposit authorization form from your credit union's website or by contacting their customer service. Many credit unions also provide digital solutions where you can fill out and submit the form online. Ensure to fill it out correctly to avoid any delays in your direct deposits.

-

What are the benefits of using a safe credit union direct deposit authorization form?

Using a safe credit union direct deposit authorization form offers several benefits, including timely access to funds, reduced risk of lost or stolen checks, and convenience of not needing to visit a bank. Moreover, it helps maintain secure financial transactions. This form simplifies the process for both employees and employers, ensuring hassle-free payments.

-

Can I use the safe credit union direct deposit authorization form for multiple accounts?

Yes, you can use the safe credit union direct deposit authorization form for multiple accounts. However, you will need to ensure that each account is correctly identified in the form. It’s advisable to check with your employer or the organization using the form to confirm they accommodate multiple account setups.

-

Is the safe credit union direct deposit authorization form secure?

Absolutely, the safe credit union direct deposit authorization form is designed to protect your financial information. Most credit unions implement strict security protocols to ensure that your data is safeguarded. Additionally, using electronic submission methods further enhances the security of your sensitive information.

-

What if I need to change my direct deposit information after submitting the safe credit union direct deposit authorization form?

If you need to change your direct deposit information after submitting the safe credit union direct deposit authorization form, simply fill out a new form with your updated information. It's important to notify your employer or payer immediately, as they may need your new form before the next deposit cycle to avoid any payment issues.

-

Are there any fees associated with using a safe credit union direct deposit authorization form?

Generally, there are no fees directly associated with using a safe credit union direct deposit authorization form. Credit unions typically provide this service as part of their banking offerings. However, it’s best to review the terms with your credit union to understand any potential charges related to ongoing account management.

Get more for Safe Credit Union Direct Deposit

Find out other Safe Credit Union Direct Deposit

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online