Unemployment Tax Form

What is the unemployment tax form?

The unemployment tax form is a crucial document used by employers to report and pay unemployment taxes to state and federal agencies. This form helps fund unemployment benefits for eligible workers who lose their jobs through no fault of their own. Employers are required to submit this form regularly, typically on a quarterly basis, to ensure compliance with state laws and regulations regarding unemployment insurance. The information provided on this form includes details about wages paid, the number of employees, and the taxes owed.

Steps to complete the unemployment tax form

Completing the unemployment tax form involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary information, including total wages paid, employee details, and any previous tax payments.

- Access the appropriate form, which may vary by state but generally follows a standard structure.

- Fill in the required fields accurately, ensuring all data is current and correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or through traditional mail.

How to obtain the unemployment tax form

Employers can obtain the unemployment tax form through various channels. Most state labor departments provide downloadable versions of the form on their official websites. Additionally, employers can request physical copies by contacting their state unemployment office directly. It is essential to ensure that the correct version of the form is used, as requirements may differ by state.

Legal use of the unemployment tax form

The unemployment tax form must be completed and submitted in accordance with federal and state laws. Legal use of this form ensures that employers fulfill their obligations regarding unemployment insurance. Failure to comply with regulations can result in penalties, including fines or increased tax rates. Employers should keep records of submitted forms and any correspondence with state agencies to maintain compliance.

Filing deadlines / important dates

Filing deadlines for the unemployment tax form vary by state but generally follow a quarterly schedule. Employers should be aware of specific due dates to avoid late fees. Common deadlines include:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

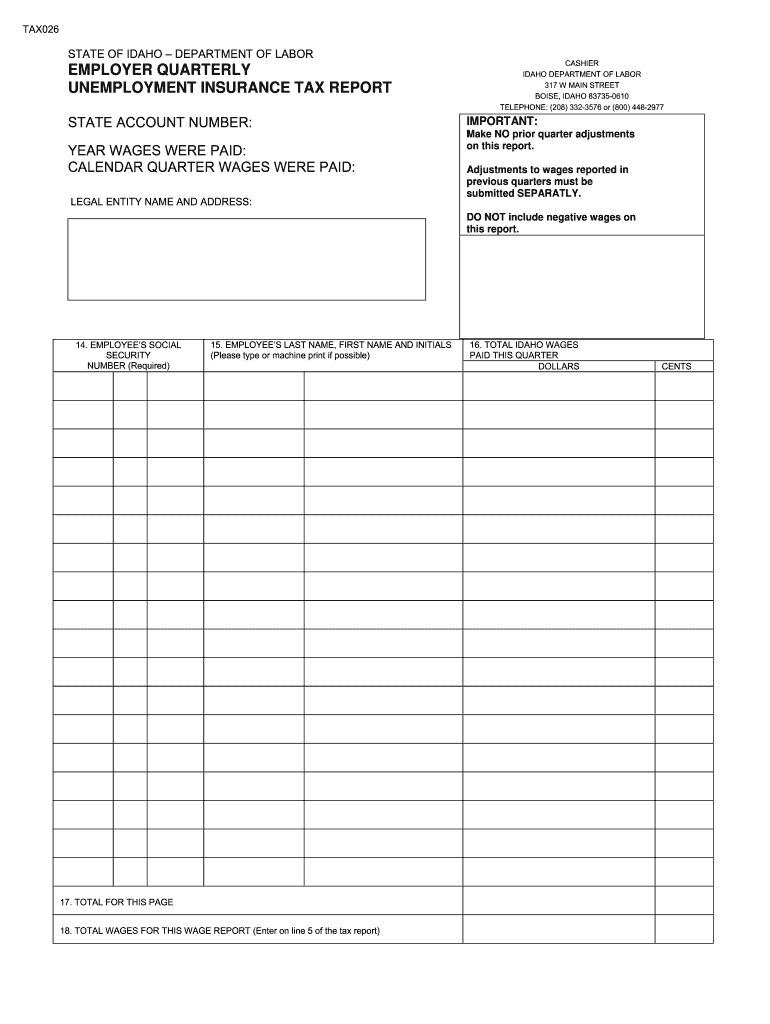

Key elements of the unemployment tax form

Understanding the key elements of the unemployment tax form is vital for accurate completion. Important sections typically include:

- Employer identification information, such as name and address

- Total wages paid during the reporting period

- Number of employees covered by unemployment insurance

- Calculation of taxes owed based on state-specific rates

Penalties for non-compliance

Employers who fail to submit the unemployment tax form on time or provide inaccurate information may face significant penalties. These can include:

- Monetary fines for late submissions

- Increased tax rates in subsequent periods

- Legal action from state unemployment agencies

Quick guide on how to complete unemployment tax form

Effortlessly Prepare Unemployment Tax Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any hiccups. Manage Unemployment Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Edit and eSign Unemployment Tax Form with Ease

- Access Unemployment Tax Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Unemployment Tax Form while ensuring effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unemployment tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an unemployment tax form and why do I need it?

An unemployment tax form is a document used by employers to report unemployment tax liabilities. It is essential for ensuring your business complies with state and federal regulations regarding unemployment insurance. Understanding how to properly complete and file this form can help you avoid penalties and ensure your employees receive the benefits they are entitled to.

-

Can airSlate SignNow help me with my unemployment tax form?

Yes, airSlate SignNow provides an easy-to-use platform for preparing, signing, and sharing your unemployment tax form. With our eSignature capabilities, you can streamline the process of getting necessary approvals from stakeholders or employees. Our platform ensures you have a legally binding document in a matter of minutes.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to different business sizes and needs. Our plans are designed to be cost-effective while providing comprehensive features for managing documents, including the unemployment tax form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing unemployment tax forms?

airSlate SignNow includes features such as document templates, eSigning, and automated workflows, making it easy to manage your unemployment tax form. With customizable templates, you can quickly generate the forms you need. Additionally, our platform allows you to track the status of each document in real-time.

-

Is airSlate SignNow secure for handling sensitive unemployment tax forms?

Absolutely! airSlate SignNow prioritizes security with features like encryption and multi-factor authentication. This ensures that your unemployment tax form and any sensitive information it contains are well-protected. Compliance with industry standards means you can trust our platform with your important documents.

-

Can I integrate airSlate SignNow with other software for handling my unemployment tax forms?

Yes, airSlate SignNow seamlessly integrates with various popular applications such as CRM and accounting software, making it easier to manage your unemployment tax forms. This integration streamlines workflows and reduces the time spent on administrative tasks. You can connect your existing tools to enhance efficiency.

-

What benefits does eSigning bring to managing unemployment tax forms?

eSigning through airSlate SignNow greatly reduces the time and hassle involved in managing unemployment tax forms. You can get needed signatures quickly, avoiding delays associated with traditional mailing or in-person meetings. Additionally, eSigning provides a more environmentally friendly option by reducing paper usage.

Get more for Unemployment Tax Form

- Apartment lease rental application questionnaire south carolina form

- Sc lease form

- Salary verification form for potential lease south carolina

- South carolina agreement pdf form

- Notice of default on residential lease south carolina form

- Letter to landlord to extend tenancy agreement form

- Application for sublease south carolina form

- Inventory and condition of leased premises for pre lease and post lease south carolina form

Find out other Unemployment Tax Form

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now