Icici Fatca Form for Non Individual

What is the Icici Fatca Form For Non Individual

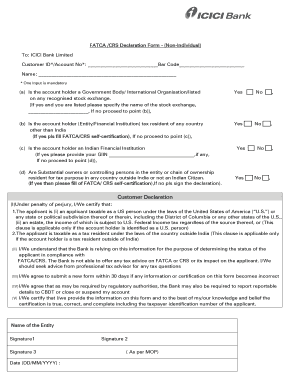

The Icici Fatca Form for non-individuals is a crucial document required for compliance with the Foreign Account Tax Compliance Act (FATCA). This form is specifically designed for entities such as corporations, partnerships, and trusts that hold accounts with ICICI Bank. By completing this form, non-individual account holders declare their tax status and provide necessary information to ensure adherence to international tax regulations. This declaration helps the bank report relevant financial information to the Internal Revenue Service (IRS) in the United States, facilitating transparency and compliance with U.S. tax laws.

Steps to Complete the Icici Fatca Form For Non Individual

Completing the Icici Fatca Form for non-individuals involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documents, including the entity's tax identification number and proof of residency.

- Access the Icici Fatca Form, which can typically be downloaded from the ICICI Bank website or obtained directly from a bank branch.

- Fill out the form with accurate information regarding the entity's tax status, including any relevant tax treaties.

- Review the completed form for any errors or omissions before submission.

- Submit the form either online through ICICI Bank's secure portal or in person at a branch, ensuring that all required signatures are included.

Legal Use of the Icici Fatca Form For Non Individual

The Icici Fatca Form for non-individuals serves as a legally binding declaration of an entity's tax status under U.S. law. By submitting this form, the entity affirms that the information provided is accurate and complete, which is essential for compliance with FATCA regulations. Failure to provide accurate information can lead to significant penalties, including withholding taxes on certain U.S. source payments. Therefore, it is vital for entities to understand the legal implications of the information they provide in this form.

Required Documents

When completing the Icici Fatca Form for non-individuals, several documents are typically required to support the information provided. These may include:

- Tax identification number (TIN) of the entity.

- Proof of the entity's residency, such as a certificate of incorporation or business registration.

- Documentation of any applicable tax treaties that may affect tax obligations.

- Financial statements or other relevant records that may be requested by ICICI Bank.

Form Submission Methods

Entities can submit the Icici Fatca Form for non-individuals through various methods to ensure convenience and compliance. The available submission methods include:

- Online submission via ICICI Bank's secure digital platform, which allows for immediate processing.

- In-person submission at any ICICI Bank branch, where representatives can assist with the process.

- Mail submission, though this method may take longer for processing and confirmation.

Penalties for Non-Compliance

Non-compliance with the requirements of the Icici Fatca Form for non-individuals can lead to severe consequences. Entities that fail to submit the form or provide inaccurate information may face:

- Withholding taxes on U.S. source income, which can be as high as thirty percent.

- Potential legal actions or penalties imposed by tax authorities.

- Increased scrutiny from financial institutions, affecting future banking relationships.

Quick guide on how to complete icici fatca form for non individual

Easily prepare Icici Fatca Form For Non Individual on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Icici Fatca Form For Non Individual on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Icici Fatca Form For Non Individual effortlessly

- Obtain Icici Fatca Form For Non Individual and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Edit and electronically sign Icici Fatca Form For Non Individual to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the icici fatca form for non individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA CRS declaration for ICICI Bank?

The FATCA CRS declaration for ICICI Bank is a mandatory documentation process designed to ensure compliance with international tax regulations. It helps identify U.S. and other foreign accounts to prevent tax evasion. By completing the FATCA CRS declaration, you ensure your banking activities align with the legal requirements set forth by the bank.

-

How do I complete my FATCA CRS declaration for ICICI Bank?

To complete your FATCA CRS declaration for ICICI Bank, you can access the declaration form online through the bank's website or visit your nearest branch. The process is straightforward, requiring you to provide personal and financial information. airSlate SignNow can assist you in electronically signing and submitting this declaration to streamline your compliance process.

-

What are the benefits of using airSlate SignNow for FATCA CRS declaration ICICI Bank?

Using airSlate SignNow for your FATCA CRS declaration for ICICI Bank simplifies document handling through seamless eSigning capabilities. It enhances the speed and security of the submission process, reducing the potential for errors. Additionally, it offers tracking features so you can confirm the status of your declaration at any time.

-

Is there a cost associated with submitting a FATCA CRS declaration through ICICI Bank?

There may be nominal fees involved with certain account types at ICICI Bank when submitting your FATCA CRS declaration, but this process is often free of charge. Using airSlate SignNow, you can eSign your documents without additional costs, making it a cost-effective solution to manage your declarations efficiently.

-

Can I submit my FATCA CRS declaration for ICICI Bank electronically?

Yes, you can submit your FATCA CRS declaration for ICICI Bank electronically by using platforms like airSlate SignNow, which allows you to eSign documents securely. This method is encouraged to ensure timely compliance and minimize paperwork. It also provides you with a digital record of your submission for your convenience.

-

What happens if I don't submit the FATCA CRS declaration for ICICI Bank?

Failing to submit the FATCA CRS declaration for ICICI Bank can lead to penalties and restrictions on your account, as it may be deemed non-compliant with tax regulations. It's crucial to understand the importance of this document to avoid complications with the bank and tax authorities. Utilizing services like airSlate SignNow can help ensure you meet your obligations on time.

-

Are there any specific eligibility criteria for FATCA CRS declaration at ICICI Bank?

Eligibility for filing a FATCA CRS declaration at ICICI Bank typically involves having a banking relationship that requires tax information reporting. This may include individual and corporate account holders. It's best to consult directly with the bank or use airSlate SignNow to ascertain your specific qualifications based on your account type.

Get more for Icici Fatca Form For Non Individual

Find out other Icici Fatca Form For Non Individual

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter