Sample Fill 2010-2026

What is the Sample Fill

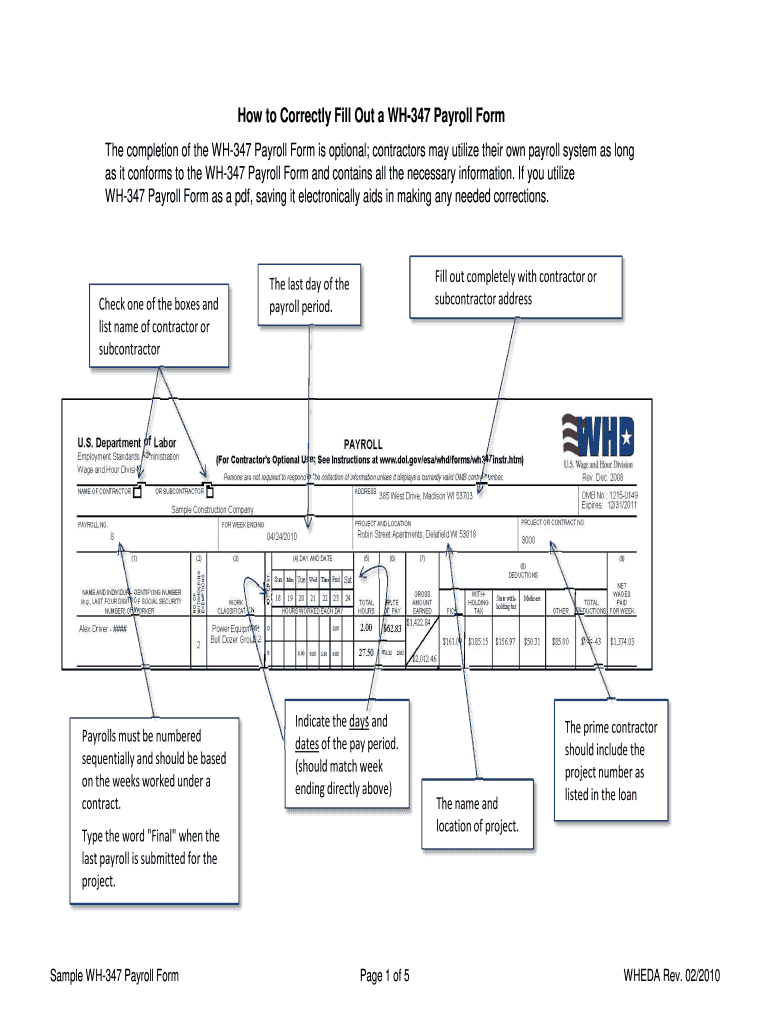

The Sample Fill refers to a template or example form that illustrates how to accurately complete payroll documentation. This form is essential for employers and employees to ensure compliance with federal and state labor laws. It typically includes sections for employee information, hours worked, wages, deductions, and other relevant payroll details. Understanding the structure and requirements of the Sample Fill is crucial for maintaining accurate payroll records.

Steps to complete the Sample Fill

Completing the Sample Fill involves several key steps that ensure accuracy and compliance. First, gather all necessary employee information, including names, Social Security numbers, and tax withholding details. Next, accurately record the hours worked and any overtime. Ensure that wage rates are correctly entered, reflecting any applicable deductions such as taxes or benefits. Finally, review the completed form for any errors before submission to prevent delays in processing.

Legal use of the Sample Fill

The legal use of the Sample Fill is governed by federal and state regulations. Employers must ensure that the information provided is truthful and complete to avoid penalties. The form must be submitted within specified deadlines to comply with labor laws. Additionally, it is essential to keep records of completed Sample Fills for a designated period, as required by law, to protect against audits and disputes.

Filing Deadlines / Important Dates

Understanding filing deadlines for payroll documentation is critical for compliance. Employers must be aware of specific dates when payroll taxes are due, as well as deadlines for submitting forms to the IRS and state agencies. Generally, payroll forms should be filed quarterly or annually, depending on the type of form and the employer's reporting schedule. Staying informed about these dates helps avoid penalties and ensures timely processing of payroll records.

Required Documents

To complete the Sample Fill accurately, several documents are necessary. Employers should have access to employee W-4 forms for tax withholding information, timecards or timesheets for hours worked, and any relevant state-specific forms. Additionally, documentation related to deductions, such as health insurance or retirement contributions, should also be collected. Having all required documents on hand streamlines the payroll process and enhances accuracy.

Examples of using the Sample Fill

Examples of using the Sample Fill can vary based on business size and industry. For instance, a small business may use the Sample Fill to record weekly payroll for hourly employees, while a larger corporation might utilize it for bi-weekly payroll for salaried staff. Each example highlights the importance of accurately filling out the form to ensure that employees receive correct pay and that the employer remains compliant with labor regulations.

IRS Guidelines

The IRS provides specific guidelines for completing payroll forms, including the Sample Fill. Employers must adhere to these guidelines to ensure compliance with federal tax laws. This includes accurate reporting of wages, withholding amounts, and timely submission of forms. Understanding IRS requirements helps employers avoid common mistakes that could lead to audits or penalties.

Quick guide on how to complete sample fill out form

Discover the simplest method to complete and sign your Sample Fill

Are you still spending time on preparing your formal documents on paper instead of doing it online? airSlate SignNow offers a superior way to fill out and sign your Sample Fill and related forms for public services. Our advanced eSignature solution equips you with all the tools necessary to handle paperwork swiftly and comply with official standards - robust PDF editing, managing, securing, signing, and sharing features all accessible within a friendly interface.

Only a few steps are needed to fill out and sign your Sample Fill:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Sample Fill.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Highlight important sections or Blackout fields that are irrelevant.

- Click on Sign to create a legally binding eSignature using the option of your choice.

- Add the Date beside your signature and complete your task with the Done button.

Store your finished Sample Fill in the Documents folder within your account, download it, or send it to your chosen cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your documents when you can send them via the appropriate public office channels - do it through email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

-

How do different countries refer to a generic person, such as "John Smith" or "Sally Jones" in America?

America is ruled by a clan, a powerful one high in government in states across the country, both eastern and western, rural and urban, democrat and Republican.I am referring of course to the sinister Sample clan.Here is Alexander Sample, from Sacramento in California.Under the name Connor, he appears in Iowa:He prefers to be known as Jelani when in Nevada though.His cousin Tina is in the oil business in Alaska, but sneaks over to Hawaii whenever she can.She also works in New Hampshire:Without forgetting Wyoming:She's had some surgery by the time West Virginia employed her though.They have a redneck relative called Connor who lives in some utopian suburb of Montgomery Alabama:He moonlights as a man from Mississippi:Curiously, Conor also is on the Maine license.He has changed his skin colour for Massachusetts though.You get the idea. Almost very state has a Sample: Susan in Arkansas, Jelani in a Arizona, Driver in Colorado (yes, what a convenient name…), another Susan in Connecticut, Gayle in Delaware, Joseph in Florida, Janice in Georgia and Texas, Emily in Idaho and South Dakota, Jane in Illinois, Avery in Indiana, Caron in Kansas, Nick in Kentucky, another Jane in Maryland, June in Michigan, another Gayle in Minnesota, Francesca in Missouri, Nebraska and North Dakota, Brenda in Montana, another Avery in New Jersey, Lani in New Mexico, Sally in Oklahoma and Utah, John in Ohio, Carol in Oregon, Evelyn in Pennsylvania, “I” in Rhode Island, Regular in South Carolina, Nick in Tennessee and Derek in Wisconsin.Only LA, NY, NC, VA, VT and WA are free of the Sample clan.

-

I am terrified of single-payer systems as implemented in socialist countries. Can this happen in the US? Was Obama trying to give everyone healthcare all along?

Edit: This story about Aetna being successfully sued for 25M USD only happens in America and is, in my view the main argument why being scared of “single payer systems” is ill advised.Lets start by making sure we have the same understanding of things:Single payer = where one entity (usually a government entity) uses a pool of funds paid into by the whole community/country to pay the health care providers (doctors/nurses/pharma) for the services they provide to the community.Socialism = a political and economic theory of social organization which advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole.Socialist country = as defined above would be countries like Mainland China, the former soviet union, cuba, vietnam, depending on how you look at it North Korea…Socialism (bis): Often used by political parties who propose a society where the richer pay a larger tax in order to support infrastructure and policies that also support the lower income portion of the population.Although to a lesser extent than most advanced nations, the US is a Socialist(bis) nation. Less so than most countries in Europe, but you do have medicaid and host of services offered by the government.My first question to you is which of the two definitions are you using?For the sake of the argument I am going to assume you are using definition (bis) which includes countries like Denmark, Finland, Australia, Japan, France, Italy, Germany, Netherlands, Belgium, Greece, Canada.Within Single Payer there are many ways to do it and two levels:Reference: List of countries with universal health care - WikipediaFree Health care: Free health care refers to a publicly funded health care that provides primary services free of charge or a nominal fee to all its citizens, with no exclusions based on income or wealth.[3]Universal Health Care: Universal health care, sometimes referred to as universal health coverage, universal coverage, or universal care, usually refers to a health care system that provides healthcare and financial protection to more than 90% of the citizens of a particular country.[4]There are 118 countries who provide both Free and universal health care.These include: All of the countries I listed above as examples of “socialist (Bis)” countries, as well as other countries such as Vanuatu, Palau, Uruguay, Chile etc etc.There are 43 countries that provide neither of these. ie if you are sick you are on your own or at the mercy of the free market.These include Iran, Iraq, China (a socialist country in the real sense of the word), Turkmenistan etc … with two exceptions, all poor countries who are behind in their development. Exception 1 is China…(although one can debate as to exactly how advanced it is). Exception 2 is the United States of America.So only 25% of countries provide neither universal nor free healthcare… And with the exception of the US, they are all poor countries (if one thinks a majority of Chinese people are still in poverty)Over 50% of countries provide both. Do you see mass demonstrations in the news about health care being bad in 50% of the world?The fact that 50% of the world (including a large number of democracies) are voting for policies and to keep single payer systems alone is an indication. Now please go on the net, and do some research, and tell me what percentage of the world outside of the US is looking at the US health care system and saying “maybe we should do like them”… (ie the perception the US system is better than the one they have now). While you will for sure find many many pages about how they wish their system to be improved, I challenge you to find information on a country in which people are voting for law makers who propose to change to the “multi payer “ system the US has… In fact I challenge you to find a law maker outside of the US who is even suggesting (never mind pushing for policy) their country should move from single payer to multi payer. Does that tell you anything? Do you think their might be a reason for that?Now lets look at the results. The point of the health care system is to keep you alive and healthy so lets look at track records:I don’t know about you but I think children are important. So what is better to help children: Single payer or not? According to your logic (ie single payer is bad), countries with single payer should have a higher mortality rate and those without should have a lower mortality rate for children. Here is how the CDC (US organisation) ranks infant mortality rates in the world: US… 27!!!!! BEHIND Poland Hungary and Slovakia, all of which are signNowly less wealthy countries than the US. Please also note that EVERY SINGLE country ranked above the US on that list has both free and universal health care / single payer. (https://www.cdc.gov/nchs/data/nv...)But maybe infants/children are not important to you. Lets look at life expectancy:The US is 31 !!… behind countries like Slovenia, Chile and Costa Rica… not exactly known for being paradise of wealth and health on earth (with all due respect to these countries which I happen to like)List of countries by life expectancy - WikipediaMaybe you say, I’m not interested in living long. OK lets go to how does the World Health Organisation rank national health care systems ? Keep in mind the WHO (as it is known) incurs strong influence from he US.US Ranking : 37… BEHIND Morocco (Single Payer, Universal) and Colombia (Single Payer, Universal and Free)!!!World Health Organization's Ranking of the World's Health SystemsI challenge you to find one … 1… one ranking where the US health care system (or lack therein of) comes in the top 10 for positive outcomes for the population at large.So, I’m sorry but what is scaring you exactly?Please tell us so we can look at it.Thank youEdit: Let me add the economic side to it.“The U.S. spent $8,233 on health per person in 2010. Norway, the Netherlands and Switzerland are the next highest spenders, but in the same year, they all spent at least $3,000 less per person. The average spending on health care among the other 33 developed OECD countries was $3,268 per person”Health Costs: How the U.S. Compares With Other CountriesSo look at this way: not only is multi payer system inferior to single payer at keeping you alive longer and keeping children healthy and alive longer, it also costs about TWO TIMES MORE per person than Switzerland (ranked 20) , Netherlands (ranked 17) and Norway (ranked 11). Which implies the top ten countries pay less than half what the US pays per person to be in top 10 except the US is 37 out of 200 countries…So lets put it this way: Your multi payer health care system actually performs in such a way you spend twice as much as #11,17,and 20, and nearly 3 times over the global average to make it to #37 BEHIND THIRD WORLD COUNTRIES, as shown by the infant mortality rate and life expectancy rate. Think about it this way: if you spent the same as the rest of the world, you would be #80 something…with every one of these countries having single payer…. And by the way, in the case of Single payer, when we say “costing them”, the government pays, so people are not going bankrupt because of health issues. In your case, it is YOU… paying and when you have cancer, diabetes, or some form of heart disease, it is you who will be paying much MORE than 8,000 dollars, where a single payer patient would be paying probably around $500 if you average out across the different systems (ie, the govt pays most of the bill and the individual is left with 10~30% depending on which country it is, a bit like a deductible if you like)…. So not only do you not seem to like to live long, and not seem to think it is important to give your kids the medical care they need to prevent them from dying at a higher rate, you also seem to like paying 12 times (when comparing what is paid by the patient) more for the privilege of not getting what people in other countries do get. So you are terrified of what?EDIT: This is one of many perfect examples of why single payer works much better:Girl has words for Aetna after brain surgery deniedThis ONLY happens in the US on a very very REGULAR basis. I might add when I was living in the US, my insurance denied a trip to the hospital for my then wife who was complaining about acute stomach pain. “wait till tomorrow” they said We went anyway. She was operated on immediately. She had peritonitis. She ran the risk of dying because I had to choose between paying thousands of dollars (I was billed 6,000 for the ambulance) or wait till the next day. A company who has a financial interest in making sure you don’t get treatment should not be allowed to make decisions on whether you need it or not.EDIT 2: Here is a graphic that says something: Notice less advanced and far less rich countries than the US have it too, and notice non of them are “Socialist” as defined in the dictionary and executed in the USSR or China.

-

How do I get my self-published Sindarin reference-grammar in bookstores alongside the other Tolkien-Elvish reference grammars?

You don’t. In fact, if Christopher Tolkien discovers you have published one at all, you are going to get a cease-and-desist letter from his lawyers.Christopher Tolkien is as protective of his father’s copyrighted material as Disney is of theirs. In order to legally publish this text, you would have to approach his agent, and agree to pay a licensing fee, which in the case of anything having to do with Middle Earth is probably well into six figures.I strongly suggest you remove your work from publication entirely before you find yourself in court.

-

How do I join the JYPE online audition? Is there an application form needed? What is it?

JYP has probably one of the best formats for an online audition. The website is easy to navigate and there are multiple language settings.To walk you through, here is a step by step.This is their most recent home page. I know because I’m literally taking screenshots right now.On the top, you can see four options, “company”, “artist”, “audition”, and “actors”.Click on the audition tab.It should bring you to this page.I already scrolled down on this page, but make sure you scroll down to the bottom of the page to see the blue button shown above.Then, click on the blue button and it will bring you to the following pageIf you are a foreigner, click on the gray foreigner button. It should bring you to the same page but in english.Then, click on number four as shown above.At this point, you should see this page if you aren’t logged in or don’t have an account.This is when you should create an account. You have to create an account for you to be able to apply. In my case, I already have an account so I’m just going ahead and log in.After you have created an account and logged in, it should take you to the page that is shown above the most recent picture.Click on number 4 again.This should bring you to the following audition form page.Fill in your personal information, click “apply” and you are entered into their system for auditions.Good luck!

-

How does email marketing work?

Hey there,It is important to understand that, growing an engaged list is a vital part of making a successful email marketing strategy. To effectively build a permission-based email list on your own, you have to spend a lot of time and money but, it is made easy with the help of good email database providers. Well, as per personal experience, I would personally recommend you to try with Infodata and E-Database Marketing. In my opinion, they deliver high-quality email lists over the globe which include countries like the USA, UK, Australia, Canada, Germany, Europe, Italy, France, New Zealand, New York, and impressively more.As you all know that there are numerous ways to market your products to the decision-makers and Email marketing is outstanding amongst the most effective ways to promote your product/service to the millions and millions of target audiences. Many marketers feel that. Email marketing is the perfect tool for building customer relationships that help you generate leads and sales. As per my research email remains the best way to communicate with users and prospects. Buying email lists will help you identify your potential customers through opt-in email messages, and get customer response in real-time.Both Infodata and E-Database Marketing aim to deliver fresh and updated email lists for email marketing. Also, these email list vendors offer you 100% accuracy and deliverability in your marketing campaigns. Their email list is gathered from reliable sources, verified, and well-segmented as per the needs of customers. You can enhance your response rates with their email list and thereby, you can make multi-channel communications possible. Meanwhile, they could help you to get your business in front of the right people at right time. With these database providers, you can get connected with clients, grow your business, and more via direct mail. The reason behind why I prefer these B2B vendors is, they work for the satisfaction of customers by offering excellent and qualified data service with a prompt delivery rate.Their verified email list contains complete multichannel marketing information such as,The benefits offered by Infodata and E-Database Marketing data providers include:Speed and AccuracyCost EffectiveRefund policy in terms of inaccurate dataFree Sample ListPrompt DeliveryRegular UpdatesWay to find a target marketHope this helps you.Best of luck… Cheers!

-

Why do we learn things in school we don't need to know in real life?

From a teacher’s perspective, the state generally sets the curriculum frameworks, which are standards that a teacher must get their students to achieve those established standards. However, there are also additional national standards that are set by various entities. For example, national music standards are set by the National Association for Music Education (NAfME). Common Core State Standards (CCSS) is an additional set of standards that came from an act at the state level even though there was some federal influence (Source: http://www.breitbart.com/big-gov...). Common Core has not worked in my classroom based on my data.Knowing this information, the various levels establish the standards of what is to be taught in public schools. So, we are taught useless things in public schools because of the control that the state, national, and the federal level has on our public education system. In this top-down approach, the higher levels set the standards, teachers teach the standards to our students, and students try to achieve those standards. If the state and higher levels were to recommend standards that would be of greater importance (e.g., real life skills, etc.), then we would see that coming from the top for teachers to teach to our students. For those dissenters, real life skills are those skills that are not currently taught in schools but are essential to survive in our society. I would suggest these skills to be taught at the high school level, which this is just a sample list:1. How to buy a car 2. How to buy a house 3. How to balance a checkbook 4. How to fill out and pay your taxes (both EZ and long form)5. How to sign your name in cursive for signatures (schools used to teach this en masse, but has diminished over the years)6. How to properly take care of yourself7. How to succeed in job interviews (colleges provide this service, but does not teach it in classrooms—my college did not teach it) 8. How to write a successful resume and cover letter (colleges also provide this service, but does not teach it in classrooms)9. How to be able to search for careers if one does not work, and to receive the proper training to succeed10. How to budget money and plan accordingly (the military taught me this skill)11. How to cook (Home Economics used to be a norm in schools)12. How to be able to detect fraud, waste, and abuse13. How to detect scams, spoof e-mail, and how to report it14. How to have proper character and professionalism through character training (this would need to be taught throughout the school years)15. How to have proper ethical character and integrity16. How to fix and troubleshoot things

-

What are the best study hacks for college? How can one most efficiently study at college to maximise time for other activities?

I have wrote this answer on Quora before and I'm going to put this here. Though this is not my idea.HOW TO STUDY BASED ON HOW MEMORY WORKSMemory works (to put it simply) in 3 stages: attention, encoding (storing/associating with other info), and retrieval(remembering)To optimize the final stage, you have to optimize the first two stages. This means you have to pay attention to the material, and you have to encode it well. (Which I'll explain below.) Additionally, if you repeat the process, you reinforce it. By retrieving something, you start to pay attention to it again, and then you are able to re-encode it better than before.To optimize encoding, remember GOAT ME.G is generate and test. i.e., quiz yourself, or otherwise come up with the answers on your own without just reading them. Even if you get it wrong, it helps more than if you just read the answer off the bat, because you're forcing yourself to think more about it (why was it wrong?). Test yourself in a way that will resemble what you'll actually have to do during the real test. (e.g., if you have to write essays on the test, instead of just writing and memorizing bullet points, actually write an essay multiple times without cheating, review it, and repeat until you can write it without forgetting any important points.) Other effective ways of testing yourself are teaching the material to someone else and talking about it out loud to yourself.O is organize. This reduces the load on your brain and helps create reminders just by coloring, position, or associations with nearby material. For instance, a time line helps remember that event A came before event B in history, not necessarily because you memorized the dates but because you organized the info so that event A was written earlier and you happen to remember that it was written earlier. The position of the information becomes meaningful. You can organize with outlines, pictures, color coding, related material, etc. My use of "GOAT ME" can be thought of as organization. Another fun example (chunking) is as follows. Which of these seems easier to memorize: "CIAFBIKGBCNNUSABBCUK" or "CIA FBI KGB CNN USA BBC UK"?A is for avoid illusions of learning. There are two kinds of memory: familiarity/recognition and recall. Recall is what you want. That's where you can remember the information on your own, as you might be expected to do on a test. Recognition is where you can't think of it on your own but if you see it you suddenly remember it. That's not good. You won't necessarily see it on your test, so you won't get a blatant reminder of it. Avoid study methods that rely on recognition. Similarly, a major problem with rereading material is "fluency". The more you read it, the easier reading it becomes, and when it feels easier to read, you assume you have learned it. You have not. You've just become more skilled at reading it. Don't bother highlighting your textbook in the first go either. You feel like you're picking out the important parts of the chapter but you can't know what's really important until you've read the whole thing. And then all you're gonna do anyway is go back and reread all the highlights, and as we've established, rereading is useless. If instead you actually organize the highlights and quiz yourself on them, highlighting may be useful. For a similar reason, rewriting information is also not very helpful unless you use it as a method of quizzing.T is take breaks. This is HUGE. If nothing else, walk away with just this tip. Your memory works best if you study in frequent, short sessions rather than one long cram session. You don't give your brain a chance to store the earlier info you studied, so it just slips out of your mind, and you'll have wasted your time studying it. So study for awhile, go do something else for a bit, and come back to it, and repeat. One of my students said she taped information in front of her toilet so whenever she went to pee or something she could study for just a couple minutes. It sounds strange but it's actually a great idea (I'd advise, in line with G and A that you tape questions in front of the toilet and tape answers elsewhere so you can quiz yourself.) Another important part of this is that you need to sleep to keep that info in your head. Even if you take regular breaks, an all nighter will do more harm than good. Your memories are stored more permanently after sleep. This is just how the brain works. You can even try to work naps into your study sessions. It's a break + sleep! [EDIT: I do not know how long breaks SHOULD be, but I believe this varies from person to person. Just try to study over the course of days instead of hours.]M is match learning and testing conditions. This is based off the principle ofencoding specificity[1] , which states that, if you want to optimize memory, then the conditions surrounding encoding (e.g., where you are when you study, how tired you are when you study, etc.) should be the same as those surrounding retrieval (e.g., where you are when you're tested, how tired you are when you're tested, etc.). This is because the conditions themselves serve as reminders. (Have you ever walked into the kitchen for something, forgotten why you were there, and as soon as you return to the other room you suddenly remember why you went to the kitchen?) This includes your environment and your physiology, serving as reminders. Think about noise level, size of room, lighting, types of furniture, mood, intoxication, sitting position, and even the way you work with the material (remember G and A). Studies show that learning while drunk is best remembered while drunk again. Learning after exercising, also best remembered after exercising. The alternative to this is that you should study under MANY different conditions. This way, the information comes easily to you regardless of your surrounding conditions. Otherwise, the information will unfortunately be associated with the specific circumstances you studied under and will be difficult to remember in any other situation. If you want to remember this stuff outside of being tested in class, STUDY UNDER MANY CONDITIONS. Study in a noisy place AND a quiet place, with and without coffee, etc.E is elaborate. Think deeply about the material and make other associations with it. At the most extreme, this can mean truly understanding the concept, why it works, how it relates to other concepts, and how it's applied. But on a simpler level, it can be the following: Does it remind you of something else? Can you make a song out of it? Can you visually imagine it? How does it apply to you or your life? Instead of taking the material at face value, do something with it. The reason this is important is because of reminders. Memory works by having a network of associations. One thing reminds you of another. If you've thought deeply about it, you've probably associated it with something else in memory, which can then serve as a reminder. You can think, "Oh yeah, this is the term that inspired me to draw that silly stick figure to represent it. And I remember what the drawing looked like so now I remember what the term means." Additionally, the quality of the memory will be better if you have elaborated on it. Elaboration allows for a lot of creativity and individuality among studiers. Choose whichever method of elaboration works for you. Maybe you enjoy making up songs, drawing doodles, creating stories, visually imagining it, relating it to yourself, or just pondering about it. If you're studying history, you might try to think about it visually, imagine what people would have said or looked like, watch them in your head doing their historical stuff, or maybe you'd like to draw a quick doodly comic about a particular event, or maybe you wanna think about why this even was signNow, or how it relates to another historical event.If I had to summarize this in fewer points:Keep similar conditions during studying and testing. This includes environmental surroundings, mental and physiological state, the way you think about the material, and so on. But if you want to remember this outside of class, study in a VARIETY of conditions, so that you don't associate the material with any particular condition.Study briefly and frequently, and sleep.But one other good point I would add is this:Take notes BEFORE class if possible, and add to them whenever necessary. Do this by reading the textbook chapters ahead of time (and take notes; refer to your syllabus to find out which chapter is next, if applicable) or see if your teacher posts Powerpoints online ahead of time. This way, you're not just frantically writing notes in class and you'll actually be able to more fully pay attention to what the teacher is saying (remember: attention is the first step of the memory process!). You may think you can pay attention to the professor as you're writing, but you are actually dividing your attention and hurting your memory.Props to Salticido in https://www.reddit.com/r/AskRedd...

Create this form in 5 minutes!

How to create an eSignature for the sample fill out form

How to generate an electronic signature for your Sample Fill Out Form in the online mode

How to make an electronic signature for the Sample Fill Out Form in Chrome

How to generate an electronic signature for putting it on the Sample Fill Out Form in Gmail

How to make an eSignature for the Sample Fill Out Form right from your mobile device

How to make an electronic signature for the Sample Fill Out Form on iOS devices

How to generate an eSignature for the Sample Fill Out Form on Android

People also ask

-

How can airSlate SignNow improve my payroll process?

airSlate SignNow streamlines your payroll process by allowing for quick and secure electronic signatures on payroll documentation. This eliminates the need for manual paperwork, ensuring that all transactions are completed efficiently. With our intuitive platform, you can ensure compliance and speed up payroll approvals dramatically.

-

What features does airSlate SignNow offer for payroll management?

airSlate SignNow offers various features tailored for payroll management, including document templates, customizable workflows, and secure eSign capabilities. These features enable your HR team to manage payroll documents seamlessly while maintaining compliance and security. Additionally, our platform supports real-time tracking of document status, ensuring nothing falls through the cracks.

-

Is airSlate SignNow a cost-effective solution for payroll?

Yes, airSlate SignNow is designed to be a cost-effective solution for payroll management. Our pricing plans are flexible and cater to small and large businesses alike, allowing you to select a plan that aligns with your payroll needs. By reducing paperwork and speeding up signature processes, you can save time and money in the long run.

-

Can airSlate SignNow be integrated with other payroll software?

Absolutely! airSlate SignNow can integrate seamlessly with a variety of payroll software applications, including popular solutions like Paychex and QuickBooks Payroll. This integration allows for smooth data exchange, enhancing the efficiency of your payroll processes and reducing the risk of errors associated with manual entries.

-

What benefits do I gain from using airSlate SignNow for payroll?

Using airSlate SignNow for your payroll process offers numerous benefits, such as increased efficiency, enhanced security, and improved compliance. Our eSigning technology ensures that all payroll documents are signed quickly and securely, which helps to accelerate your payroll cycle. Additionally, the platform's audit trails provide peace of mind regarding document integrity.

-

How does airSlate SignNow ensure the security of payroll documents?

airSlate SignNow prioritizes the security of your payroll documents through advanced encryption and secure cloud storage. All eSigned documents undergo rigorous authentication processes, ensuring that only authorized parties can access them. This commitment to security helps safeguard sensitive payroll information from unauthorized access.

-

How can airSlate SignNow help with payroll compliance?

airSlate SignNow aids in payroll compliance by providing features that ensure documents meet regulatory standards. Our platform retains an auditable history of document changes and signatures, which is essential during compliance audits. Additionally, we keep you updated on any regulatory changes related to payroll processes.

Get more for Sample Fill

- Sample filled ppf form sbi pdf

- Printable radiology order form pdf

- Aku degree form

- Cell organelles review worksheet answer key form

- Hipaa credit dispute letter pdf form

- Get pediatric symptom checklist psc 35 scoring sheet form

- Fillable online order form supplement for social

- Fishing license for the disabled 17182257 form

Find out other Sample Fill

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF